WHAT IS A CROSS-CHAIN SWAP | HOW TO SWAP SMART AND SAVE MORE

DeFi has a rising need for the ability to move tokens across Blockchains. Cross-Chain transactions are the building block towards a multi-chain future. The need of the hour is easy and intuitive swaps from one major blockchain to another.

WHAT IS A CROSS-CHAIN SWAP?

A key component of blockchain technology is the cross-chain swap, which enables token exchanges across different blockchains and makes them interoperable. It allows people to make payments in a particular token even when they are on different blockchains. Cross-chain swap is possible without the need for fiat money as an intermediary.

Here are just a few examples of how a cross-chain swap can enhance your DeFi experience:

- Want to get some L1 native coins to pay gas fee but have no assets on that chain? No more bridges or CEX withdrawals needed — simply swap some of your assets onto another chain and the gas token will arrive in the destination address on the chain you pick.

- Want to buy some USDT but the staking APR is higher on another chain? Just choose the chain you want your USDT on and swap it with just one click.

WHY IS CROSS-CHAIN SWAP CRUCIAL FOR THE BLOCKCHAIN ECOSYSTEM?

Lowering Volatility:

To answer this question, we could look at how a crypto upswing or downswing could affect the value of your tokens. With an upswing, users have an increase in the value of their tokens in one network. The situation might change when a downswing occurs. Tokens can lose value and lead to losses.

Cross-chain swaps provide a way of dealing with the volatility of crypto by giving users the chance to move crypto across networks. Users can swap crypto to protect the value of their tokens and the losses that come along with it. An example is to swap volatile crypto with stablecoins, which ensures a lower level of volatility in the market.

Join Us on Telegram

Reaping Benefits of Layer 2 sidechains:

The expanding blockchain ecosystem has necessitated interest in blockchain bridges. In the past users were mostly inclined toward popular blockchains like Ethereum for decentralized applications (dApps) or Bitcoin for high-value payments. However, the shortcomings of these well-known blockchains, like Ethereum, prompted the creation of other blockchains and even Layer 2 sidechains. These new chains provided benefits including lower transaction costs, increased network throughput, and access to novel yield-earning activities.

Imagine you needed to utilize a Layer 2 network like Polygon and you had money on the Ethereum network (ETH). Your best bet would be to use a centralized exchange, like Coinbase or Binance, to swap ETH for MATIC. To use the network, you would then send the tokens to your Polygon chain wallet address. However, what if you had to transfer money back to Ethereum? You would have to go through the conversion procedure again and incur multiple transaction fees and withdrawal fees as well.

TYPES OF CROSS-CHAIN SWAP

The cross-chain swap can be categorized into the following:

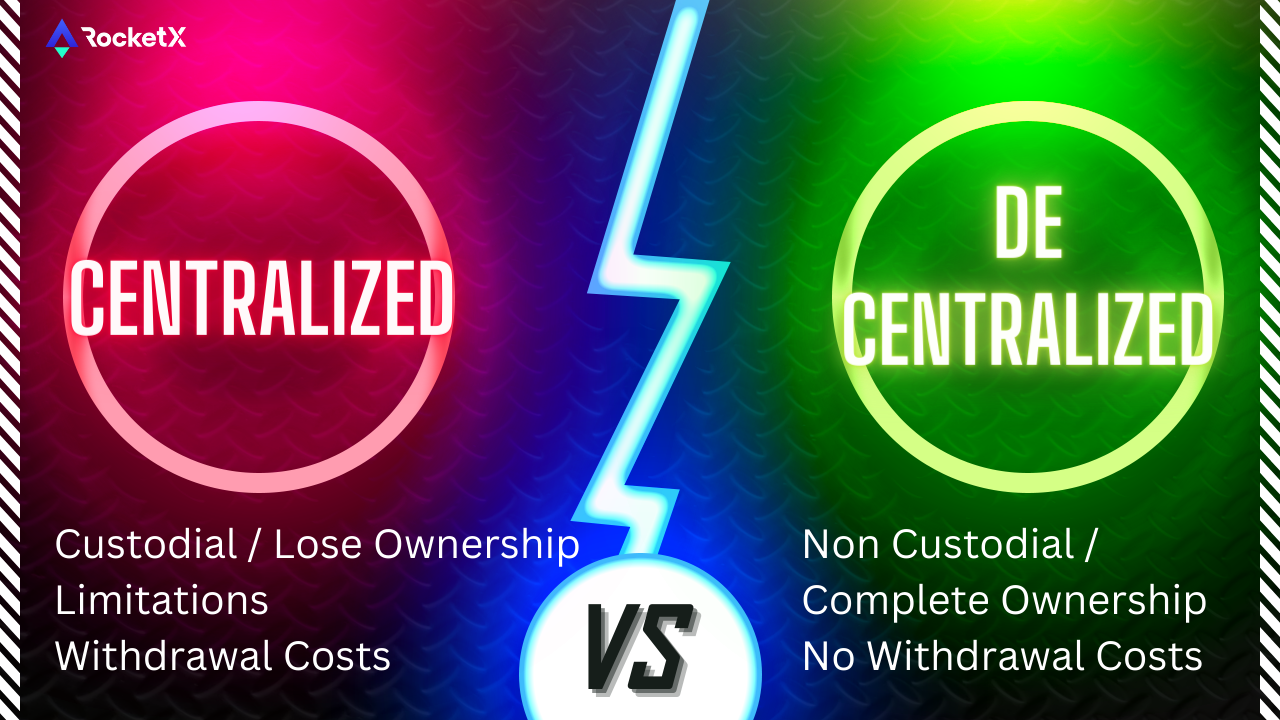

CUSTODIAL CENTRALIZED EXCHANGE:

Going via a centralized exchange, you can swap your crypto across different chains. However, they are custodial in nature, meaning your cryptocurrency stays under their control if you don’t withdraw it from their site. This suggests that they could place limitations on your account and thereby, on your cryptocurrency. Additionally, there are expenses associated with the withdrawal of cryptocurrency out of the CEX as well.

