Introduction

Falcon Finance is a decentralized finance (DeFi) protocol designed to turn crypto, stablecoins, and tokenized real-world assets into a yield-generating synthetic dollar called USDf. Instead of earning yield by lending funds to borrowers, Falcon Finance uses over-collateralization, arbitrage, and real-world assets to generate returns in a more capital-efficient way.

This guide explains what Falcon Finance is, how USDf and sUSDf work, what risks exist, and how users can safely access Falcon Finance using cross-chain infrastructure like RocketX Exchange.

What Is Falcon Finance and Why Buy FF Tokens?

Falcon Finance operates as a next-generation synthetic dollar platform that transforms any liquid asset into yield-bearing onchain liquidity. The protocol has achieved remarkable growth, reaching over $2.05 billion in total value locked as of January 2026, making it one of the fastest-growing DeFi protocols in the collateralized stablecoin sector.

The FF token captures value as the protocol scales. As more assets are deposited and USDf adoption expands across DeFi ecosystems, FF token holders benefit from governance rights, staking rewards, reduced collateralization requirements, and access to exclusive features through the Falcon Miles loyalty program. With institutional backing from DWF Labs and World Liberty Financial totaling $45 million in funding, Falcon Finance is positioning itself as infrastructure designed for trillions in tokenized assets.

Note: While the FF governance token trades on Ethereum and BNB Chain, the protocol recently expanded its USDf stablecoin to Base network in December 2025, allowing users to bridge USDf between Ethereum and Base for lower-cost transactions.

How Does Falcon Finance Work?

Falcon Finance operates through a three-token system that creates a complete DeFi yield ecosystem:

USDf (Synthetic Dollar): Users deposit collateral including Bitcoin, Ethereum, Solana, stablecoins like USDT and USDC, and tokenized real-world assets such as U.S. Treasury bills, gold, and sovereign bonds. The protocol requires overcollateralization ratios typically between 110-150%, depending on asset volatility. This creates USDf, a synthetic dollar pegged to $1 USD, with current circulation of 2.06-2.17 billion USDf backed by a 109.15% reserve ratio.

sUSDf (Yield-Bearing Token): Users can stake their USDf to receive sUSDf, which accrues yields from diversified institutional-grade trading strategies. Current APY rates range from 5.55% to 12.8%, averaging around 8.7-10%. These returns come from delta-neutral arbitrage, real-world asset yields from tokenized Treasuries, and liquidity provision across DeFi protocols. Yields remain resilient across market conditions, with projections showing a minimum 4.44% floor over the next month.

FF Token: The native governance token provides voting rights on protocol parameters, staking rewards, reduced collateralization requirements, and priority access to new features. FF holders can also earn Falcon Miles, a loyalty system that unlocks additional yield opportunities and protocol benefits.

Where to Buy Falcon Finance Token

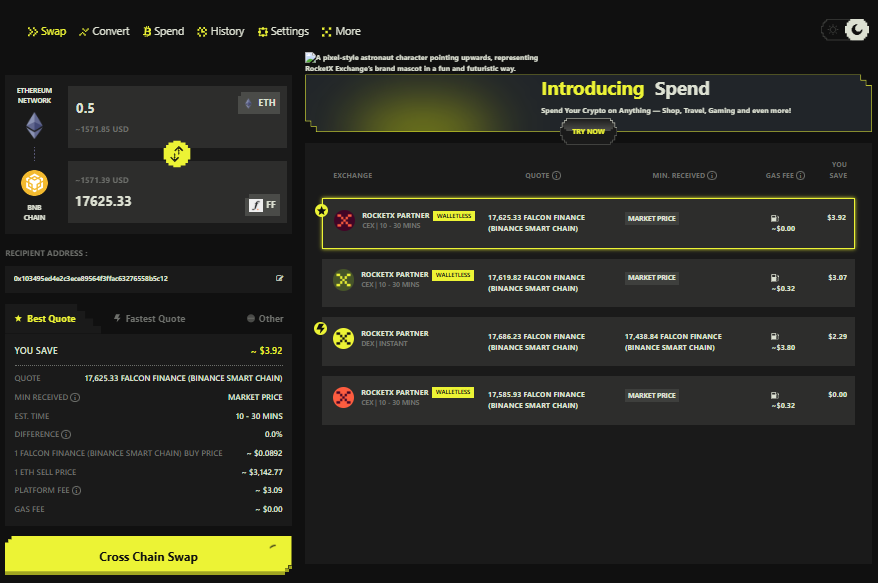

RocketX Exchange is the premier platform for buying Falcon Finance tokens across multiple blockchains. As a hybrid CEX-DEX aggregator supporting over 200 blockchains and 250+ exchanges, RocketX automatically scans all available liquidity sources to provide the absolute best price for FF purchases.

