Introduction

In the volatile world of cryptocurrency, few tokens have captured the imagination like River token (RIVER) in 2026. Surging over 500% in January alone, hitting an all-time high (ATH) of $87.73 before correcting to around $12.50, RIVER has become a poster child for chain-abstraction innovation. Backed by heavyweights like Justin Sun (TRON DAO) and Arthur Hayes (Maelstrom Fund), this DeFi protocol is redefining how stablecoins move across blockchains without the headaches of bridges or wrapped assets.

In this guide, we will break down everything from its core tech (like the satUSD stablecoin) to market sentiment, competitors, and future outlook. Whether you’re a newbie or a seasoned trader, let’s dive into why River could be the “liquidity ghost” of multi-chain DeFi.

What Is River (RIVER)? Chain Abstraction Explained Simply

River Protocol solves DeFi’s $200B problem: liquidity fragmentation across blockchains. When you want to use DeFi on Sui but your Bitcoin is on Ethereum, you typically need expensive, risky bridges. River eliminates bridges.

The core innovation:

Launched in September 2025, River allows you to deposit collateral (Bitcoin, Ethereum, BNB, staking tokens) on one blockchain and mint satUSD stablecoin on a completely different blockchain without bridges, wrapped tokens, or cross-chain exposure.

Example scenario:

- You hold 1 BTC worth $105,000 on Ethereum

- You want to use DeFi on Sui Network (faster, cheaper, higher yields)

- Traditional method: Bridge BTC to Sui ($50+ fees, bridge hack risk)

- River method: Lock BTC on Ethereum, mint $70,000 satUSD natively on Sui (150% collateralization), earn yields while BTC stays safe

The three-layer system:

- satUSD (The Stablecoin):

- Over-collateralized to maintain a $1 peg (backed 150-200% by crypto)

- Exists natively on 15+ chains without wrapping or bridging.

- Current circulation: $159M (40th largest stablecoin globally)

- Peg stability: 99.5-100.5% maintained through liquidations, arbitrage, and insurance.

- Omni-CDP (The Technology):

- Collateralized Debt Position that works across chains using the LayerZero OFT standard

- Deposit collateral Chain A → Mint debt on Chain B → Repay on any chain → Unlock original collateral

- Accepted collateral: BTC, ETH, BNB, USDT, USDC, liquid staking tokens (stETH, rETH, etc.)

- No bridges used = eliminates $2B+ in historical bridge hack exposure

- satUSD+ (The Yield Layer):

- Liquid staking derivative of satUSD earning 6% real yield + 36% implied (River Points)

- Auto-compounds through integrations: Curve, Uniswap, Pendle, PancakeSwap

- Stays liquid—use as collateral in other DeFi protocols while earning

- Convertible back to satUSD 1:1 anytime

Why institutional investors care:

Justin Sun ($8M TRON investment), Arthur Hayes’ Maelstrom Fund, Spartan Group, and Nasdaq-listed firms backed River because chain abstraction is DeFi’s next infrastructure layer. Current DeFi requires users to manually bridge between ecosystems, but River makes blockchain invisible to users.

Competitive advantage over other stablecoins:

| Feature | River satUSD | USDT | USDC | DAI |

| Backing | Crypto 150%+ | Fiat | Fiat | Crypto 150%+ |

| Native cross-chain? | Yes (no bridges) | No (wrapped) | No (wrapped) | Limited |

| Decentralized? | Yes | No | No | Yes |

| Yield-bearing? | Yes (satUSD+) | No | No | Via DSR |

| Market cap | $159M | $114B | $32B | $5.2B |

The gap between $159M (River) and $114B (USDT) represents either a massive opportunity or an uphill battle against entrenched network effects.

