Introduction

Crypto was created to give people more control over their money, but most blockchains still feel complicated, slow, and expensive for everyday users. High gas fees, network congestion, and constantly switching between bridges, wallets, and different apps make decentralized finance harder than it should be. This is exactly the challenge Nibiru Chain is built to solve.

Nibiru is a high-performance Layer 1 blockchain designed from day one to make DeFi fast, secure, and simple for everyone. Launched on March 12, 2024, it delivers lightning-fast transactions, fees under $0.001, and seamless interoperability with dozens of networks through IBC. Its dual execution design supports both Ethereum-compatible smart contracts and secure Rust-based CosmWasm applications, giving developers more flexibility and users a smoother experience.

If you’re searching for a fresh, user-friendly gateway into the future of decentralized finance, Nibiru Chain is a project worth paying attention to.

In this guide, we will explain what Nibiru Chain is, how it works, everything you need to know about the NIBI token, and how you can easily buy or bridge assets to Nibiru Chain using RocketX Exchange.

What Is Nibiru Chain?

Nibiru Chain is a high-performance Layer 1 blockchain that solves three major problems blocking mainstream DeFi adoption: network congestion, high transaction fees, and fragmented user experiences across multiple applications. Launched on mainnet March 12, 2024, it represents a new generation of blockchain infrastructure designed for decentralized finance.

Founded by CEO Unique Divine along with a team of former Sommelier Protocol data scientists, traditional finance specialists, and experienced blockchain engineers, the platform positions itself as a “Web3 hub ushering in the next era of money.” The founding team brings expertise across institutional finance, quantitative analysis, and distributed systems engineering.

Its technical architecture combines Cosmos SDK modularity with Tendermint Core consensus, enabling remarkable performance with over 40,000 transactions per second and a finality time under two seconds. Transaction costs stay extremely low at around $0.001, allowing frequent trading and micro transactions without friction.

What makes Nibiru stand out is its dual execution framework. Developers can build using Ethereum-compatible Solidity or secure Rust-based CosmWasm smart contracts within the same environment. This enables flexibility for builders and strengthens security by reducing vulnerabilities such as reentrancy attacks.

Nibiru also integrates key DeFi components directly into the protocol layer. It features IBC interoperability with more than 40 chains, decentralized oracles for accurate pricing, liquid staking with stNIBI, and automated yield optimization vaults. Instead of depending heavily on external applications for crucial DeFi functions, Nibiru includes these capabilities natively — making the entire user experience faster, safer, and more reliable.

How Nibiru Chain Works

Nibiru Chain is designed with a modular and performance-focused architecture that solves the biggest challenges in DeFi: scalability, security, and interoperability.

At its core, the network operates with a dual execution environment. The first layer, Nibi EVM, offers full compatibility with existing Ethereum dApps and developer tools, allowing Solidity projects to deploy on Nibiru with minimal effort. The second layer, CosmWasm, enables Rust-based smart contracts compiled to WebAssembly, providing memory safety and reducing common vulnerabilities like reentrancy attacks that have led to major losses across other ecosystems. Together, these layers give developers flexibility while maintaining high contract security.

Nibiru’s efficiency comes from its Cosmos SDK foundation and fast BFT consensus system, delivering sub-2-second finality and transaction throughput in the tens of thousands per second. This is essential for real-time trading, liquidations, and high-frequency DeFi, where delays can directly cause financial losses.

Another key advantage is native interoperability through IBC (Inter Blockchain Communication). Assets can move freely across the Cosmos ecosystem without third-party bridges, while omnichain messaging expands connectivity beyond IBC networks and unlocks safer cross-chain liquidity.

Nibiru also integrates essential DeFi primitives directly at the protocol layer, including decentralized price oracles, liquid staking with stNIBI, and automated vault strategies for liquidity providers. This reduces ecosystem fragmentation and helps new projects launch faster.

In simple terms, Nibiru Chain is a secure and highly efficient DeFi engine built for speed, flexibility, and smooth cross-chain access.

