Introduction

When people talk about the Base ecosystem today, Aerodrome Finance naturally becomes part of the conversation because almost every major liquidity movement, meme rotation, yield wave, or DeFi surge happening on Base eventually runs through the Aerodrome at some stage. It became the foundation layer for liquidity routing on Base, where deeper liquidity, better execution, and more aligned incentives are designed to scale together rather than break under market pressure.

Aerodrome proved that liquidity can be engineered intelligently. Instead of letting capital sit idle or depend on static AMM structures that cannot adjust fast enough during volatility, Aerodrome introduced a model where liquidity can shift, adapt, and concentrate where it matters most — giving traders better pricing, LPs stronger yield leverage, and builders a reliable base-layer liquidity engine they can depend on long-term.

In this guide, you will understand what Aerodrome Finance is, how it works, how the AERO + veAERO token model empowers the ecosystem, and how you can access Aerodrome and buy AERO using RocketX Exchange in a simple, unified way — even if your funds are not on Base.

What is Aerodrome Finance and How It Works

Aerodrome Finance is a next-generation liquidity infrastructure protocol built on the Base network. Its purpose is to make liquidity deeper, faster, and smarter for real DeFi usage. Most AMMs in the market still operate using passive liquidity pools, which remain static even during high volatility moments. Aerodrome changes this model completely by creating a liquidity engine that reacts according to demand and real activity happening across the ecosystem. This is one of the main reasons Aerodrome continues to grow as the dominant liquidity layer inside the Base ecosystem. The Base network itself is expanding extremely fast with new dApps, AI-driven applications, meme assets, gaming models, and real-world asset experiments. Aerodrome strengthens this growth by making liquidity highly efficient and continuously active.

Aerodrome Finance originally evolved from Velodrome on Optimism but it was redesigned for the next phase of Base adoption. Its incentive structure motivates long-term alignment rather than short-term farming. Instead of distributing rewards blindly, Aerodrome channels the real value created inside the system to veAERO participants who are actively committed to the protocol. This helps the ecosystem grow stably and prevents unhealthy inflation that destroys token value.

The working model is simple but extremely powerful. Users supply liquidity into pools. Traders then swap assets through these pools. All trading fees and external incentives are directed toward veAERO holders. veAERO holders vote every week to decide where future emissions should go. Pools that win votes receive more liquidity, and as liquidity grows, trading volume increases, and that generates more fees, which return back to veAERO holders. This creates a natural value loop that keeps strengthening over time.

Because of this continuous reinforcement cycle, Aerodrome Finance is becoming one of the most important liquidity gateways not only on Base but potentially across the next wave of multi-chain DeFi expansion.

Everything You Need to Know About AERO and veAERO Tokens

AERO is the primary token used inside Aerodrome Finance. It keeps the liquidity engine running across the Base network. You can think of AERO as the fuel that powers rewards, governance, emissions, and value distribution across the entire ecosystem. veAERO is simply the locked form of AERO that offers additional benefits, increased control, and higher earning potential inside the protocol.

Tokenomics

AERO does not follow the limited supply hype pattern. New tokens are released slowly through emissions and are mainly given to users who help support liquidity pools. Today more than 900 million AERO tokens are already circulating, and a large portion of supply is locked as veAERO for several years. This long term locking model helps reduce selling pressure and keeps incentives aligned with steady protocol growth.

Use Cases of AERO and veAERO

When a user locks AERO, they receive veAERO in return. veAERO holders can vote on decisions, direct emissions toward specific pools, earn a share of all protocol trading fees, and also receive additional incentives from other protocols. They also earn boosted rewards while providing liquidity.

Think about it like this:

AERO = the normal token you can buy and use

veAERO = the upgraded version designed for committed long term holders who want extra influence and additional benefits

How to Buy AERO Token Using RocketX Exchange (Beginner Friendly Guide)

Once you understand why AERO is important and how Aerodrome plays a major role in Base DeFi, the next part is actually buying AERO tokens. The simplest and fastest way to do this is through RocketX Exchange, especially if your funds exist on other blockchains.

RocketX allows you to buy AERO directly from major chains like Ethereum, BNB Chain, Solana, Polygon, and many more, without using multiple bridges or extra swap steps.

Follow these easy steps to get started:

