Introduction

Aster DEX has become one of the most talked-about names in DeFi this year. Born from the merger of Astherus and APX Finance, it quickly turned into a multi-chain perpetual trading giant, attracting millions of users and billions in trading volume.

Its native token, $ASTER, has been at the center of this surge, climbing into the top 50 cryptos within weeks of launch. Backed by YZi Labs (formerly Binance Labs) and even receiving public support from CZ, Aster combines the speed of centralized exchanges with the transparency of DeFi.

With features like 1001x leverage, hidden orders, yield-bearing collateral, and cross-chain execution, it is positioning itself as a “CEX-like DEX” for the future of trading. In this guide, we’ll break down why Aster is gaining popularity and show you step-by-step how to buy Aster tokens easily using RocketX Exchange.

What is Aster DEX and How Does It Work?

Aster DEX is a next-generation decentralized exchange (DEX) designed to deliver the speed and simplicity of centralized trading platforms while keeping the transparency, security, and self-custody benefits of DeFi. It was born in early 2025 from the merger of Astherus (a yield and staking protocol) and APX Finance (a derivatives trading platform). By combining Astherus’ yield-generating strategies with APX’s advanced perpetuals infrastructure, the two projects created a powerful all-in-one trading hub.

So, how does Aster actually work? At its core, it offers perpetual futures markets across cryptocurrencies, altcoins, and even tokenized U.S. stocks tradable with leverage up to 1001x. What makes it stand out is the use of yield-bearing collateral, such as BNB or yield-backed stablecoins. Instead of leaving your collateral idle, Aster allows you to earn passive income while using it for trading, creating an unmatched level of capital efficiency.

Another breakthrough is Aster’s use of hidden orders. Unlike traditional DEXs, where orders are visible and vulnerable to front-running, Aster keeps orders concealed until they’re executed, dramatically reducing MEV risks and giving traders a fairer playing field. On top of this, Aster runs as a multi-chain platform, aggregating liquidity from BNB Chain, Ethereum, Solana, Arbitrum, and more. This lets users deposit directly and trade without unnecessary bridges or wrapped assets.

Key Features of Aster DEX

- Ultra-high leverage (up to 1001x on crypto and tokenized stocks).

- Yield-bearing collateral, so you earn rewards even while trading.

- Hidden orders to eliminate front-running and MEV manipulation.

- Cross-chain liquidity aggregation across major blockchains.

- Dual trading modes: simple one-click for beginners, pro orderbook for advanced traders.

- Mobile-first design with iOS and Android apps for on-the-go trading.

- Audited security with ZK proof integrations and MEV resistance.

In short, Aster DEX functions like a CEX in DeFi clothing: fast execution, deep liquidity, cross-chain support, yield integration, and strong security—all while keeping you in control of your assets.

What is the Aster Token ($ASTER) and Why Is It Gaining Popularity?

The Aster token ($ASTER) is the native utility and governance token of the Aster DEX ecosystem. It powers everything from trading fee discounts and staking rewards to governance proposals and ecosystem incentives. With a fixed maximum supply of 8 billion tokens, this token is designed to be deflationary over time, thanks to its aggressive buyback and burn model. Also 97% of all trading fees generated on the platform are used to purchase and burn tokens, reducing the circulating supply.

Beyond governance and fee discounts, $ASTER also enables users to stake for additional yield and access premium trading features. Holding the token isn’t just about speculation; it provides real utility within one of the fastest-growing perp DEXs in the market.

So, why has this token has become one of the hottest tokens of 2025? Several factors have fueled its rise:

- Explosive launch performance: After its TGE, ASTER token surged over 2,800% in just 12 days, propelling it into the top 50 cryptocurrencies by market cap.

- Massive adoption metrics: Aster DEX recorded $500B+ lifetime trading volume, $1B+ TVL, and over 2 million users before the token even launched. These numbers gave instant credibility to the token.

- Strong backers and endorsements: Aster is backed by YZi Labs (formerly Binance Labs), and Binance founder Changpeng Zhao (CZ) publicly praised the project. This endorsement alone fueled a wave of adoption and speculation.

- Innovative features: Traders are attracted to Aster’s 1001x leverage, hidden orders, yield-bearing collateral, and cross-chain liquidity, all powered by $ASTER as the central token.

- Community-first tokenomics: Over 53% of supply is dedicated to community rewards and airdrops, driving strong grassroots adoption and viral buzz.

Put simply, the ASTER token is gaining popularity because it sits at the intersection of utility, community incentives, and massive narrative momentum. It’s not just a governance token—it’s a core part of how Aster DEX operates, and its explosive growth reflects the exchange’s rapid adoption.

The Future Roadmap of Aster

Aster’s vision goes far beyond being a popular perpetual DEX—it aims to become a full-scale DeFi ecosystem with its own blockchain, advanced privacy features, and broader trading opportunities. This roadmap explains why the project continues to attract traders, investors, and attention across the crypto space.

In the near term (Q4 2025), Aster plans to launch the Aster Chain testnet, a privacy-focused Layer-1 with zero-knowledge proofs for secure and anonymous trading. Alongside this, the team is working on a mobile-first UX overhaul and intent-based trading, where AI will automate strategies to make trading simpler for both retail and professional users.