Everything You Need to Know About the NIBI Token (Price, Utility & Future Outlook)

NIBI is the native token that powers the Nibiru Chain DeFi ecosystem. Its market performance since launch has been challenging, dropping more than 90 percent from its early 2024 peak near $0.80 to around $0.014 today. With a market capitalization of approximately $12 million and a circulating supply of about 852 million NIBI, the token is still in an early and highly volatile phase. Even so, daily trading volume remains between $700,000 and $1 million, signaling active participation and growing liquidity for a relatively new Layer 1 blockchain.

Nibiru follows a responsible and transparent tokenomics design. The maximum supply is 1.5 billion NIBI, primarily allocated for sustainable ecosystem development.

60% is dedicated to community incentives such as staking rewards, grants, and liquidity programs

15.3% is reserved for core contributors with strict vesting schedules

16.5% is allocated to early investors through seed and strategic rounds, with 12 to 24 months of vesting

8% was distributed through public sale offerings

As with many early-stage networks, gradual token unlocks have created selling pressure. The next vesting event on December 12, 2025, will release around 10 million NIBI, roughly 0.67 percent of the supply, which the market can likely absorb with current liquidity. Over time, unlocks continue to decline, helping stabilize supply dynamics.

The price decline can be attributed to several factors, including token unlock dilution, low initial TVL, which is now improving, market conditions during mid-2024, and competition from more established ecosystems. Despite that, NIBI continues to expand in real utility. It is used for gas fees, staking, governance, and collateral across lending and perpetual trading platforms. Liquid staking through stNIBI enables users to earn rewards while participating in liquidity vaults offering 20 to 33 percent APR through partners such as Gamma and Steer. Monthly incentives through the Aura Block Party campaign have driven a 15 to 20 percent increase in TVL, reflecting strong ecosystem engagement.

Looking ahead, the roadmap focuses on Bitcoin DeFi expansion, improved EVM compatibility, and onboarding new regions, including Korea, where Burrito Wallet already has more than 200,000 users. Analysts expect short-term recovery toward $0.03 in favorable market conditions and potential growth beyond $0.08 in 2026 if TVL surpasses the $50 million milestone.

In conclusion, NIBI remains a high-risk but high-opportunity asset. Its long-term value depends on continued growth in real usage, successful ecosystem partnerships, and the execution of Nibiru Chain’s expanding roadmap.

How to Bridge to Nibiru Chain or Buy NIBI Using RocketX Exchange

Since most centralized exchanges don’t yet support NIBI directly, RocketX Exchange offers the simplest way to enter the Nibiru ecosystem. You can convert your existing crypto from over 200+ blockchains straight into NIBI or bridge assets to Nibiru Chain, all in one smooth, secured transaction, without losing custody of your funds.

