Introduction

Monad Network is one of the most talked-about Layer 1 blockchains to launch in 2025. Built to solve Ethereum’s long-standing scalability limits without breaking compatibility, Monad combines high-performance execution with full EVM support. The result is a network designed for fast, low-cost applications while preserving the developer experience Ethereum is known for.

In this guide, we break down what Monad Network is, how its technology works, the role of the MON token, and how users can safely bridge assets to the Monad network using a non-custodial approach.

What Is Monad Network?

Monad is a high-performance Layer 1 blockchain developed by Monad Labs, a team founded in 2022 by Keone Hon, James Hunsaker, and Eunice Giarta. The founders bring deep experience from high-frequency trading and large-scale systems, with backgrounds at firms like Jump Trading, which heavily influenced Monad’s focus on speed, efficiency, and reliability. After several years of research and testing, Monad launched its public mainnet in November 2025.

It is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to deploy existing Ethereum smart contracts without rewriting code. This lowers migration friction and makes Monad immediately accessible to the broader Ethereum developer ecosystem.

The network’s primary goal is to deliver Ethereum-level decentralization and security while achieving performance closer to centralized systems. With fast block times, low fees, and parallel transaction execution, Monad is well-suited for DeFi, on-chain trading, payments, gaming, and other high-throughput applications.

Despite being new, It quickly attracted developers, liquidity, and users, signaling strong early momentum for its growing ecosystem.

How Monad Network Works

This Network works by fundamentally improving how Ethereum-style transactions are processed, without breaking compatibility with the EVM. Instead of executing transactions one by one like Ethereum, It introduces parallel execution, which allows multiple non-conflicting transactions to run at the same time. This dramatically increases throughput while preserving deterministic results and security.

At the core of the network is a re-engineered EVM built to support concurrency, paired with MonadBFT, a Proof-of-Stake consensus mechanism designed for fast confirmations and strong fault tolerance. Blocks are produced roughly every 0.4 seconds, and transactions reach finality in under one second, making the network suitable for real-time applications.

Monad also maintains a single shared state, avoiding the complexity and fragmentation introduced by sharding. Combined with optimized execution and pipelining, this keeps gas fees extremely low, even during high network activity.

This architecture allows the network to process thousands of transactions per second while remaining fully compatible with existing Ethereum tools, smart contracts, and developer workflows.

The MON Token Explained

The MON token is the native utility and governance asset of the Monad Network, playing a central role in securing the chain and supporting ecosystem growth. The token has a fixed total supply of 100 billion MON, with approximately 10.8% circulating at launch. Distribution includes a public sale, an airdrop for early users and testnet participants, long-term vested allocations for the team and advisors, and reserves for ecosystem development, validator incentives, and foundation operations. There is no inflation, which helps keep supply predictable over time.

MON is used to pay gas fees, stake and secure the network, participate in on-chain governance, and fund ecosystem incentives like developer grants and liquidity programs. Liquid staking solutions such as Kintsu’s sMON allow users to earn staking rewards while keeping their tokens usable in DeFi.

Since launch, MON has seen high volatility, driven by market conditions and allocation concerns, but continued whale accumulation and developer activity suggest long-term interest in the network’s future.

How to Bridge to the MON Network Safely

The safest way to move assets to Monad is through a non-custodial cross-chain aggregator such as RocketX. This ensures your funds stay in your wallet at all times, without deposits or exchange custody risk.

Step-by-Step: Bridge to Monad Using RocketX

Step 1 — Open RocketX and connect your wallet

Go to app.rocketx.exchange and connect your wallet based on the network where your funds are currently stored.

Your funds always remain in your wallet. RocketX never takes custody.

