Introduction

There are two kinds of blockchains in the market today: those built for speculation and those built for integration with real financial systems. MANTRA Chain clearly belongs to the second category. Instead of chasing hype cycles, it is building regulated infrastructure for tokenizing assets such as real estate, bonds, private credit, and institutional grade financial instruments — the kind of value that banks and governments actually recognize.

What makes MANTRA Chain compelling is not only what it is now but what it has been in the past. The project started as a community driven DeFi DAO during the 2020 cycle, went through several pivots, survived one of the most dramatic crashes in recent memory, and eventually returned as a fully regulated Layer One chain focused on real world assets. In a market dominated by short lived experiments, MANTRA stands out as a story of persistence, compliance, and positioning for long term adoption.

The native OM token is at the center of this ecosystem. It is used for staking, governance, transaction fees, and RWA functionality on the network. And with RocketX Exchange, users do not need multiple bridges or separate routes to get access to MANTRA. They can buy, bridge, and interact with OM directly from one interface that supports more than two hundred blockchains.

Before exploring OM’s crash, its rebound, and the economic architecture behind it, it is important to first understand what MANTRA Chain actually is and why institutional interest around it continues to grow.

The Full Story of MANTRA Chain — From DAO to Regulated RWA Layer-1

MANTRA did not begin as a blockchain. It started as MANTRA DAO, a DeFi experiment on Ethereum in mid 2020 with one clear ambition: bring traditional finance closer to decentralized finance without violating compliance rules. The team launched the OM token as an ERC20 asset and introduced staking and lending products. Within a short time, it gained a reputation as a transparent and community driven protocol.

However, during 2021 and 2022 the team realized a crucial reality. Serious institutional capital does not enter crypto unless there is regulation, verifiable identity, and legal enforceability. Instead of fading away during the bear market, MANTRA used that phase to pivot. The team began designing a sovereign Layer 1 chain that could achieve what Ethereum could not at the time, specifically provide compliant infrastructure for tokenizing real world assets.

By late 2023, the first MANTRA Chain testnet launched using the Cosmos SDK. In early 2024, the rebrand from MANTRA DAO to simply MANTRA was completed. The Dubai VARA license for MANTRA Finance became a landmark moment that signaled the shift from a crypto experiment to an institution ready asset network. In October 2024, the MANTRA Chain mainnet went live and the OM token migrated from Ethereum to its native chain.

What followed was a dramatic cycle. OM experienced a massive rally driven by the real world asset narrative and then a violent liquidation crash that erased most of its gains. Unlike many projects that disappear after such collapses, MANTRA responded with token burns, revised vesting schedules, compliance modules, and new partnerships. By mid 2025, MANTRA re-emerged with a stronger identity, not as a hype token but as a compliance aligned RWA blockchain built to connect banks, funds, and asset issuers to web3 infrastructure.

How MANTRA Chain Works

MANTRA Chain is a Cosmos based Proof of Stake blockchain designed for regulated asset issuance. It is not built to compete on speed or gas cost alone, but to become a legally acceptable infrastructure for financial institutions.

Here is the logic of how it functions:

- It uses Cosmos SDK and IBC, making it interoperable with other app-chains and enabling cross-chain asset movement.

- Smart contracts are built using CosmWasm, and EVM compatibility was added later so Ethereum-style dApps can also run on it.

- It embeds modules for KYC/AML, identity, permissions, and compliance, allowing apps to operate legally without sacrificing decentralization.

- The OM token is the gas, staking, and governance unit — validators secure the network by staking OM and processing transactions.

- Real-world assets (like property or securities) can be tokenized, fractionalized, traded or collateralized on-chain through MANTRA-based platforms.

In summary, MANTRA Chain is not focused on running speculative or entertainment driven applications. It is built to provide the compliant financial infrastructure required for the tokenization of real world assets in a regulated environment.

Everything You Need to Know About OM Coin

OM is the native token of the MANTRA ecosystem. It was first launched in 2020 as an ERC20 token during the MANTRA DAO phase. In its early phase, OM was used for staking, governance, and rewards for a community focused on decentralized finance. Later, in 2024, when MANTRA transformed into an independent Layer 1 blockchain, OM moved from Ethereum to become a Cosmos based staking coin. This change was not superficial. It brought OM in line with MANTRA’s new goal of building a regulated network for real world assets.