Unlike traditional exchange platforms that limit you to their internal liquidity, RocketX aggregates order books from both centralized and decentralized exchanges simultaneously. This means you get better prices, deeper liquidity, and more trading routes than any single platform can offer.

Key advantages of using RocketX for Falcon Finance:

- Guaranteed Best Price: Real-time aggregation across 250+ exchanges ensures you never overpay. RocketX compares quotes from major centralized exchanges and DEX liquidity pools to find the optimal route.

- True Cross-Chain Freedom: Swap from Bitcoin, Solana, Avalanche, or any token on 200+ supported chains directly into FF tokens on Ethereum or BNB Chain—no manual bridging required.

- Non-Custodial Security: Keep full control of your wallet throughout the entire process. No account creation, no KYC for crypto-to-crypto swaps, no exchange custody risk.

- Dynamic Fee Optimization: Starting from just 0.2-0.4% platform fee, or completely free when holding RVF tokens. RocketX’s fee structure beats traditional exchange trading fees.

- Audited & Trusted: Multiple security audits by Zokyo and Network Intelligence provide institutional-grade security for every transaction.

- Universal Liquidity Access: By aggregating hundreds of exchanges, RocketX solves the liquidity fragmentation problem that plagues individual trading platforms.

For users holding assets across different blockchains, RocketX eliminates the multi-step process of bridging tokens, creating exchange accounts, and managing multiple platforms. Everything happens in one seamless swap with transparent routing and real-time execution.

How to Buy Falcon Finance on RocketX Exchange: Step-by-Step

Step 1: Connect Your Wallet

Navigate to app.rocketx.exchange and click “Connect Wallet.” RocketX supports MetaMask, WalletConnect, Trust Wallet, Coinbase Wallet, and 50+ other options. Select your preferred wallet and approve the connection.

Step 2: Select Your Source Token

Choose the cryptocurrency you want to swap for FF tokens. RocketX supports conversions from Bitcoin, Ethereum, BNB, Solana, USDT, USDC, and thousands of other tokens across 200+ blockchains. Enter the amount you wish to swap.

Step 3: Choose FF Token as Destination

In the “You Receive” field, search for “Falcon Finance” or “FF” and select the token on your preferred network (Ethereum or BNB Chain – these are the only networks where the FF token is currently available). RocketX will display all available trading routes with real-time pricing.

Step 4: Review Best Price Route

RocketX automatically recommends the optimal route based on price, gas fees, and transaction time. The interface shows comparison quotes from all aggregated exchanges, allowing you to verify you’re getting the best deal. You can manually override the recommendation if desired.

Step 5: Execute the Swap

Click “cross-chain swap” and approve the transaction in your wallet. RocketX handles all bridging automatically. Transaction times vary from 30 seconds for single-chain swaps to 3-5 minutes for cross-chain transfers. Track your swap status in real-time through the “History” tab.

Step 6: Receive FF Tokens

Once confirmed, FF tokens appear in your connected wallet on Ethereum or BNB Chain (depending on which network you selected). You can now hold, stake, or use them within the Falcon Finance ecosystem to access reduced collateralization ratios, governance rights, and Falcon Miles rewards.

Falcon Finance vs Competitors: Why FF Stands Out

| Protocol | TVL (Jan 2026) | Stablecoin | Yield APY | Key Differentiator |

| Falcon Finance | $2.05B | USDf | 8.7-12.8% | Universal collateral (crypto + RWAs), consistent yields, institutional backing |

| Ethena | $7.14B | USDe | 10-15% | Larger scale, funding rate focus, higher volatility risk |

| MakerDAO | ~$6.25B | DAI | 5-8% | Established governance, lower yields, limited RWA diversity |

| Synthetix | ~$60M | sUSD | Variable | Synthetic asset variety, complex system, inconsistent yields |

| Liquity | ~$370M | LUSD | 0% | Zero-fee loans, no native yield mechanism |

Falcon Finance differentiates through its universal collateralization model that accepts both traditional crypto assets and tokenized real-world assets. The protocol’s integration with U.S. Treasury bills, tokenized gold, and sovereign bonds provides yield stability that competitors relying solely on DeFi strategies cannot match. Additionally, Falcon’s transparency through Chainlink Proof of Reserve, weekly audits, and real-time dashboards addresses security concerns that have plagued other synthetic dollar protocols.