The 85% Crash: What Actually Happened

The Surge (September 2025 – January 2026):

- Launched at $1.14, grew to $8.50 on organic adoption

- January 21: Justin Sun announces $8M TRON investment

- January 21-26: Price explodes 1,930% to $87.73 ATH in 5 days

- Peak market cap: $1.72B, #1 trending on Binance

The Manipulation (January 24-26):

On-chain researchers exposed a sophisticated operation:

- 2,418 addresses controlled by a single entity

- 9.8M RIVER accumulated (50% of circulating supply)

- Entry: $4.12 (Bitget withdrawals December 2025)

- Peak value: $350M, paper profits: $300M+

The Crash (January 27 – February 9):

- Entity unwound positions, price collapsed 85% to $12.50-13.40

- Contributing factors: Token unlocks (61M locked), 80x futures leverage, profit-taking

- Entity still controls 30-40% supply (down from 50%)

Current situation: $248-263M market cap, rank #122-153, $24-61M daily volume, 38% daily volatility

Should You Buy River Token After the 85% Crash?

River at $12.50-13.40 represents either a generational buying opportunity (85% discount from ATH) or a value trap heading lower. Here’s the honest assessment with a decision framework.

The Bull Case: Why $12.50 Could Be Cheap

Technology fundamentally works

Despite token crashing 85%, TVL grew from $50M (December) to $290M (February). This proves:

- Users value satUSD for actual cross-chain utility

- Protocol solves real pain point (bridges are expensive/risky)

- Product-market fit exists independent of token speculation

Institutional validation is genuine

$12M funding from sophisticated investors:

- Justin Sun (TRON): $8M strategic investment, TRON integration Q1 2026

- Arthur Hayes (Maelstrom Fund): Former BitMEX CEO, deep DeFi expertise

- Spartan Group: Major crypto VC with track record (Polygon, Avalanche)

- Nasdaq-listed firms: Traditional finance showing interest

These aren’t retail FOMO—institutional money validates 3-5 year vision.

85% crash created irrational pessimism

At peak $87.73, market cap was $1.72B on $290M TVL = 5.9x TVL ratio (bubble). At the current $12.50, the market cap is $250M on $290M TVL = 0.86x TVL ratio (reasonable)

Most successful DeFi protocols trade at 1-3x TVL. The river is now fairly valued relative to fundamentals.

First-mover in chain abstraction

LayerZero enables the technology, but River is the first major application focused on stablecoins. If chain abstraction becomes standard (like L2s did), River is positioned to capture the majority of stablecoin cross-chain flow.

The Bear Case: Why $12.50 Could Go to $5

The manipulation entity is the sword of Damocles

30-40% supply controlled by a single entity ($97-104M holdings):

- Bought at $4.12, still profitable down to $4

- No accountability because an anonymous whale can dump anytime

- Each dump triggers panic liquidations

- Retail buyers are exiting liquidity until the entity fully exits

Historical precedent: Similar manipulations often end with a token down 95%+ from ATH (not just 85%).

Token unlocks are mathematically bearish

61M RIVER unlocking over 60 months = 1M+ monthly:

- At the current $12.50, that’s $12.5M+ new sell pressure monthly

- Unless protocol generates $12.5M+ monthly demand, price declines

- Current protocol revenue: ~$500K/month (not enough to absorb unlocks)

Math doesn’t work unless there is a massive adoption increase or the price already reflects future dilution.

The stablecoin market has brutal winner-take-all dynamics

Network effects favor incumbents:

- USDT is accepted everywhere (85% of CEX pairs)

- USDC has Circle’s regulatory relationships

- DAI has an 8-year DeFi integration history

- satUSD has… potential

For River to succeed, satUSD needs to capture 1-2% of $177B market ($1.77-3.54B) = 11-22x growth from $159M. That’s 3-5 years minimum, even with perfect execution.

Regulatory uncertainty could kill the project

Stablecoins face increasing scrutiny:

- U.S. pushing reserve requirements, licensing

- EU MiCA regulations restricting algorithmic stablecoins

- satUSD is crypto-backed (like DAI)—regulators might classify it as a security

One adverse regulatory ruling in a major jurisdiction could halt operations.

