Introduction

Stablecoins now represent more than $300 billion in circulating supply, yet the infrastructure powering them was never designed specifically for stable value transfer. On many blockchains, users still face unpredictable gas costs, congestion during peak demand, and slow confirmations.

Stable Network follows a new “stablechain” model, where the blockchain itself is optimized around stablecoins rather than treating them as secondary assets. By making USDT the gas token, Stable Network enables low and predictable fees, often under one cent, regardless of market conditions.

This article explains what Stable Network is, how it works, its token model, and how users can bridge assets safely using RocketX Exchange.

What Is Stable Network?

Stable Network, sometimes referred to as StableChain, is an EVM-compatible Layer-1 blockchain designed for stablecoin-native activity. Unlike traditional chains that rely on volatile native tokens for gas, this Network uses USDT directly for transaction fees and settlement.

This design removes one of the biggest friction points in crypto payments: gas volatility. Users and businesses no longer need to hold or manage an extra token just to move stable value on-chain.

Stable Network targets use cases such as cross-border payments, remittances, merchant settlements, on-chain FX, and institutional stablecoin flows, where speed, cost predictability, and reliability matter more than speculation.

The network went live in December 2025 with over 150 ecosystem partners and strong early participation from wallets, DeFi protocols, payment providers, and institutional infrastructure platforms.

How Stable Network Works

This Network is fully compatible with the Ethereum Virtual Machine, allowing developers to deploy existing Solidity smart contracts without modification. Ethereum tools, wallets, and infrastructure work out of the box.

Under the hood, the network uses StableBFT, a delegated proof-of-stake consensus mechanism optimized for fast confirmations and high throughput. The Stable network is currently designed for sub-second block finality and has plans to scale to 10,000+ Transactions Per Second (TPS)

Finality is achieved in sub-second timeframes, making transactions feel nearly instant. Because the network is optimized for stablecoin usage rather than speculative activity, congestion is minimized even during high-volume periods.

The result is a blockchain that behaves more like financial infrastructure than a general-purpose experimental network.

Tokens on Stable Network

Stable Network uses a dual-token model, each serving a distinct purpose.

USDT is the native gas and settlement asset. It is used to pay transaction fees and move value across the network, eliminating exposure to gas token volatility.

$STABLE is the governance and staking token. It has a fixed supply of 100 billion tokens and is used to secure the network through delegated staking, participate in governance decisions, and support long-term decentralization. Staking incentives and validator rewards are paid in $STABLE.

This separation allows users to transact purely in stablecoins while still enabling a sustainable security and governance model.

Ecosystem and Early Adoption

Since its mainnet launch, Stable Network has shown strong early traction by onboarding more than 150 partners across payments, DeFi, infrastructure, wallets, and fiat on-ramps. Rather than prioritizing speculative applications, the ecosystem has been built around real-world stablecoin use cases such as payments, settlements, and financial infrastructure.

On the DeFi side, integrations with protocols like Uniswap and Curve Finance enable efficient stablecoin liquidity and low-slippage trading. Institutional custody and settlement are supported through partners such as Anchorage Digital, reinforcing Stable Network’s focus on compliance-ready infrastructure. Wallet connectivity is handled through WalletConnect, ensuring broad user access from day one.

For payments and on-ramps, integrations with Transak and Alchemy Pay allow seamless fiat-to-stablecoin flows, while platforms like Chipper Cash support cross-border and regional payment use cases. Early applications also include tokenized real-world assets, treasury management, and merchant settlements.

Overall, early adoption reflects a clear positioning of Stable Network as practical, stablecoin-focused infrastructure built for scale rather than hype.

How to Bridge to Stable Network Safely Using RocketX

At the moment, RocketX supports bridging to the Stable Network through the $STABLE token. While USDT is the native gas and settlement token on this Network, direct USDT support is not yet available on RocketX due to current ecosystem limitations. Until broader infrastructure support is in place, users can bridge into the Stable Network using the supported $STABLE token and manage assets securely within the network.