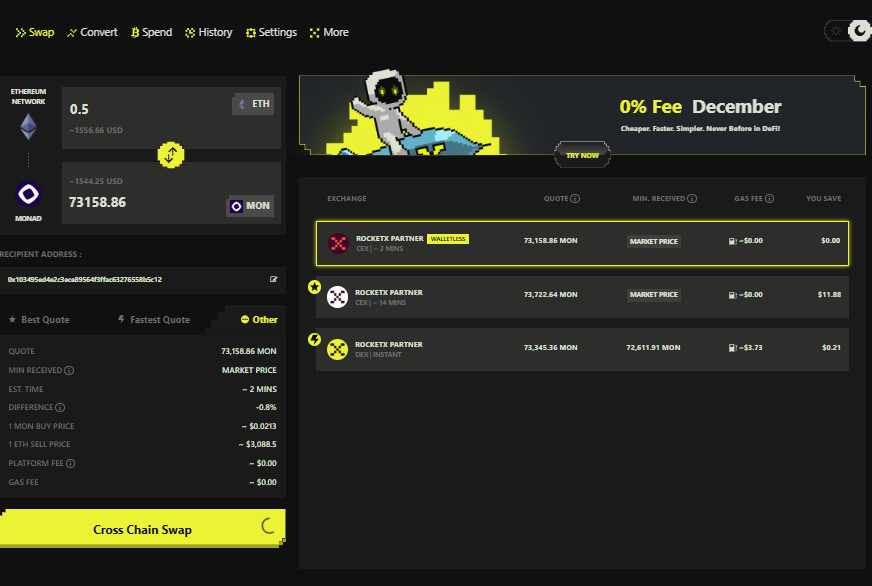

Step 2 — Select the source network and token

In the From section, choose the blockchain where your assets are currently held, such as Ethereum, BNB Chain, Arbitrum, Base, Polygon, or Solana.

Then select the token you want to bridge, for example, ETH, SOL, USDT, USDC, or WBTC, and enter the amount.

Step 3 — Select the destination network and token

In the To section, choose Monad Network as the destination and select MON as the token to receive.

RocketX automatically compares prices and liquidity across 250+ centralized and decentralized exchanges to find the most efficient route.

Step 4 — Enter the recipient wallet address

Paste your Monad-compatible wallet address where you want to receive MON.

This ensures the tokens are delivered directly to your wallet on the Monad network.

Step 5 — Review details and confirm the swap

Review the estimated MON amount, fees, execution route, and expected completion time.

Click Cross Chain Swap and approve the transaction in your wallet.

Step 6 — Receive MON in your wallet

Once the transaction is complete, your MON tokens are credited directly to your Monad wallet.

There are no deposits, withdrawals, or custody risk at any stage of the process.

Future Potential of the MON Token: Upside and Risks

The MON token represents a promising but high-risk opportunity tied directly to the success of the Monad network. On the positive side, Monad brings strong technical advantages to the EVM ecosystem, including high throughput, sub-second finality, and extremely low fees. These features make it attractive for DeFi, trading, gaming, and other applications that struggle with congestion on existing networks. Early ecosystem growth, rising TVL, and deployments from well-known protocols suggest genuine developer interest rather than pure speculation.

However, there are also important challenges to consider. Only a small portion of MON’s total supply is currently in circulation, and future token unlocks could create sustained selling pressure. The network is also entering a crowded market, competing with Ethereum Layer-2s, Solana, and other high-performance chains. Long-term success will depend on Monad’s ability to retain users, attract flagship applications, and communicate transparently with the community.

Overall, MON has meaningful upside if adoption continues, but investors should weigh that potential against volatility, dilution risk, and execution uncertainty.

Final Thoughts

Monad Network introduces a compelling approach to scaling Ethereum-compatible applications without compromising on developer experience or decentralization. With fast execution, low fees, and growing ecosystem activity, it has positioned itself as a serious contender among next-generation Layer 1 blockchains.

For users looking to explore Monad, bridging assets safely is the first step. Using a non-custodial platform like RocketX helps reduce risk while maintaining flexibility and control.

As the ecosystem matures, Monad’s long-term success will depend on adoption, transparency, and sustained developer engagement. For now, it remains a network worth watching closely.