What Is Axie Infinity?

Axie Infinity is a blockchain game where you collect, breed, and battle digital creatures called Axies—think Pokémon meets crypto. Created by Vietnam-based Sky Mavis in 2018, it pioneered “play-to-earn” gaming where players earn real money through gameplay.

Each Axie is an NFT with distinct attributes determining battle strengths. You field teams of 3 Axies in turn-based battles. Win battles, earn tokens, breed new Axies, sell them on the marketplace, or stake for rewards.

The 2021 boom: Axie hit 2.8M daily players and generated $1.3B revenue. Filipino players famously earned more from Axie than local minimum wage jobs, sparking global play-to-earn mania.

The 2022 crash: Bear market exposed economic flaws. The breeding token (SLP) experienced hyperinflation from bot farming—automated scripts grinding rewards 24/7. SLP crashed from $0.40 to $0.001. AXS fell from $165 to under $3 (98% loss).

2026 reforms: January 7, 2026 brought major changes. Sky Mavis halted SLP emissions (cutting daily inflation 90%), introduced bAXS (bonded rewards preventing instant dumps), and previewed Atia’s Legacy MMORPG for Q2 2026 beta.

The ecosystem runs on two tokens:

- AXS: Governance token for staking, voting, treasury management ($321M+ assets)

- SLP: Breeding token (emissions now halted to fix inflation)

Current scale: 12M+ Axies exist, Ronin Network processed 1B+ transactions, and pioneered blockchain gaming infrastructure.

How Axie Infinity’s Economy Works (Simplified)

Axie Infinity operates on a three-token system designed to balance player rewards with ecosystem sustainability. Understanding how these tokens interact is crucial before investing.

The three tokens:

- AXS (Governance Token): Max supply 270M, 99% circulating (low dilution risk). Used for staking rewards, governance voting, treasury management, and marketplace fees.

- SLP (Utility Token): Previously earned through battles for breeding. January 2026 change: Emissions halted (90% reduction), solving bot farming inflation that destroyed 2021 economy.

- bAXS (New Innovation): Bonded AXS rewards backed 1:1 by real AXS. Can’t immediately sell—requires conversion with a reputation-based fee. Higher Axie Score (activity, holdings) = lower fees. Keeps value circulating inside the ecosystem.

Economic evolution:

Before reforms (2021-2022): Battle → Earn SLP → Immediately sell → Infinite supply → Price crashes to $0.001

After reforms (2026): Battle/stake → Earn bAXS → Build reputation → Convert with low fees if engaged → Rewards tied to participation quality

Staking: Lock AXS, earn bAXS rewards (previously 5-12% APY), vote on governance. July 2025 halving reduced emissions 35% (like Bitcoin halvings).

Marketplace: 12M+ Axies exist with rarity determining value (Common $5-20, Rare $50-200, Mystic $500+). Platform charges 4.25% fee on sales. Land plots are also tradeable.

Why it matters: The 2021 collapse came from infinite SLP inflation, where new supply outpaced demand. The 2026 reforms tie rewards to participation quality, not quantity. If this works, it’s a sustainable GameFi blueprint. If it fails, it proves that play-to-earn is fundamentally broken.

Should You Invest in Axie Infinity in 2026?

AXS is a high-risk, high-reward bet on GameFi’s second wave—but only if you believe blockchain gaming can evolve beyond 2021 speculation into sustainable entertainment.

Current situation:

- Price: $1.87-2.13 (volatile after 98% weekly surge)

- Where we stand: Down 98.9% from $165 ATH, up 194% from $0.12 ATL

- Market cap: $307-360M (rank #132-220)

January 2026 catalysts driving renewed interest:

- Tokenomics overhaul (Jan 7): Halted SLP emissions (90% inflation cut), addressing bot farming that crashed the 2021 economy

- bAXS bonded rewards: New system where rewards require reputation-based conversion fees—keeps value circulating inside the ecosystem

- Treasury staking: Community voted to stake $9M ETH, demonstrating functional governance

- Atia’s Legacy MMORPG: Q2 2026 beta with 72.8% early satisfaction—shift from auto-battler to full MMO

- GameFi rotation: Capital flowing into gaming tokens after AXS sparked sector interest