In 2025, OM went through one of the fastest collapses in crypto history after a strong rally driven by excitement around real world assets. Rather than letting the project fail, MANTRA redesigned its token economy with supply burns, lower inflation, longer vesting, and governance driven adjustments. These changes helped OM evolve from a speculative narrative token into a utility asset used for chain security and compliance within the MANTRA network.

Tokenomics

Originally, OM had a fixed hard-cap supply of 888,888,888 tokens on Ethereum. This model was not sustainable for a PoS chain and limited funding, security rewards, and ecosystem growth.

After migration, the supply was expanded to 1,777,777,776 native OM, with inflation enabled (≈3%) to fund staking rewards, ecosystem incentives, validators, developers, and RWA builders. A key change was the split between legacy tokens (old ERC-20) and mainnet staking coins (CosmWasm-native). Burns, vesting extensions, and upgrade incentives were introduced to reduce dumping and align long-term stakeholders.

Use Cases

OM is integral to the MANTRA Chain in multiple ways:

- Staking & Security — Secures the PoS chain and rewards delegators

- Gas & Fees — Required for transactions, especially Guard Module actions

- Governance — Used to vote on proposals and protocol changes

- Access Control — Required to unlock regulated features (KYC/AML, DID, Guard Module)

- RWA Enablement — Powers tokenization and lifecycle functions for real-world assets

- Developer & dApp Participation — Used for deploying and interacting with apps

In short, OM evolved from a speculative DeFi token into the economic backbone of a regulated RWA Layer-1 blockchain.

Future Potential of OM Coin

Both promise and proven volatility shape the future of OM. On the positive side, OM is no longer just a speculative DeFi token. It is now the native staking and governance asset of a regulated RWA Layer One that is positioned for institutional adoption. The world is steadily moving toward the tokenization of real estate, funds, credit, and commodities, and MANTRA is one of the few chains built with compliance, identity, and legal enforceability in mind. The post crash reforms, which include burns, vesting extensions, and a reduction in inflation, have aligned validators, developers, and long term holders toward sustainable growth. As more regulated real world assets go live on the chain, more OM is staked, locked, and used for fees and governance. This creates structural demand that is driven by real utility instead of hype.

However, OM’s future is not risk free. We have already seen how violently it can move. Its collapse from about eight dollars to below one dollar in a matter of days is a reminder that even strong projects are not immune to fear, liquidations, or supply shocks. Token unlocks, staking rewards, and inflation can still create sell pressure if demand does not grow fast enough. And although MANTRA is well positioned for institutional adoption, actual deployment from banks and asset managers may take time. Fundamentals can mature long before the price reflects that maturity.

In short, the potential of OM comes from its fit within the real world asset narrative and its institutional readiness, but the same market mechanics that once pushed it upward also proved that it can fall just as fast. It remains a conviction based and high risk asset in a sector that is still under construction.

How to Bridge to MANTRA Chain and Buy OM Using RocketX

If you believe OM still has long-term potential after surviving a boom, a collapse, and a fundamental rebuild, the next logical step is knowing how actually to acquire it the right way. Instead of juggling different bridges, networks, or exchanges, you can buy or bridge to MANTRA Chain directly using RocketX Exchange, which aggregates liquidity across 200+ blockchains in a single interface.

