Introduction

OnyxCoin (XCN) is the native gas and governance token of the Onyx Protocol, a Layer 3 blockchain built on Ethereum and Base designed for financial-grade applications. XCN surged 119% in early January 2026, following its listing on Robinhood and the anticipated launch of its Goliath mainnet. You can buy OnyxCoin through RocketX Exchange, a cross-chain aggregator that scans 250+ exchanges across 200+ blockchains to guarantee the best price. With backing from institutional investors and U.S. regulatory clarity, XCN targets the $0.01-$1 price range as adoption grows.

What Is OnyxCoin (XCN)?

OnyxCoin (XCN) powers the Onyx Protocol, a Layer 3 blockchain infrastructure optimized for banking, securities, and payment applications. It operates as a modular architecture built on Ethereum and Base, delivering sub-second transaction finality with fees consistently below $0.01.

The protocol was originally founded in 2014 as Chain Protocol by venture capitalist Adam Ludwin with support from several venture capital firms. After years of development focused on enterprise blockchain solutions, the project rebranded to Onyx Protocol in its evolution toward Web3 financial infrastructure. Onyx is based in the United States and maintains compliance with U.S. regulatory frameworks, including classification under the CLARITY Act.

XCN serves three critical functions within the ecosystem. As the native gas token, users pay transaction fees in XCN rather than ETH, making costs predictable and affordable. As a governance token, XCN holders vote on protocol upgrades, treasury allocations, and tokenomics parameters through the Onyx DAO. As a utility token, XCN enables staking to secure the network and access premium features.

The token supply includes 48.4 billion XCN, with 37 billion currently in circulation. Periodic token burns have already reduced the maximum supply from 68.89 billion to 48.4 billion, creating deflationary pressure that supports long-term value appreciation.

What Is OnyxCoin Used For?

XCN has multiple practical applications within the rapidly growing Onyx ecosystem:

Transaction fees and gas: All operations on the Onyx network require XCN to pay for gas, similar to how Ethereum uses ETH. However, Onyx fees remain below $0.01, making microtransactions and frequent DeFi interactions economically viable.

DeFi protocol operations: Onyx hosts decentralized exchanges, such as Slingshot, lending protocols, and liquidity pools, where XCN serves as both a trading pair and a settlement token. Users can swap assets, provide liquidity, and earn yields all using XCN.

Enterprise payment processing: The upcoming Bank Connectivity Mesh Network (launching Q2 2026) targets institutional settlement and interbank transactions. Financial institutions can process real-time payments using XCN as the settlement layer.

Cross-chain asset bridging: XCN facilitates seamless asset transfers between Ethereum, Base, Arbitrum, BNB Chain, and other networks through Superbridge integration. Users moving assets across chains use XCN to pay bridging fees.

AI-powered automation: The Onyx AI Agent uses XCN for autonomous execution of on-chain tasks, including smart contract deployment, token transfers, and workflow automation. Developers building intelligent dApps leverage XCN for programmatic operations.

Network governance: XCN stakers influence protocol development through Onyx DAO voting on treasury spending, technical upgrades, and economic parameters. This decentralized governance ensures community alignment as the ecosystem evolves.

Who Invested in Onyxcoin?

OnyxCoin has attracted backing from notable investors and institutions, lending credibility to the project’s long-term vision.

The project received early funding from multiple venture capital firms when it operated as Chain Protocol starting in 2014. While specific early investors are not fully disclosed, the protocol has maintained institutional relationships throughout its development.

In recent developments, OnyxCoin’s classification as a “Digital Commodity Token” under the U.S. CLARITY Act has attracted institutional interest from traditional finance entities exploring blockchain integration. This regulatory clarity makes XCN one of the few crypto assets institutions can hold with confidence.

The December 2025 Robinhood listing represented a major validation, bringing XCN to millions of retail investors through one of America’s largest trading platforms. Robinhood’s rigorous listing standards require tokens to meet specific criteria around transparency, security, and regulatory compliance.

Additionally, major exchanges including Coinbase, Kraken, and KuCoin have listed XCN, indicating confidence from the industry’s most established platforms. These listings followed extensive due diligence on the protocol’s technology, team, and tokenomics.

The upcoming Goliath mainnet and Bank Connectivity Mesh Network have generated interest from financial institutions seeking blockchain solutions for payment processing. While specific enterprise partnerships remain under NDA, Onyx’s focus on institutional-grade infrastructure positions it for banking sector adoption.

Is OnyxCoin a Good Investment in 2026?

OnyxCoin presents a compelling investment opportunity based on several fundamental strengths, though like all cryptocurrencies, it carries significant risks.

Bullish factors: The 119% January 2026 surge demonstrates renewed market confidence, breaking through $0.01 resistance. The Q1 2026 Goliath mainnet launch targets institutional-grade performance with Visa-level speeds. U.S. CLARITY Act classification provides regulatory clarity that most crypto lacks. Deflationary tokenomics from ongoing burns create supply pressure—supply already reduced 30% from original maximum. Transaction costs below $0.01 solve critical adoption barriers for payments and enterprise applications.