Who should consider buying AXS:

- Believe blockchain gaming has a 2-3 year potential beyond hype

- Okay with extreme volatility (98% drawdowns happened)

- Diversifying portfolio, not going all-in on one gaming token

- Understand 99% supply circulating (low dilution risk)

- See value in 8-year proven community

Who should avoid AXS:

- Need price stability (gaming tokens are notoriously volatile)

- Looking for quick 2-3 month gains

- Don’t believe play-to-earn can work sustainably

- Can’t stomach 50-70% corrections

- Scared by Ronin hack history ($622M in 2022)

What analysts predict: Conservative targets see $2.08-2.37 by February 2026. Bearish case targets $1.66 (38.2% Fibonacci support). Bulls see $5-10 if GameFi rotation continues and Atia’s Legacy succeeds. Realistic year-end: $2.50-4.00 if execution delivers.

Axie Infinity vs Illuvium: Which Gaming Token to Buy?

When evaluating blockchain gaming investments, Axie Infinity and Illuvium represent two fundamentally different approaches. Axie is the established pioneer with a proven player base but a damaged reputation. Illuvium is the unreleased AAA contender with stunning graphics but zero gameplay proof. Here’s how they compare:

|

Factor |

Axie Infinity (AXS) |

Illuvium (ILV) |

|

Launch Date |

2018 (6+ years live) |

2021 (3+ years dev) |

|

Game Type |

Turn-based battler → MMORPG |

Open-world RPG (unreleased) |

|

Current State |

Live with 12M+ Axies |

Beta/testnet phase |

|

Price (Jan 2026) |

$1.87-2.13 |

~$60-70 |

|

ATH |

$165 (-98.9% from peak) |

$191 (-67% from peak) |

|

Proven Players |

Yes (2.8M daily in 2021) |

No (not launched yet) |

|

Tokenomics Reform |

Yes (Jan 2026 overhaul) |

TBD |

|

Graphics Quality |

Cute/casual |

AAA Unreal Engine 5 |

|

Target Audience |

Casual gamers, mobile |

Hardcore PC gamers |

|

Blockchain |

Ronin (own L1) |

Immutable X (Ethereum L2) |

|

Risk Level |

High (proven crash history) |

Very high (unproven gameplay) |

When to choose Axie Infinity:

- You want exposure to a proven GameFi brand with actual players

- You believe iterative improvement beats starting from scratch

- You value an 8-year track record even with failures

- You think casual mobile gaming has a broader appeal than hardcore PC gaming

When to choose Illuvium:

- You believe graphics quality determines GameFi success

- You want unrealized potential (not yet launched = no proven failures)

- You prefer Ethereum ecosystem over custom blockchain

- You think AAA production values will attract traditional gamers

- You’re okay waiting 1-2+ more years for full launch

Realistic assessment: Axie has proven it can attract millions of players but also proven economic models can collapse. Illuvium has proven it can build beautiful games but not that anyone will play them. Neither is “safer”—both are speculative bets on blockchain gaming’s future.

How to Buy Axie Infinity (AXS): Complete Cross-Chain Guide

Whether you want to buy AXS tokens for investment or move existing crypto to purchase Axies and participate in the game, RocketX handles both scenarios with the same simple process.

Why RocketX Beats Traditional Gaming Token Exchanges

Most centralized exchanges create unnecessary friction when buying gaming tokens like AXS. You face mandatory KYC verification with passport uploads and selfies, forced conversions through intermediate trading pairs that stack fees, withdrawal charges that eat into small purchases, and price variations of 2-5% between platforms that you might not even notice.

The problems with traditional exchanges:

- Binance, KuCoin require full KYC verification (passport, selfies, waiting periods)

- You probably hold ETH, SOL, or USDT—but CEXs force you to convert to their base pairs first

- Withdrawal fees eat into purchases (0.5-1 AXS = $0.90-2.13 withdrawal cost)

- Prices vary 2-5% between exchanges—you might overpay without realizing

- Moving funds between wallets/exchanges costs gas and time

How RocketX solves everything:

- No registration: Connect wallet, swap immediately. Zero KYC.

- Direct cross-chain swaps: Hold SOL? Swap directly SOL → AXS. No intermediate USDT step.