Investment Considerations and Risks

The FF token price is directly correlated to protocol growth metrics including total value locked, USDf circulation, and trading volume. With 103% monthly supply growth in late 2025 and expansion to Base Layer 2 in December, fundamental indicators remain bullish for early 2026.

However, potential buyers should consider several risk factors. Falcon Finance experienced a temporary depeg event in July 2025 when USDf briefly traded at $0.97 due to large collateral withdrawals during market volatility. The protocol has since implemented a $10 million insurance fund and enhanced liquidation mechanisms to prevent future occurrences.

Smart contract risk remains inherent to all DeFi protocols, though Falcon’s multiple security audits and partnership with Chainlink for oracle infrastructure mitigate this concern. The team has introduced an offchain Bitcoin vault that eliminates smart contract exposure entirely for BTC deposits, earning 3-5% APR paid in USDf.

Regulatory uncertainty around synthetic stablecoins could impact long-term viability, particularly as Falcon expands real-world asset integration. The protocol’s institutional funding and compliance-forward approach position it well for regulatory adaptation, but buyers should monitor developments in stablecoin regulation.

Maximizing Returns with Falcon Finance

After purchasing FF tokens, several strategies can enhance your returns:

Stake FF for Protocol Benefits: Lock your FF tokens to reduce collateralization requirements when minting USDf, allowing you to unlock more liquidity from the same collateral. Staking also qualifies you for Falcon Miles, which unlock tiered rewards and priority access to new features.

Mint USDf and Stake for sUSDf Yields: Use your collateral assets to mint USDf, then immediately stake it for sUSDf to earn 8-12% APY. This strategy generates passive income while maintaining exposure to your original collateral through overcollateralization.

Provide Liquidity: Supply USDf or FF tokens to decentralized exchange liquidity pools on Ethereum and Base. Current pools offer additional trading fee income on top of protocol yields, though this exposes you to impermanent loss risk.

Frequently Asked Questions

Is Falcon Finance safe?

Falcon Finance has undergone security audits and uses Chainlink oracles for price feeds and Proof of Reserve verification. The protocol maintains a 109.15% reserve ratio with a $10 million insurance fund. While no DeFi protocol is completely risk-free, Falcon’s security infrastructure is among the most robust in the synthetic stablecoin sector.

What’s the minimum amount to buy FF tokens?

There is no official minimum on most exchanges. On RocketX, you can swap any amount starting from approximately $10 worth of any supported cryptocurrency, making Falcon Finance accessible to all investors.

Can I earn yield just by holding FF?

Holding FF tokens alone does not generate automatic yield. However, staking FF provides governance rights and protocol benefits. To earn yields, deposit collateral to mint USDf, then stake it for sUSDf which accrues 8-12% APY.

Which network should I buy FF on?

FF tokens are available on Ethereum (primary network with highest liquidity) and BNB Chain according to CoinGecko tracking. Ethereum hosts the majority of FF trading volume and protocol activity. Choose Ethereum for maximum liquidity and deepest order books, or BNB Chain for lower gas fees. Note that USDf stablecoin has expanded to Base network for bridging, but FF token trading remains concentrated on Ethereum and BNB Chain.

How long does it take to buy FF on RocketX?

Single-chain swaps (e.g., USDT to FF on Ethereum) complete in 30-60 seconds. Cross-chain swaps (e.g., Bitcoin to FF) take 3-5 minutes as RocketX handles bridging automatically.

Start Buying Falcon Finance Today

Falcon Finance represents a new paradigm in DeFi collateralization, combining cryptocurrency backing with real-world asset integration to create sustainable yield opportunities. The protocol’s rapid growth to $2.05 billion TVL, institutional backing, and expansion of its USDf stablecoin to Base network signal strong momentum heading into 2026. While FF token currently trades on Ethereum and BNB Chain, the protocol is expanding cross-chain support through Chainlink’s CCIP to networks including Solana, TON, TRON, Polygon, and NEAR.

RocketX Exchange offers the most efficient path to purchasing FF tokens, aggregating liquidity across 200+ blockchains and 250+ exchanges to guarantee the best prices with minimal fees. Visit app.rocketx.exchange to swap any cryptocurrency for Falcon Finance tokens in seconds.