Investment reality: XCN trades 95% below its $0.18 all-time high, typical of altcoins post-correction. The #200 CoinGecko ranking with $340M market cap shows established mid-cap status with growth potential. Daily volume of $13-33M provides adequate liquidity. Analyst projections range from $0.005-0.01 (conservative) to $0.01-0.015 (base case) to $0.02-0.05 (bullish) for 2026.

Bottom line: XCN shows promising fundamentals—legitimate technology, regulatory compliance, institutional backing, and catalysts. However, cryptocurrency investments carry inherent volatility. Best suited for moderate-to-high risk tolerance investors seeking Layer 3 infrastructure exposure. Consider your timeline, diversification, and ability to handle price swings before purchasing.

What Are the Risks of Investing in Onyxcoin?

Technical execution risk: Goliath’s mainnet success is critical. Delays, bugs, or performance issues could undermine confidence. The protocol must deliver promised speeds to justify valuations.

Competition: Layer 3 blockchain space includes Arbitrum, Optimism, and others. Onyx must differentiate to capture meaningful market share.

Adoption uncertainty: Institutional blockchain adoption remains early-stage despite growing interest. Banks move slowly—anticipated enterprise adoption may take longer than projected.

Token unlock pressure: February 15, 2026, unlock releases 296.38M XCN (0.55% supply). While small, unlocks can create temporary selling pressure. Additional 2026 unlocks could pressure prices if demand doesn’t absorb supply.

Overbought conditions: Recent RSI of 71 indicates overbought territory typically preceding consolidation. 242M XCN moved to exchanges suggests profit-taking positioning. Short-term 20-30% pullbacks are possible despite a positive long-term outlook.

Regulatory changes: While the CLARITY Act classification helps now, crypto regulations evolve. Tax, reporting, or use-case restrictions could impact adoption.

Market correlation: Broader crypto conditions heavily influence altcoins. Bitcoin/Ethereum corrections will likely pull XCN down regardless of project developments.

Liquidity concentration: $13-33M daily volume is modest. Large orders can create significant slippage for institutional-sized positions.

Size positions appropriately, never invest more than you can afford to lose, and maintain stop-loss discipline.

How to Buy OnyxCoin on RocketX Exchange

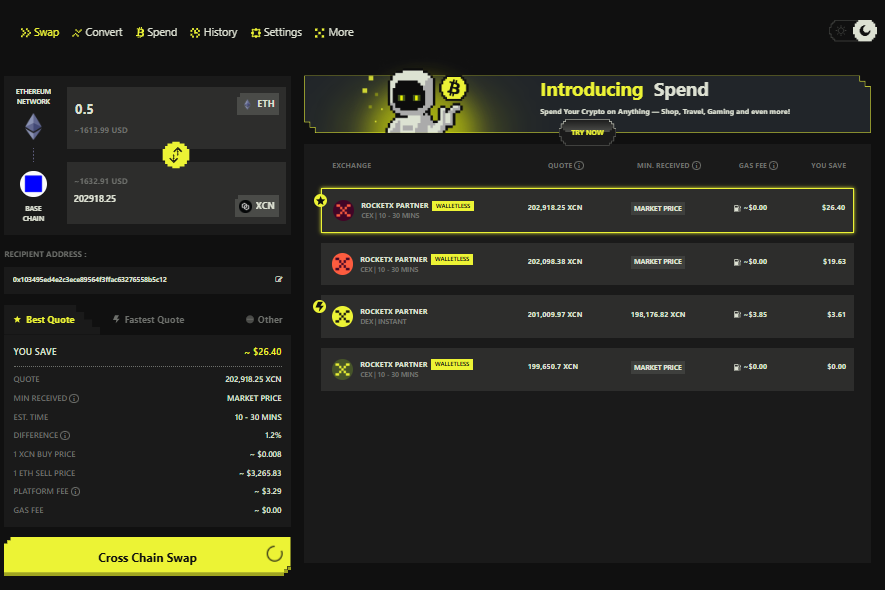

RocketX Exchange provides the most efficient method for purchasing OnyxCoin across multiple blockchains. As a hybrid CEX-DEX aggregator supporting over 200 blockchains and 250+ exchanges, RocketX automatically identifies the optimal route for XCN purchases, guaranteeing the best pricing by simultaneously querying liquidity from hundreds of exchanges and comparing real-time quotes.

Key advantages: RocketX offers true cross-chain capability—purchase XCN using Bitcoin, Solana, USDC on Polygon, ETH on Arbitrum, or any cryptocurrency on 200+ blockchains without manual bridging. The platform is non-custodial (your funds never leave your wallet), charges transparent fees of just 0.2-0.4% (or free with RVF tokens), and maintains institutional-grade security verified by Zokyo and Network Intelligence audits.