- Best price guaranteed: Highlights cheapest route with exact savings shown

- Non-custodial: Funds never leave your wallet—eliminates exchange hack risk

- Transparent fees: See platform fee (0.2-0.4%), gas, slippage upfront

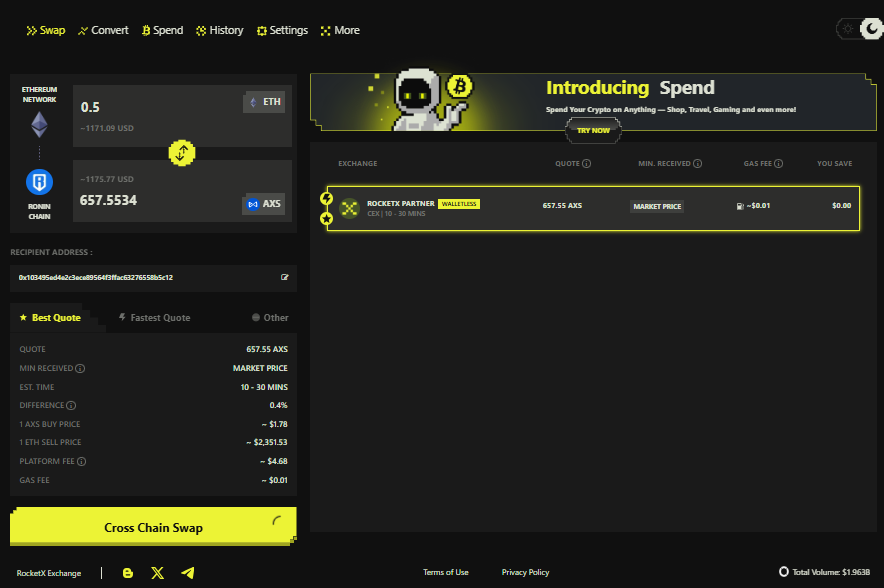

Universal Process (Works from Any Blockchain)

The process remains identical whether you’re swapping from Ethereum, Solana, BNB Chain, or any of the 200+ supported blockchains. RocketX automatically handles the complexity of cross-chain routing.

Step 1: Visit RocketX Go to app.rocketx.exchange

Step 2: Connect your wallet

- Ethereum/EVM chains: MetaMask, Coinbase Wallet, WalletConnect, Trust Wallet

- Solana: Phantom, Solflare

- Other chains: 50+ wallet options supported

Step 3: Select source cryptocurrency

- “From” field: Choose your blockchain (Ethereum, Solana, BNB Chain, Base, Polygon, Arbitrum, etc.)

- Asset: Select what you’re swapping (ETH, SOL, USDT, USDC, BTC, or any token)

- Amount: Enter how much you want to convert to AXS

Step 4: Select AXS as destination

- “To” field: Search “Axie Infinity” or “AXS”

- Network: AXS exists on Ethereum (ERC-20) and Ronin Network

- Choose Ethereum AXS for maximum liquidity and exchange compatibility

- Or choose Ronin AXS if using for in-game purposes immediately

Step 5: Review route options

RocketX displays multiple routes with transparent pricing:

- Quote: How much AXS do you receive

- You Save: Comparison vs. other routes

- Completion time: Usually 30 seconds to 15 minutes

- Gas fees: Network transaction costs shown separately

- Best Quote highlighted with yellow “WALLET LESS” tag

Step 6: Execute swap

- Click the “Cross Chain Swap” button

- Wallet pop-up shows exact transaction details

- Approve transaction (sign with wallet)

- Wait for completion (1-15 minutes typically)

Step 7: Receive AXS

Tokens arrive automatically in your wallet. You can then:

- Hold as investment: Store in a hardware wallet (Ledger supports AXS)

- Stake for rewards: Stake on the Axie Infinity dashboard for bAXS rewards

- Use in game: Bridge Ethereum AXS → Ronin ge

- Trade: Sell on exchanges when price targets are hit

Common Questions

“Which network should I buy AXS on—Ethereum or Ronin?”

- Ethereum: More liquidity, accepted on all exchanges, easier to sell later

- Ronin: Lower in-game transaction fees, required for breeding/marketplace

- Recommendation: Buy on Ethereum via RocketX if investing. Buy on Ronin (or bridge) only if you plan to play the game immediately.