Step-by-Step Guide to Buy OM Using RocketX

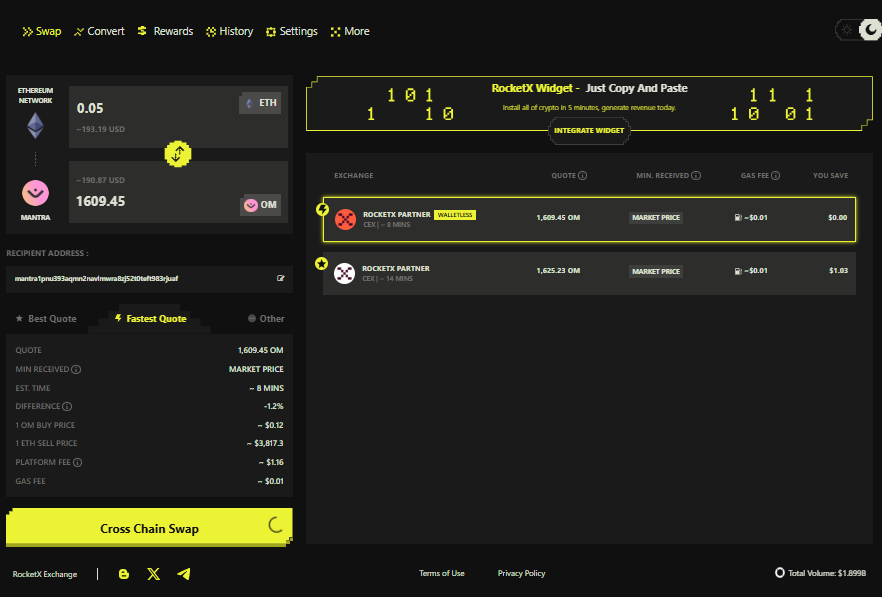

1) Open RocketX & Connect Your Wallet

Go to app.rocketx.exchange and connect the wallet that holds your funds (MetaMask/Rabby for EVM, Phantom for Solana, etc.).

2) Select Source Network and Token

In the “From” field, choose the blockchain and token you want to swap (e.g., ETH on Ethereum, USDT on Polygon, or SOL on Solana).

3) Set MANTRA Chain as Destination

In the “To” section, select MANTRA Chain and choose OM as the token you want to receive.

4) Enter Your MANTRA Chain Wallet Address

Copy your MANTRA-compatible address (e.g., Keplr/Cosmostation) and paste it into the destination field.

5) Enter Amount & Get Best Route

Enter the amount you want to bridge. RocketX automatically aggregates the best rate from CEX + DEX liquidity sources.

6) Review & Confirm Transaction

Check the networks, token symbols, and slippage. Click Cross-chain Swap and approve the transaction in your wallet.

7) Wait for Completion

RocketX handles bridging + swapping automatically. Your OM tokens will arrive on MANTRA Chain within minutes.

Best Wallets to Store OM Tokens

Once you receive OM on MANTRA Chain, you need a crypto wallet that supports Cosmos-based assets and lets you stake or interact with dApps on the network. Below are the most reliable wallets to store and manage OM securely.

1) Keplr Wallet (Recommended for MANTRA Native Users)

Keplr is the leading wallet for Cosmos ecosystem chains, including MANTRA. It supports staking, governance, and IBC transfers directly inside the interface. If you plan to participate in governance or validate transactions on MANTRA, Keplr provides the most seamless experience.

2) Cosmostation Wallet (Mobile-Friendly & Secure)

Cosmostation is a mobile-first wallet with strong security and support for Cosmos SDK chains. It is a good choice for users who want to hold and monitor OM on mobile without interacting with dApps frequently.

3) Leap Wallet (Modern UI + dApp Friendly)

Leap is a newer Cosmos wallet with a refined interface and smooth dApp connectivity. It supports staking, IBC, portfolio tracking, and integrates well with MANTRA applications.

4) Ledger (For Cold Storage Security)

For long-term holders, OM can be stored through Keplr or Cosmostation linked to a Ledger hardware wallet. This prevents exposure to online threats while still allowing staking operations.

Conclusion

MANTRA Chain is not just another blockchain. It is a matured evolution of a project that survived speculation, rebuilt with compliance, and positioned itself for the real world tokenization era. The OM coin has transformed from a simple ERC20 governance token into the economic backbone of a regulated Layer 1 built for real world assets. It secures the network, enables access to compliant features, and powers asset issuance on chain.

Although its past volatility reminds us that no crypto asset is risk free, its recovery, governance reforms, institutional alignment, and expanding ecosystem show that MANTRA is being built for long term relevance rather than short term noise. With RocketX Exchange enabling seamless bridging and purchasing across more than 200 networks, entering the MANTRA ecosystem is now easier than ever.

As the world moves toward tokenizing real assets, the real question is not whether the industry will adopt blockchain, but which chains will earn that trust. MANTRA has placed itself in that race with regulation, architecture, and resilience to support it. Whether OM becomes a long term winner will depend on execution and adoption, but its foundation is already stronger than most competing projects in the same category.