Step-by-Step Buying Process:

Step 1: Connect your wallet: Navigate to app.rocketx.exchange and click “Connect Wallet.” RocketX supports MetaMask, WalletConnect, Coinbase Wallet, Trust Wallet, and 50+ other options.

Step 2: Select source chain and cryptocurrency: Choose the token you want to exchange for XCN—Bitcoin, Ethereum, USDT, USDC, or any asset on 200+ supported blockchains. Enter the amount you wish to swap.

Step 3: Choose destination chain and OnyxCoin (XCN): Search for “OnyxCoin” or “XCN” in the destination field. RocketX primarily supports XCN on Ethereum, Base, and BNB Networks, where most trading volume occurs.

Step 4: Review routing option: RocketX automatically recommends the optimal route based on price, gas fees, and speed. The interface shows detailed breakdowns with completion time estimates (typically 30 seconds to 5 minutes).

Step 5: Verify recipient address: Confirm the destination wallet address. For most users, this is the connected wallet from Step 1.

Step 6: Execute the Swap: Click “cross-chain swap” and approve the transaction in your wallet. RocketX handles all bridging automatically.

Step 7: Track progress: RocketX provides real-time status updates. Single-chain swaps complete within 30-90 seconds. Cross-chain swaps take 3-8 minutes, depending on network congestion.

Step 8: Receive XCN: Once completed, OnyxCoin appears in your wallet. You can immediately use XCN on the Onyx network, stake it for governance, or hold it as an investment.

Frequently Asked Questions

What is the onyxcoin price prediction for 2026?

Conservative estimates suggest XCN trading between $0.005-0.01 by year-end 2026. Base case scenarios anticipate $0.01-0.015 if Goliath launches successfully. Bullish scenarios project $0.02-0.05 if institutional adoption accelerates. These predictions assume successful technical execution and generally favorable crypto market conditions.

Is Onyxcoin American?

Yes, Onyx Protocol is based in the United States. It was originally founded as Chain Protocol by American venture capitalist Adam Ludwin with support from U.S. venture capital firms. The protocol maintains compliance with U.S. regulatory frameworks and achieved classification under the CLARITY Act as a Digital Commodity Token.

Can I stake OnyxCoin?

Yes. XCN holders can stake tokens through Ethereum-based decentralized smart contracts to secure the Onyx network and participate in governance. Staking rewards vary based on network parameters set by Onyx DAO. Visit the official Onyx platform for current staking options, APY rates, and requirements.

Which blockchain is XCN on?

XCN is an ERC-20 token on Ethereum, the primary network for trading and liquidity. The Onyx Protocol itself operates as a Layer 3 blockchain built on Ethereum and Base infrastructure. XCN can be bridged across multiple chains, including BNB Chain, Arbitrum, and others through Superbridge.

Will Onyx Coin Recover?

Recovery indicators are strong. XCN has already surged 1,092% from its all-time low and broke through $0.01 resistance with a 119% January 2026 rally. The upcoming Goliath mainnet, institutional backing, and regulatory clarity support continued upside. However, full recovery to the $0.18 all-time high requires significant adoption and favorable market conditions. Near-term realistic targets: $0.01-0.015 (2026), $0.02-0.05 (2026-2027), with $0.10-0.25 possible during the next bull cycle (2027-2028).

Can OnyxCoin reach $1?

Reaching $1 would require an 11,800% increase, valuing XCN at a $37 billion market cap. While ambitious, it’s not impossible—Solana reached $77B, and Cardano hit $90B in 2021. For XCN to reach $1, Onyx must capture significant institutional payment processing market share over 3-5 years. This is a moonshot scenario requiring nearly perfect execution and a major crypto bull market, but it is conceivable if the protocol delivers on its institutional blockchain vision.

Start Buying OnyxCoin Today

OnyxCoin represents a compelling opportunity in the Layer 3 blockchain sector, combining technical innovation with institutional positioning and regulatory clarity. The 119% early-2026 surge, upcoming Goliath mainnet, and Bank Connectivity Mesh Network position XCN for continued growth as blockchain adoption accelerates in traditional finance.

With backing from established investors, listings on major platforms like Robinhood and Coinbase, and U.S. regulatory compliance, XCN offers a relatively lower-risk entry point into institutional blockchain infrastructure compared to unproven projects.

RocketX Exchange provides the most efficient path to purchasing OnyxCoin, aggregating liquidity across 250+ exchanges to guarantee optimal pricing. Whether swapping from Bitcoin, Ethereum, stablecoins, or any other cryptocurrency, RocketX handles routing automatically while you maintain complete control.

Ready to buy XCN? Visit app.rocketx.exchange and swap any cryptocurrency for OnyxCoin in minutes—no KYC, no custody risk, no hidden fees.