Introduction

In a crypto world often defined by hard forks, network congestion, and unpredictable gas spikes, Tezos (XTZ) stands out as the quiet innovator. A blockchain that can literally upgrade itself without ever pausing or splitting. Think of it like a smartphone that updates automatically in the background, keeping everything running smoother with each release.

Launched in 2018, Tezos is an open-source, energy-efficient Proof-of-Stake blockchain built for continuous evolution. Its core design allows for seamless self-amendments, enabling upgrades through community consensus rather than disruptive forks. This unique mechanism makes Tezos one of the most stable and forward-thinking Layer-1 networks in the market today.

Tezos is making headlines again with major leaps in scalability and usability, most notably through Etherlink, its new EVM-compatible Layer 2 solution that delivers ultra-fast, near-zero-cost transactions. With Tezos’ thriving ecosystem of NFTs, gaming, and DeFi applications, the network has evolved into a real contender for those seeking secure, eco-friendly, and developer-friendly alternatives to congested blockchains like Ethereum.

This guide explores everything you need to know about the Tezos Network: how it works, why XTZ is unique, its latest ecosystem updates, and how to trade it seamlessly on RocketX. Whether you’re a beginner or a seasoned crypto enthusiast, by the end of this read, you’ll understand why Tezos continues to be one of the most quietly powerful networks in Web3.

What is the Tezos Network and How It Works

Tezos is an open-source, self-amending Layer-1 blockchain designed to evolve without disruption. Launched in 2018 by Arthur and Kathleen Breitman, Tezos was designed to address one of the most significant challenges in blockchain history—the need for hard forks to upgrade networks. Instead of dividing the community every time an improvement is proposed, Tezos enables token holders to vote directly on upgrades, which are then integrated automatically. This makes Tezos a “living” blockchain capable of upgrading itself while maintaining network continuity.

At its core, Tezos operates on Liquid Proof-of-Stake (LPoS) consensus, a modern, energy-efficient mechanism that replaces miners with validators known as “bakers.” Anyone holding XTZ (the native token) can participate in governance by either baking (staking) directly or delegating their tokens to trusted bakers while keeping full control of their assets. This democratic model ensures decentralization, energy efficiency, and user empowerment.

The network architecture is composed of three primary layers:

- Network Layer – Handles peer-to-peer communication between nodes.

- Transaction Layer – Executes smart contracts and transactions.

- Consensus Layer – Validates and finalizes blocks using LPoS.

Tezos’ flexibility also extends to its developer ecosystem. Its smart contracts are written in Michelson, a language built for formal verification—ideal for high-value use cases like DeFi, tokenized assets, and enterprise-grade dApps. In 2025, the launch of Etherlink, Tezos’ EVM-compatible Layer 2, expanded its reach by allowing Ethereum developers to easily deploy dApps on Tezos with faster speeds and sub-cent gas fees.

In simple terms, Tezos works like a self-upgrading operating system for blockchain—continuously improving without fragmenting the community. With its blend of security, sustainability, and scalability, Tezos is redefining what long-term blockchain evolution looks like.

The XTZ Token: Everything You Need to Know

Tezos raised $232 million in its 2017 ICO, one of the largest of its time. Since then, XTZ has evolved from a governance token to a vital asset fueling DeFi protocols, NFT marketplaces (like Objkt), and Layer-2 innovations such as Etherlink.

In essence, XTZ is the lifeblood of Tezos a token that secures the network, rewards participation, drives upgrades, and empowers its global community.

Utility and Core Functions

- Transaction Fees – XTZ is used to pay for all on-chain activities, including transferring tokens, minting NFTs, deploying smart contracts, and interacting with dApps. Thanks to Tezos’ efficiency, average transaction fees remain under $0.01, making it ideal for everyday use.

- Staking (Baking and Delegation) – Tezos uses Liquid Proof-of-Stake (LPoS), meaning users can earn passive rewards by either becoming a “baker” (validator) or delegating their tokens to one. Bakers secure the network, validate transactions, and earn around 5–6% APY, depending on network conditions.