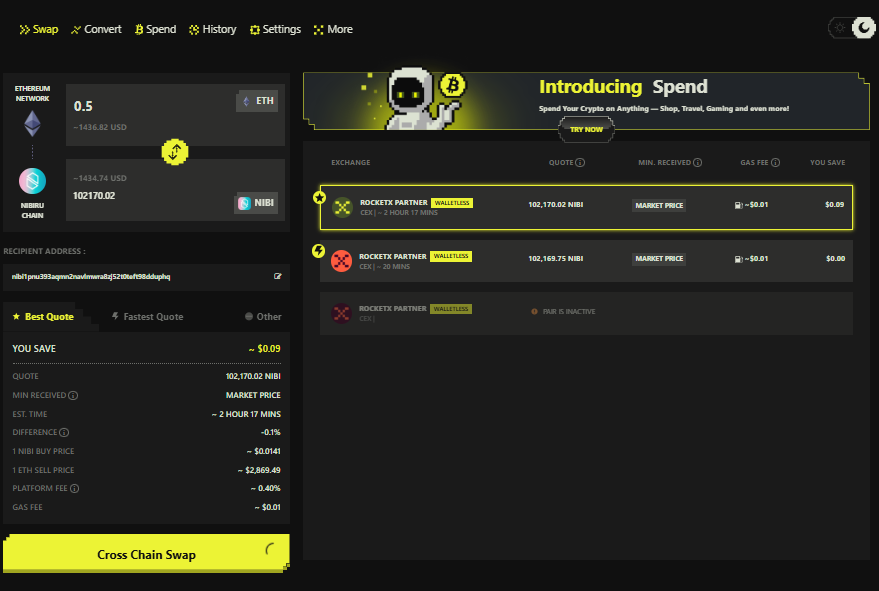

Here’s a simple, beginner-friendly step-by-step guide to bridge funds to Nibiru Chain using RocketX Exchange:

Step 1 — Open RocketX and connect your wallet

Visit app.rocketx.exchange, click “Connect Wallet,” and select the wallet where your funds are stored. You can use wallets like MetaMask, Rabby, Trust Wallet, OKX Wallet (for EVM chains), or Phantom / Backpack (if your funds are on Solana, etc).

Step 2 — Select your source network and token

In the “From” section, choose the blockchain where your crypto currently is, such as Ethereum, BNB Chain, Polygon, Arbitrum, Solana, or others. Then select the token you want to swap from, like ETH, USDT, or USDC.

Step 3 — Select Nibiru Chain and NIBI token

In the “To” section, choose Nibiru Chain as the destination network and NIBI as the token you want to receive. RocketX will automatically route through the best available pricing and liquidity sources.

Step 4 — Enter the amount and destination address

Type in how much you want to convert. Paste your Nibiru-compatible wallet address (Keplr or Leap Wallet recommended). Make sure it’s correct — once a transfer is executed, it cannot be reversed.

Step 5 — Confirm and approve the swap

Review the quote — amount, fees, and estimated time — then click “Cross-Chain Swap.” Approve the transaction in your connected wallet to continue.

Step 6 — Check your Nibiru wallet

After a few confirmations, open your Nibiru wallet and verify that your NIBI tokens have arrived. If the token doesn’t appear instantly, you can manually add NIBI from the official Nibiru documentation.

No separate bridges, no multiple exchanges — RocketX handles the entire route for you in one smooth flow.

Best Wallets to Store NIBI Tokens

To securely store and manage your NIBI tokens on Nibiru Chain, you need a wallet that supports Cosmos-based networks and the IBC standard. The most recommended options include Leap Wallet and Keplr Wallet, both offering native compatibility with Nibiru Chain’s mainnet. These wallets allow you to receive NIBI, stake it for network rewards, interact with Nibiru dApps, and perform cross-chain transfers through IBC.

Nibiru also supports Coinbase Wallet and MetaMask, which can connect through the network’s EVM configuration, making them ideal for users already familiar with Ethereum or Layer 2 ecosystems. However, it is important to note that RocketX currently supports only Nibiru’s mainnet (Cosmos side) and does not enable bridging directly to the EVM environment. So while MetaMask is great for DeFi interactions on Nibiru EVM, you should use a Cosmos-enabled wallet like Keplr or Leap when bridging assets or receiving NIBI purchased through RocketX.

Conclusion

Nibiru Chain is shaping a new direction for decentralized finance where speed, security, and simplicity finally come together. With its dual execution technology, ultra low fees, and native interoperability through IBC, the network is designed to deliver a smoother DeFi experience for both beginners and advanced users.

While the NIBI token has faced some early challenges in the market, its growing utility, expanding DeFi products, and steadily increasing TVL show that the ecosystem is gaining real strength. As adoption continues to rise through initiatives like liquid staking, concentrated liquidity vaults, and global expansion, Nibiru’s fundamentals are becoming more compelling.

If you want to explore this ecosystem, RocketX Exchange is the easiest way to begin. With one secure cross chain swap, you can bridge assets to Nibiru, buy NIBI, and start engaging with staking, vaults, governance, and more while always remaining in full control of your funds.

The future of finance is faster, simpler, and more connected. Nibiru Chain is working to lead that transformation.

Start your Nibiru journey today with RocketX and experience seamless cross chain DeFi.