“Can I buy AXS with a credit card?”

Not on RocketX (crypto-to-crypto only). To go fiat → AXS:

- Buy ETH or USDT on Coinbase/Kraken with bank account

- Send to your MetaMask

- Use RocketX to swap ETH/USDT → AXS

Alternative: Some CEXs allow direct credit card → AXS but charge 3-5% fees vs. RocketX’s 0.3%

“Is RocketX safe for buying gaming tokens?”

Yes. RocketX is:

- Non-custodial (you control funds the entire time)

- Audited by CertiK and other security firms

- Aggregates only reputable DEXs/CEXs

- No custody = no hack risk like centralized exchanges

“How much AXS do I need to start playing Axie Infinity?”

- Minimum: 0 AXS (can play free with starter Axies)

- To breed/trade: 3 Axies minimum (~$15-60 depending on quality)

- To stake: Any amount works (even 1 AXS)

- Recommended: $100-200 gives meaningful participation

What Could Go Wrong with Axie Infinity?

Before investing in any gaming token, it is essential to understand the specific risks that have already materialized in Axie’s history—and the new risks introduced by the 2026 reforms.

Risk #1: Play-to-earn might be fundamentally broken

Despite reforms, nobody’s proven that play-to-earn works long-term. If earning money is the primary motivation, games become jobs. When earnings drop, players leave—death spiral repeats. The 2026 reforms try to address this, but sustainable GameFi economics remain unproven.

Risk #2: Atia’s Legacy could flop

Everything depends on the MMORPG succeeding. If Q2 2026 beta is buggy, boring, or fails to retain players, the entire revival thesis collapses. Traditional game studios with 10x the budget fail regularly—Sky Mavis faces enormous execution risk.

Risk #3: You’re buying 98.9% below ATH—but it could go lower

AXS crashed from $165 to $1.87. Could easily drop another 50% to $0.90. Gaming tokens get obliterated in bear markets. No price floor exists.

Risk #4: Competing games could win

Illuvium has better graphics. Star Atlas has better marketing. Being first doesn’t guarantee winning (remember MySpace losing to Facebook). If next-gen games deliver superior entertainment, Axie’s first-mover advantage means nothing.

Risk #5: Ronin hack history and regulatory uncertainty

March 2022 saw $622M hack—one of crypto’s largest. Another exploit destroys credibility permanently. Plus regulatory uncertainty: Are gaming tokens securities? Is SLP taxable income? SEC enforcement could freeze development or ban US players.

Risk #6: Treasury depletion and community toxicity

Developing AAA games costs $50-100M+. If Atia takes 3+ years and fails, $321M treasury depletes. Meanwhile, volatile communities turn toxic when prices drop—Discord/Twitter fills with anger, driving away new players.

Bottom line: Only invest money you’re okay losing entirely. AXS could 5-10x if everything goes right. It could also drop to $0.50 if everything goes wrong. Gaming tokens are among crypto’s most volatile—treat as high-risk speculation, not safe investment.

Frequently Asked Questions About Axie Infinity

Is Axie Infinity still popular in 2026?

Player count dropped massively from 2.8M daily (2021) to estimated 100-300K daily (2026). It’s not “dead” but far from peak popularity. The Atia’s Legacy MMORPG aims to revive player base—success determines if Axie regains relevance or fades. Current momentum suggests renewed interest, but sustainability unproven.

How much can you earn playing Axie Infinity?

Earnings depend on skill, time investment, and AXS/SLP prices. In 2021 peak, Filipino players earned $200-1,000/month (above minimum wage). In 2023 crash, earnings fell below $10/month. With January 2026 reforms shifting to bAXS rewards, earning model now ties to participation quality rather than grinding. Realistic 2026: $20-100/month if highly engaged. “Playing for fun” should be primary motivation—not income replacement.

What’s the difference between AXS and SLP?

AXS is the governance/utility token (max 270M supply) used for staking, voting, ecosystem management. SLP is the breeding utility token (infinite supply, emissions now halted) used to create new Axies. Think of AXS like Bitcoin (scarce, valuable) and SLP like a consumable resource. January 2026 introduced bAXS (bonded AXS) as new reward layer preventing instant dumps.