Decision Framework: Should YOU Buy?

Buy if all these are true:

- ✓ You’re experienced with DeFi (understand Omni-CDP, LayerZero, liquidations)

- ✓ You can stomach 50-80% additional downside without panic selling

- ✓ This represents <5% of your total crypto portfolio

- ✓ You believe multi-chain DeFi needs bridge-free stablecoin infrastructure

- ✓ You’re willing to hold 2-3+ years (not looking for quick flip)

- ✓ You have emotional discipline for 30-50% daily swings

Avoid if any of these are true:

- ✗ You’re new to crypto (start with BTC/ETH, not speculative alts)

- ✗ You need this money in the next 12 months

- ✗ Losing this amount would impact your life

- ✗ You don’t understand the technology (can’t explain Omni-CDP to a friend)

- ✗ You’re uncomfortable with manipulation concerns

- ✗ You check prices multiple times daily (emotional decision-making)

How satUSD Stablecoin Works

Traditional stablecoins:

- USDT/USDC: Fiat-backed, centralized, require bridges for multi-chain

- DAI: Crypto-backed but Ethereum-only

River’s innovation:

Deposit BTC on Ethereum → Mint satUSD on Sui → Collateral never moves

Example: Lock 1 BTC ($105K) on Ethereum → Mint $70K satUSD on Sui (150% collateralization) → Earn yields on Sui while BTC stays safe on Ethereum → Repay satUSD on any chain to unlock BTC

Why it’s better:

- No bridges = no hack risk ($2B+ lost to bridge exploits)

- Lower fees (~$15 one-time vs $100+ bridging round-trip)

- Zero slippage (minting, not swapping)

- Collateral stays on the most secure chain (Ethereum)

Current adoption: $159M satUSD backed by $290M TVL (182% over-collateralization). Yield-bearing satUSD+ earns 6% real yield through Curve, Uniswap, and Pendle integrations.

How to Buy River (RIVER) Token

RIVER tokens offer utility in the River ecosystem beyond the use of satUSD stablecoin.

Why Buy RIVER Tokens

Ecosystem benefits:

- Governance: Vote on protocol changes, collateral additions, and fee structures

- Yield boost: Staking RIVER increases satUSD+ yields by 20-50%

- Fee discounts: Reduce protocol fees by 10-30%

- River Points: Convert Points to RIVER at 2-4x multiplier rates based on holding duration

Current price: $12.50-13.40 | Circulating supply: 19.6M RIVER | Market cap: $248-263M

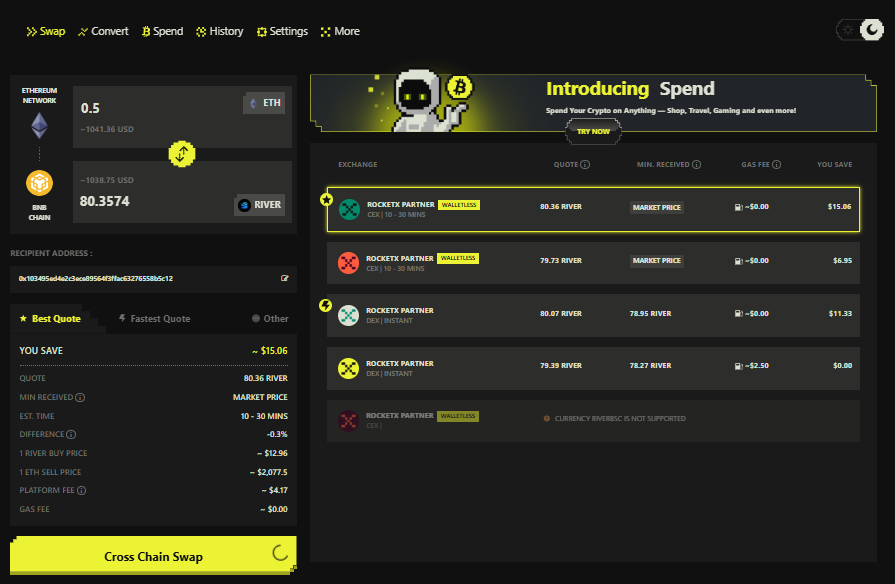

Buy RIVER Using RocketX (Simple Method)

RocketX is a decentralized exchange aggregator that allows you to swap any cryptocurrency for RIVER in a single transaction. It checks 250+ exchanges to find the best price automatically.