- Governance – XTZ holders can propose, vote, and decide on network upgrades through Tezos’ on-chain governance system. This democratic model ensures the blockchain evolves with community consensus—no forks, no chaos.

Supply and Tokenomics

- Current Price (Oct 2025): ~$0.71 USD

- Market Cap: ~$750 million

- Circulating Supply: ~1.06 billion XTZ

- Inflation Rate: ~4.5% annually (used to reward stakers)

- No fixed max supply, but inflation remains controlled through staking participation.

Future Potential of the XTZ Token

The future of XTZ looks increasingly promising as Tezos continues to evolve into one of the most adaptive and forward-looking blockchains in the Web3 ecosystem. While many networks struggle to balance scalability, decentralization, and governance, Tezos has already built a foundation that thrives on all three—and that gives XTZ a strong long-term growth narrative.

- The Tezos X Roadmap and Etherlink Expansion

Tezos’ 2025 roadmap, known as Tezos X, marks a major leap forward. Its centerpiece, Etherlink, is an EVM-compatible Layer 2 that has already driven exponential activity growth, handling over 20 million transactions in Q2 2025. As more Ethereum developers migrate to Etherlink for its sub-cent gas fees and instant finality, demand for XTZ is expected to rise—since all ecosystem activities ultimately rely on Tezos for settlement and governance.

- Growing Use in Real-World Assets and DeFi

Tezos’ entry into Real-World Assets (RWA) through projects like xU3O8 (tokenized uranium) signals a shift toward institutional adoption. Combined with integrations from DeFi giants like Curve Finance and stablecoin expansions on Etherlink, XTZ is gaining new use cases beyond staking or speculation—anchoring itself in real-world economic activity.

- Sustainable Tokenomics and Passive Income

Unlike inflationary networks, Tezos maintains an annual inflation rate of around 4–5%, rewarding long-term stakers and minimizing dilution. With delegation rewards around 5–6% APY, XTZ offers a sustainable passive income model, especially appealing in a maturing market where yield opportunities are shrinking.

- Market Outlook and Long-Term Vision

Analysts anticipate that XTZ could see 2x–4x growth potential through 2026 as Tezos scales toward 1 million transactions per second (TPS) via rollups and Data Availability Layers. Its clean energy profile, governance maturity, and cross-chain compatibility make it a top contender for enterprise partnerships and developer adoption.

In short, XTZ’s value lies not just in price speculation, but in its role as a governance, staking, and settlement asset powering one of the most resilient and self-evolving blockchains in the world.

How to Buy XTZ Tokens Using RocketX Exchange

Tezos’ expanding ecosystem, powered by Etherlink, NFTs, DeFi, and real—world assets, has made the XTZ token a must-have for traders and investors who value scalability, governance, and long-term growth. The best part? You don’t need to hop between bridges or exchanges to buy XTZ.

With RocketX Exchange, you can buy or swap any token to XTZ directly in just a few clicks. As a hybrid CEX + DEX aggregator, RocketX pulls liquidity from both centralized and decentralized exchanges across 200+ blockchains and 20,000+ tokens, giving you the best rates instantly, without the complexity.