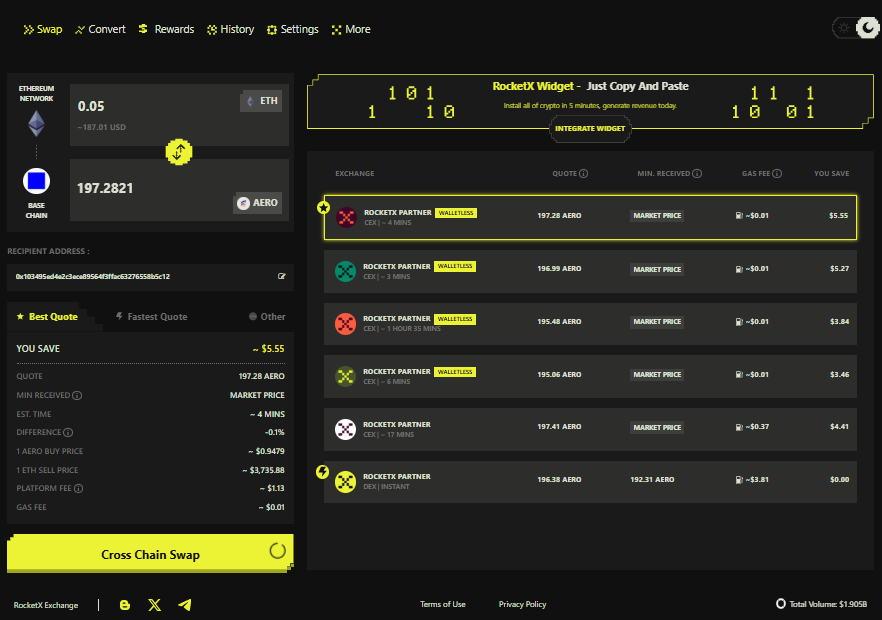

Step 1 — Open RocketX Exchange and Connect Your Wallet

Go to app.rocketx.exchange using your browser.

Connect your wallet, such as MetaMask, Coinbase Wallet, Trust Wallet, OKX Wallet, Phantom, etc, depending on where your funds currently are.

Step 2 — Select Your Current Network and Token

Choose the blockchain where your assets exist at the moment.

Here, your token can be ETH, BNB, USDT, USDC, SOL, or any other token you hold.

Step 3 — Select Base Network and Choose AERO

Now select Base as your destination network and choose AERO as the token you want to receive.

Step 4 — Enter the Amount and Paste Your Base Wallet Address

Enter how much you want to convert and paste your Base-compatible wallet address where your AERO tokens should be delivered.

Step 5 — Confirm the Cross-Chain Swap

Click Cross Chain Swap and approve the transaction inside your wallet. RocketX will automatically find the best route, best pricing and the most efficient path on its own.

Step 6 — Check Your Wallet

Once everything is completed, simply open your wallet, and you will see your AERO tokens on Base network safely delivered and ready to use.

This is how RocketX makes it extremely simple for anyone to enter the Aerodrome ecosystem effortlessly without manual bridging, switching DEXs, or wasting extra gas fees.

Future Potential of AERO and the Aerodrome Ecosystem

The future potential for Aerodrome Finance continues to grow stronger as the Base ecosystem expands at a record pace. Today, Base is not only onboarding new retail users but also attracting AI-focused applications, gaming liquidity, new DeFi primitives, stablecoin utility, institutional experimentation, and RWA-backed yield models. Every new wave of activity requires deeper liquidity, faster routing, and better execution. Aerodrome sits directly at the center of all of this, which naturally positions AERO and veAERO holders to benefit as the entire Base network scales.

Over the last few months, Aerodrome has also moved beyond just being a DEX. Multiple innovations such as the Pool Launcher upgrade, Aero Ignition for RWA liquidity, automated DCA strategies built on top of Aerodrome, AI marketplace token launches, and new governance-powered emission control through Aero Fed upgrades have transformed Aerodrome into a full-stack liquidity engine for Base. As weekly fees continue to rise, advanced emission decay keeps inflation controlled, and major partners like Animoca Brands are actively locking positions for four years, Aerodrome is now entering a phase where value creation is shifting from pure speculation toward real, sustained long-term yield.

Going forward, Aerodrome is expected to play a major role not only for Base native users but for cross-chain demand as well. As more assets flow into Base and DeFi rotate through new sectors like RWA-based pools, AI-powered trading agents, tokenized FX, and more sophisticated LP strategies, AERO will remain the central access token that aligns incentives, powers governance, and captures protocol revenue. If Base continues growing toward becoming one of the largest L2 ecosystems, Aerodrome could evolve into one of the most influential liquidity infrastructures in the entire multi-chain economy — with AERO becoming a long-term value asset linked directly to real organic on-chain usage instead of hype driven narratives.

This is the type of positioning that very few tokens in DeFi naturally achieve. Aerodrome already has it. And this is why long-term adoption of AERO could continue to strengthen as Base matures into the next wave of mainstream DeFi expansion.

Conclusion

Aerodrome Finance is proving that liquidity can be engineered with intelligence, purpose, and long-term alignment. By rewarding committed participation and keeping value inside the ecosystem, it has become one of the strongest pillars of the Base network. The AERO and veAERO token model gives users both influence and earning power, creating a positive cycle where stronger liquidity leads to stronger growth.

As Base continues to expand with new projects, assets, yield innovations, and real utility-driven adoption, Aerodrome will remain a central force shaping how liquidity operates across the network. And for users who want to access this ecosystem in the easiest possible way from any chain, RocketX Exchange offers a simple path to buy AERO without complications or multi-step risks.

The future of DeFi is moving toward smarter liquidity, cleaner incentives, and more cross-chain simplicity. Aerodrome is already building in that direction.