Should I buy AXS or buy Axies to play?

Depends on goals:

-

Buy AXS if: Investing/speculating on ecosystem success. Easier to trade, stake for rewards, liquid.

-

Buy Axies if: Want to actually play the game. Axies are NFTs used in battles, breeding. Illiquid, harder to sell, but necessary for gameplay.

Many do both: Hold AXS as investment, buy 3 cheap Axies ($15-60 total) to try the game.

How do I start playing Axie Infinity in 2026?

-

Download Axie Infinity app or visit app.axieinfinity.com

-

Create Ronin wallet (axieinfinity.com/ronin-wallet)

-

Buy 3 starter Axies from marketplace (minimum to play)

-

Or use free starter Axies (limited earning potential)

-

Complete tutorials to learn battle mechanics

-

Play Adventure mode (vs AI) or Arena (vs players)

Note: Free-to-play exists but owning Axies required for full earning potential.

Can Axie Infinity make you rich?

Realistically: No. A few early adopters became millionaires in 2021 (bought at $0.50, sold at $165). Those opportunities rarely repeat. You might 2-5x investment if GameFi rebounds, but “get rich” unlikely. Treat as high-risk speculation with potential for good returns, not life-changing wealth. If you invested $1,000 at current $2.11 and it reached $10 (374% gain), you’d have $4,740—nice gain but not “rich.”

Is Axie Infinity a good investment for beginners?

Honestly: No. Gaming tokens are among crypto’s most volatile and risky. If you’re new to crypto, start with Bitcoin or Ethereum. If you insist on altcoins, choose Layer 1s with proven use cases. Gaming tokens like AXS should be <5-10% of portfolio for experienced investors who understand they might lose everything. Beginners should gain experience with more stable assets before touching gaming tokens.

What happened to Axie Infinity’s price?

AXS peaked at $165 (November 2021) during play-to-earn boom when millions played daily. Crashed 98.9% to under $2 due to: (1) SLP hyperinflation from bot farming, (2) Bear market 2022-2023, (3) Ronin hack ($622M stolen), (4) Players leaving when earnings dried up. January 2026 reforms (SLP halt, bAXS) attempt to fix core economic problems. Price surged 98% on announcement but remains 98.9% below ATH.

How long does it take to earn back your investment?

Depends on investment size and play time. In 2021 peak: 1-3 months to recover costs. In 2023 crash: Never (earnings less than electricity costs). With 2026 reforms: Unclear—new bAXS system unproven. If you spend $200 on Axies + AXS and earn $50/month, 4-month breakeven. But earnings fluctuate with AXS price. Many players never recover initial investment. Don’t invest more than you can afford to lose.

Final Verdict: Should You Buy Axie Infinity in 2026?

Axie Infinity represents blockchain gaming’s longest-running experiment—8 years of real users, proven demand, spectacular success, catastrophic failure, and now attempted redemption. The January 2026 tokenomics reforms address documented economic failures. The Atia’s Legacy MMORPG offers genuine innovation beyond 2021’s simple auto-battler. At $1.87-2.13 after 98% crash, AXS is priced for pessimism.

The bull case: First-mover brand recognition, 8-year track record, functional governance DAO, $321M treasury, proven ability to attract millions of users, credible management willing to admit mistakes and reform, and tangible 2026 catalyst (MMORPG beta). If GameFi’s second wave comes, Axie leads.

The bear case: Play-to-earn fundamentally unsustainable, competing games have superior technology, 98% drawdown proves volatility, hack history scares institutions, could easily drop another 50-70% in crypto bear market, and Sky Mavis faces enormous execution risk on MMORPG.

For those buying: Use RocketX to get best prices across 250+ exchanges. Start small (1-5% of crypto portfolio max). Plan 2-3 year hold minimum. Stake for bAXS rewards to earn while waiting. Set stop losses if you can’t stomach 50% drawdowns. Dollar-cost average rather than lump sum—volatility works in your favor.

Axie isn’t dead. But it’s fighting for relevance in GameFi 2.0. That makes AXS a high-risk, high-reward speculation—not an investment. Bet accordingly.