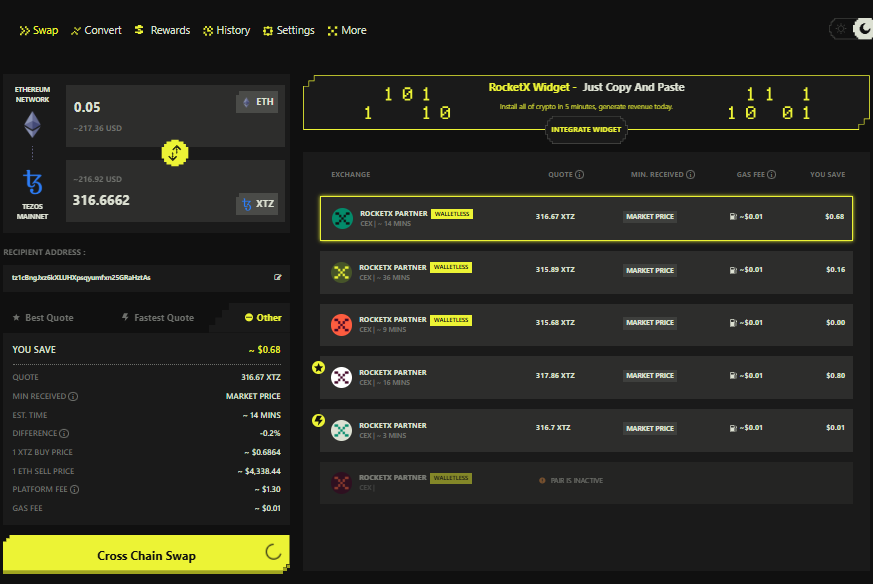

Here’s how you can buy XTZ tokens step by step:

🔹 Step 1: Visit RocketX

Go to app.rocketx.exchange on your desktop or mobile browser.

🔹 Step 2: Connect Your Wallet

Click “Connect Wallet” and choose your preferred option—MetaMask, Rabby, Trust Wallet, Phantom, or any other supported wallet.

🔹 Step 3: Select Your Source Network and Token

From the Source Network dropdown, choose the blockchain you’ll be paying from (like Ethereum, BNB Chain, Solana, or Polygon). Then, select the token you want to swap, such as ETH, USDT, or SOL.

🔹 Step 4: Choose Destination Network and Token

In the Destination Network, select Tezos, and under tokens, choose XTZ.

🔹 Step 5: Enter the Amount & Get a Quote

Enter the amount of tokens you want to swap for XTZ tokens. RocketX automatically scans hundreds of liquidity pools and exchanges to find the best rate for your swap. Review the quote carefully, including estimated gas and time.

🔹 Step 6: Confirm the Transaction

Click on Cross-chain swap and approve the transaction in your wallet. Within minutes, your new tokens will be deposited directly into your wallet.

Best Wallets to Store Your Tezos (XTZ) Tokens

Choosing the right wallet is crucial when holding or staking Tezos (XTZ). Since Tezos runs on its own self-upgrading blockchain with smart contract capabilities, it’s important to pick a wallet that’s secure, user-friendly, and compatible with staking (delegation). Here are some of the best Tezos wallets available today, categorized by use case and security level.

1. Hardware Wallets (Maximum Security)

For long-term holders, hardware wallets like Ledger Nano S/X and Trezor Model T offer unmatched protection. Your private keys stay offline, isolated from the internet, minimizing hacking risks.

2. Web and Desktop Wallets (Balance Between Security & Convenience)

-

Guarda Wallet – A multi-asset wallet available on Web, Mobile, and Desktop, supporting 40+ coins and 10,000+ tokens, including XTZ. Users can also buy or exchange crypto directly within the app.

-

Atomic Wallet – A secure desktop wallet supporting over 500 cryptocurrencies. It allows users to store, swap, and stake XTZ easily with full control of private keys.

3. Mobile Wallets (On-the-Go Access)

-

Trust Wallet – Backed by Binance, it supports Tezos alongside other major assets. Simple UI, easy setup, and staking features make it great for beginners.

-

AirGap Wallet – Offers a dual-device setup for maximum protection—your main phone acts as a wallet while an old offline phone holds your private keys securely.

Whether you’re staking, trading, or simply holding XTZ, these wallets provide the right mix of security, accessibility, and reliability—helping you stay in full control of your Tezos assets.

Conclusion

Tezos has quietly proven itself as one of the most resilient and future-ready blockchains in the industry. Its self-upgrading design, low fees, and expanding Layer-2 ecosystem through Etherlink make it both practical and forward-looking. With the XTZ token powering governance, staking, and real-world applications, Tezos continues to attract developers and investors who value innovation with stability.

Through RocketX Exchange, accessing Tezos is effortless—you can buy, swap, and bridge XTZ across 200+ blockchains and 20,000+ tokens in just a few clicks. For anyone seeking a sustainable, scalable, and community-driven network, Tezos stands as a strong contender in the next era of Web3 growth.