Why this method works:

- No account creation or KYC verification needed

- Swap from any blockchain (Ethereum, Solana, BNB Chain, etc.)

- Tokens delivered directly to your wallet

- Takes 2-15 minutes total

Step-by-Step Guide

Step 1: Visit RocketX

Go to app.rocketx.exchange in your browser

Step 2: Connect Your Wallet

Click “Connect Wallet” and choose your wallet:

- MetaMask (most popular)

- Phantom (for Solana users)

- Coinbase Wallet

- Trust Wallet

- 50+ other options supported

Step 3: Select What You’re Trading

In the “From” field:

- Choose blockchain: Where your crypto currently lives (Ethereum, Solana, BNB Chain, Polygon, Base, Arbitrum, etc.)

- Choose token: What you want to trade (ETH, SOL, USDT, USDC, BNB, or any token you hold)

- Enter amount: How much to swap to RIVER

Example: If you hold 0.5 ETH on Ethereum, select “Ethereum” as blockchain, “ETH” as token, and enter “0.5”

Step 4: Select RIVER as Destination

In the “To” field:

- Type “River” or “RIVER” in search

- Select destination network:

- Ethereum RIVER: Higher liquidity, accepted on most exchanges

- BNB Chain RIVER: Lower gas fees for staking and protocol use

Recommendation: Choose Ethereum RIVER unless you plan to use River protocol immediately (where BNB Chain has lower transaction fees)

Step 5: Review route options

RocketX displays multiple routes with transparent pricing:

- Quote: How much River do you receive

- You Save: Comparison vs. other routes

- Completion time: Usually 30 seconds to 15 minutes

- Gas fees: Network transaction costs shown separately

- Best Quote highlighted with yellow “WALLET LESS” tag

Step 6: Execute swap

- Click the “Cross Chain Swap” button

- Wallet pop-up shows exact transaction details

- Approve transaction (sign with wallet)

- Wait for completion (1-15 minutes typically)

What to Do With Your RIVER Tokens

Once you have RIVER, you can:

- Hold for price appreciation

- Store in a hardware wallet (Ledger, Trezor) for maximum security

- Hold long-term if you believe in the chain abstraction vision

- Stake for additional yields

- Visit app.river.inc

- Connect your wallet with your RIVER tokens

- Stake to boost satUSD+ yields by 20-50%

- Participate in governance

- Vote on protocol proposals

- Influence collateral types accepted

- Shape fee structures and protocol direction

- Convert River Points

- If you’ve earned River Points from protocol usage

- Redeem for RIVER at 2-4x bonus rates based on your holding duration

- Provide liquidity

- Add RIVER to Uniswap or PancakeSwap pools

- Earn trading fees from other users

- Higher risk but potential for additional returns

Common Questions

Q: Is this safe? Yes. RocketX is non-custodial, meaning your funds never leave your wallet until the swap executes. The platform has processed billions in volume since launch.

Q: What if the price changes during the swap? RocketX shows you the exact amount of RIVER you’ll receive before confirming. Price is locked for ~2 minutes while the transaction processes.

Q: Can I use a credit card? Not directly. You need cryptocurrency to use RocketX. If you only have fiat, buy crypto on Coinbase/Kraken first, then use RocketX.

Q: Which network should I choose for RIVER? Ethereum, if you plan to trade on exchanges or hold. BNB Chain, if you plan to use it in the River protocol (staking, minting satUSD) due to lower fees.