RocketX continuously monitors network maturity and ecosystem readiness, and additional asset support may be considered as Network integrations expand.

Step-by-Step: Bridge to Stable Network on RocketX

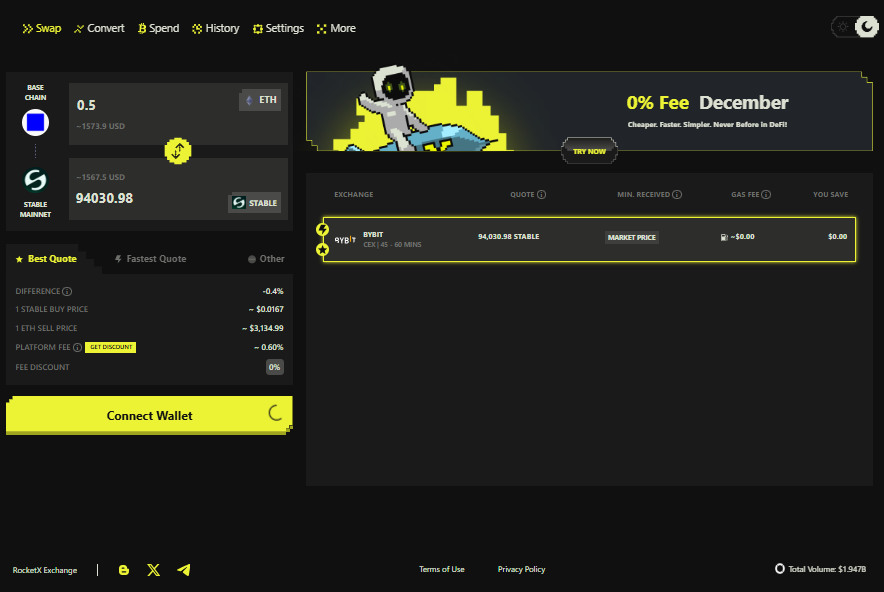

Step 1: Open RocketX and connect your wallet

Visit app.rocketx.exchange and connect a wallet based on where your funds are stored. RocketX supports major EVM and non-EVM wallets, and your assets remain in your wallet at all times.

Step 2: Select the source network and token

Choose the blockchain where your funds currently reside, such as Ethereum, BNB Chain, Arbitrum, Base, Polygon, or Solana. Select the token you want to bridge, such as USDT or USDC, and enter the amount.

Step 3: Select Stable Network as the destination

In the destination field, choose Stable Network and the Stable Token. RocketX automatically finds the most efficient route by comparing liquidity across hundreds of exchanges.

Step 4: Enter the recipient wallet address

Paste your Stable Network-compatible wallet address to ensure funds are delivered directly to your wallet.

Step 5 — Review details and confirm the swap

Review the estimated output, fees, and route. Click on cross-chain swap and confirm the transaction in your wallet.

Step 6 — Receive funds in your wallet

Once completed, your assets arrive directly on Stable Network with no deposits, withdrawals, or custody risk.

Future Potential and Risks

Stable Network addresses a real and growing need: stablecoin-native infrastructure built for payments and settlement. Its focus on USDT gas, fast finality, and predictable fees gives it a strong foundation for long-term adoption.

However, success depends on sustained transaction volume, merchant adoption, and real-world usage beyond early integrations. Competition from other stable-focused chains and evolving regulatory landscapes also remains a factor.

Overall, Stable Network represents a meaningful step toward turning stablecoins into practical global payment rails rather than speculative assets.

Final Thoughts

Stable Network is not trying to reinvent crypto. Instead, it focuses on making stablecoins work better for real users, businesses, and institutions. With a payment-first design, USDT-native gas model, and early ecosystem traction, it stands out as serious infrastructure in a rapidly growing market.

For users looking to explore the network, bridging safely through RocketX provides a simple and non-custodial entry point. As adoption grows, Stable Network will be one to watch closely in the evolution of stablecoin-based finance.