The use of centralized exchange involves high switching costs. There are several procedures you must do, such as choosing a trustworthy exchange, providing personal information to register, adhering to the terms & conditions, making deposits on the exchange, and so on.

SMART-CONTRACT BASED:

Also known as atomic swaps, they rely on smart contracts that allow the user to swap tokens directly on another blockchain without any intermediary or central authority. These smart contracts are powered by a technology called Hash Time Lock Contracts (HTCLs), which locks the transactions with unique combinations to ensure verification is done on both ends.

Also, these smart contracts implement an atomic process for completing transactions. It means the transaction executes as per the agreement, or the whole transaction becomes invalid. However, smart contracts though are not without flaws; for instance, their level of security depends on the developers. The atomic swaps rely on the smart contract code’s robustness and not the security of the blockchain. Because of this, the smart-contracts-based atomic swaps can be a target of malicious exploits, increasing the risk to users.

SMART-ORDER-ROUTING BASED:

The cross-chain swap, in this case, is performed via a novel proprietary Smart-Order-Routing Engine leveraging the liquidity of both CEXs and DEXs pool. Hence, they are hybrid exchanges and let the users trade across chains at best prices and lowest fees.

In the next section, we’ll see how users can leverage this to do cross-chain swap most efficiently.

HOW TO CROSS-CHAIN SWAP EFFICIENTLY?

Investors find it constricting to do a cross-chain swap through a centralized exchange where they must abide by their deposit and withdrawal policies, which can be halted or restricted without any notice. Many traders and investors are switching to a more decentralized alternative as a result of these restrictions. Atomic swaps, however, require a lot of technical intricacies that most people would rather ignore. Then what is the most efficient way, one could ask?

Non-Custodial solution like RocketX revolutionizes the DeFi experience of users. With the liquidity being sourced from 250+ exchanges, both centralized and decentralized, they leverage their novel proprietary smart-order-routing engine, for cross-chain swaps across networks.

- Non-custodial wallet

- No pre-deposit or collateral

- No wrapped/synthetic counterparty asset

- No hidden fees

- No hopping around exchanges in search of lower price

The liquidity is obtained through their CEX Pool, which has higher liquidity since the involved CEXs have incentives to retain asset pools on numerous platforms. RocketX multi-chain swaps are therefore cost-effective and have minimal slippage. The platform fee can be slashed down by 100% by holding the exchange’s token RVF. With just 1-click you can swap crypto across chains in a jiffy.

NATIVE CROSS-CHAIN SWAPS:

No more wrapped tokens or synthetic counterparty assets! With RocketX, you will always receive native assets on the supported blockchains. Consolidating cross-chain swaps into a single transaction significantly simplifies moving crypto across chains. RocketX eliminates fragmented pools produced by the competing wrapped-token projects and allows consumers to access the higher liquidity of native tokens, throughout the whole market.

RocketX is a scalable solution to cross-chain interoperability and can be extended to practically any network.

ADVANTAGES OF CROSS-CHAIN SWAP

Overall, cross-chain swaps help to avoid the barriers of moving coins across different Blockchain networks. By using efficient platforms, you can get the benefit of low prices for cross-chain swaps.

- It aids in the generation of considerably more dynamic crypto usage. For instance, the cross-chain would make it possible for us to increase the number of cryptos we use at any moment with minimal difficulty. In the event that a company or facility only takes stablecoin as payment, we may immediately exchange our BTC for USDT or USDC.

- Cross-chain swaps can help to avoid the effects of crypto downswings as users easily swap to less volatile coins without worrying about disparate blockchains.

- Investors can switch chains to get better deals for their crypto assets, like a higher APY for their staking, or to enjoy lower transaction fees on L2 chains.

CONCLUSION

Finally, cross-chain swaps help to lower the barriers of moving coins across different blockchains. By using an efficient platform like RocketX, users can enjoy the swap at best price, lowest fees and minimal slippage. Users would not require previous crypto knowledge to swap their tokens in a single click. Also, they wouldn’t need to download a new browser wallet, back up a key file, or install any specialized software. They can simply swap their tokens and provide an appropriate destination address.

MOST POPULAR CROSS-CHAIN SWAPS

Explore more CROSS-Chain Swaps...

Hybrid 1-step crypto exchanges are the easiest way to traverse the cryptoverse seamlessly across different networks and gain access to their varied benefits.

Video Tutorial on CROSS-CHAIN SWAPS

Check the following video tutorial on how to economically and easily do cross-chain crypto transfers via Hybrid and decentralized platform – RocketX Exchange.

ETH to BNB Cross-Chain Swap

RocketX and MEXC Partner to Expand Global Reach

In the fast-paced world of...

Introduction to Arbitrum Nova: Bridging Assets and Exploring the Advantages

Introduction: As the Ethereum network...