Moving into 2026, the roadmap focuses on growth. The mainnet launch of Aster Chain will introduce sub-second finality and near gasless transactions, while new staking options for $ASTER holders are expected to offer yields of 3–7%. The platform also aims to integrate real-world assets (RWAs) such as stocks, ETFs, and commodities, bringing 24/7 access to traditional markets through DeFi. Additionally, Aster plans to scale through 100+ Orbit Chains, boosting liquidity and app-specific rollups.

Looking further ahead to 2027 and beyond, Aster envisions a massive community treasury, CEX-level liquidity in a non-custodial format, and global expansion targeting tens of millions of traders. If delivered, this could transform Aster from a DEX into a DeFi super app, directly rivaling both centralized and decentralized exchanges.

And if you’re wondering how to get started and buy ASTER token securely, the process is simpler than you think. Thanks to RocketX Exchange, you can swap or bridge from any token on any chain directly into ASTER in just a few clicks.

How to Buy Aster Tokens Using RocketX Exchange

Aster’s roadmap and explosive growth have put the token in the spotlight, and many investors are looking for the easiest way to get their hands on the token. The good news? With RocketX Exchange, you don’t need to worry about juggling multiple platforms or bridges. RocketX aggregates liquidity from both CEXs and DEXs across 200+ blockchains, giving you the best prices in just a few clicks.

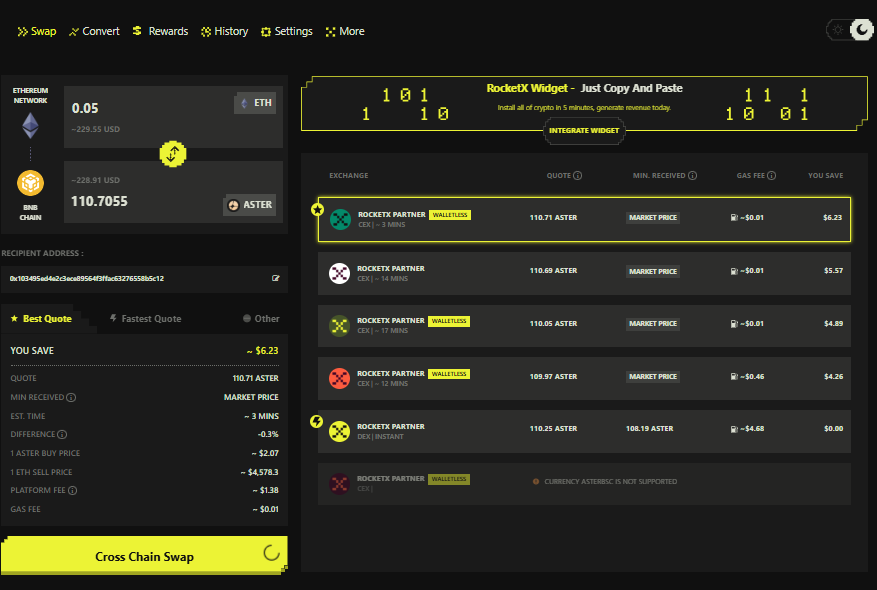

Here’s how you can buy ASTER token step by step:

🔹 Step 1: Visit RocketX

Head over to app.rocketx.exchange on your desktop or mobile browser.

🔹 Step 2: Connect Your Wallet

Click Connect Wallet and choose your preferred option—MetaMask, Phantom, Rabby, Trust Wallet, or any supported wallet.

🔹 Step 3: Select Your Source Network and Token

From the Source Network dropdown, choose where you want to pay from (Ethereum, BNB Chain, Solana, etc.). Then select the token you’ll use—like ETH, USDT, or SOL.

🔹 Step 4: Choose Destination Network and Token

In the Destination Network, pick the chain where ASTER is live (currently BNB Chain and expanding to others) and select ASTER token.

🔹 Step 5: Enter the Amount & Get a Quote

RocketX instantly scans all available liquidity pools and exchanges to give you the best possible rate for your swap. Review the quote before proceeding.

🔹 Step 6: Confirm the Transaction

Click on Cross-chain swap and approve the transaction in your wallet. Within minutes, your new tokens will be deposited directly into your wallet.

You can also watch our detailed YouTube video to learn more about the Aster token and see a step-by-step tutorial on how to buy it using RocketX Exchange.

🎥 Watch here

Conclusion

Aster DEX has quickly become one of the most exciting stories in DeFi—blending CEX-like speed with DeFi transparency, powered by unique features like yield-bearing collateral, hidden orders, and cross-chain liquidity. Its native token, $ASTER, has gained massive attention not just because of hype, but due to real adoption, strong backers, and an ambitious roadmap that points toward long-term growth.

For traders and investors who want exposure to this rising ecosystem, RocketX Exchange offers the simplest and most secure way to buy ASTER. With its one-click swaps, deep liquidity, and support for 200+ blockchains, RocketX ensures you get the best execution every time—all while keeping full control of your assets.

In short, Aster is shaping the future of decentralized trading, and with RocketX, getting started with $ASTER is easier than ever.