Q: Minimum purchase amount? No minimum on RocketX, but small purchases (<$50) may have fees that represent a higher percentage. Recommend $100+ for efficiency.

Top 3 Critical Risks You Must Understand

Risk 1: Manipulation Entity Still Controls 30-40% Supply

Single entity holds 7.8M+ RIVER worth $97-104M. Can dump anytime, overwhelming demand. Retail buyers risk becoming exit liquidity.

Mitigation: Only invest amounts you can lose. Use stop-losses at $10.

Risk 2: Token Unlocks Create Constant Sell Pressure

61M RIVER (61% supply) locked, vesting over 60 months. An estimated 1M+ unlocking monthly = $12.5-13.4M new sell pressure. Unless demand grows proportionally, the price stays suppressed for years.

Risk 3: Extreme Volatility Destroys Psychology

38% daily volatility, -62.9% weekly, -74.73% monthly. $69 to $30 on the same day (January 26). Most retail traders panic sell at bottoms, FOMO buy at tops.

Mitigation: Set stop-losses, use limit orders, don’t check price more than daily, accept 50%+ drawdowns possible.

Frequently Asked Questions

Is River Token a scam or legitimate?

Legitimate protocol with $12M institutional backing (Justin Sun, Maelstrom Fund), functional satUSD ($290M TVL), and audited contracts. However, the token experienced supply manipulation (50% cornered). Technology is legitimate; the token price was manipulated. Assess based on risk tolerance.

Why did River crash 85%?

Single entity used 2,418 addresses to corner 50% supply at $4.12 average. Began unwinding after $87.73 peak, triggering cascading liquidations. Contributing factors: token unlocks, 80x futures leverage, profit-taking. Revealed January 24-26, 2026.

Should I buy after the crash?

Only if: experienced DeFi user, can stomach 50%+ additional downside, <5% portfolio allocation, willing to hold 2-3+ years. Avoid if: beginner, need stability, can’t afford loss. Entity still controls 30-40% supply. Dollar-cost average over months.

What is satUSD?

Over-collateralized stablecoin (150%+ crypto backing) enabling cross-chain minting without bridges. Deposit BTC on Ethereum, mint satUSD natively on Sui using LayerZero. $159M circulation backed by $290M TVL. Stake for satUSD+ earning 6% yield.

Can River reach $87 again?

Possible but requires 18-36 months minimum and catalysts: manipulation entity exits, TVL grows to $1B+ (3.4x current), satUSD top 10 stablecoin, major listings. Conservative 2026: $26-35. Bullish 2027-2030: $50-100 if dominant chain-abstraction. Many tokens never recover from 85% crashes.

How do I buy without KYC?

Use RocketX (app.rocketx.exchange): Connect wallet, swap any crypto to RIVER across 250+ exchanges, no registration. BNB Chain is the cheapest (~$3.50 total for $1K purchase vs $18-38 on Ethereum, $24+ on CEXs).

Final Verdict: High-Risk Speculation, Not Investment

River at $12.50 after 85% crash is either a generational opportunity or a value trap heading to $5. The technology solves real DeFi problems—$290M TVL proves users value satUSD. Institutional backing ($12M from Sun/Hayes) validates long-term vision.

But: Manipulation entity controlling 30-40% supply, 61M token unlocks over 60 months, and extreme 38% daily volatility make this among crypto’s riskiest plays.

If buying:

- Use RocketX to save $20-40 per purchase

- Start with a <5% portfolio allocation

- Dollar-cost average over 3-6 months

- Set stop-losses at $10

- Plan to hold 2-3 years minimum

- Accept you might lose everything

Price at $12.50 reflects: Extreme pessimism + manipulation overhang + proven technology. Recovery requires patience and high risk tolerance.

This is speculation on chain abstraction becoming DeFi infrastructure—not a safe investment. Only speculate with money you can afford to lose entirely.

For current prices and protocol updates: app.river.inc, CoinGecko, @RiverdotInc on X/Twitter.