The unconnected blockchain ecosystems operating side by side yet siloed from each other is preventing the industry from reaching its full potential. Economical multi-chain bridges are the need of the hour to enable improved collaboration across various blockchains. Let’s delve into tips and tricks for efficient crypto bridge options to save you both money and time!

WHAT IS A CRYPTO BRIDGE?

A crypto/blockchain bridge is a technology that connects two disparate blockchains to allow them to communicate. Crypto bridge allows you to transfer assets from one blockchain to another, hence addressing one of the primary issues with blockchains: lack of interoperability.

If you wish to move tokens from one blockchain to another, you’ll most likely require a crypto bridge to do it. For instance, you cannot use ETH on Bitcoin network or BTC on Ethereum. In contrast, your credit card can be used at several point-of-sale in the legacy systems like banking.

WHY IS A CRYPTO BRIDGE NEEDED?

The expanding blockchain ecosystem has necessitated interest in blockchain bridges. In the past users were mostly inclined toward popular blockchains like Ethereum for decentralized applications (dApps) or Bitcoin for high-value payments. However, the shortcomings of these well-known blockchains, like Ethereum, prompted the creation of other blockchains and even Layer 2 sidechains. These new chains provided benefits including lower transaction costs, increased network throughput, and access to novel yield-earning activities.

Imagine you needed to utilize a Layer 2 network like Polygon and you had money on the Ethereum network (ETH). Your best bet would be to use a centralized exchange, like Coinbase or Binance, to swap ETH for MATIC. To use the network, you would then send the tokens to your Polygon chain wallet address. However, what if you had to transfer money back to Ethereum? You would have to go through the conversion procedure again and incur multiple transaction fees and withdrawal fees as well.

The issue was resolved with a decentralized cross-chain crypto bridge, which made transferring money between various networks simpler. Now there are many crypto bridges with distinctive trade-offs, advantages, and applications available. We would discuss them in the following sections

TYPES OF CRYPTO BRIDGES

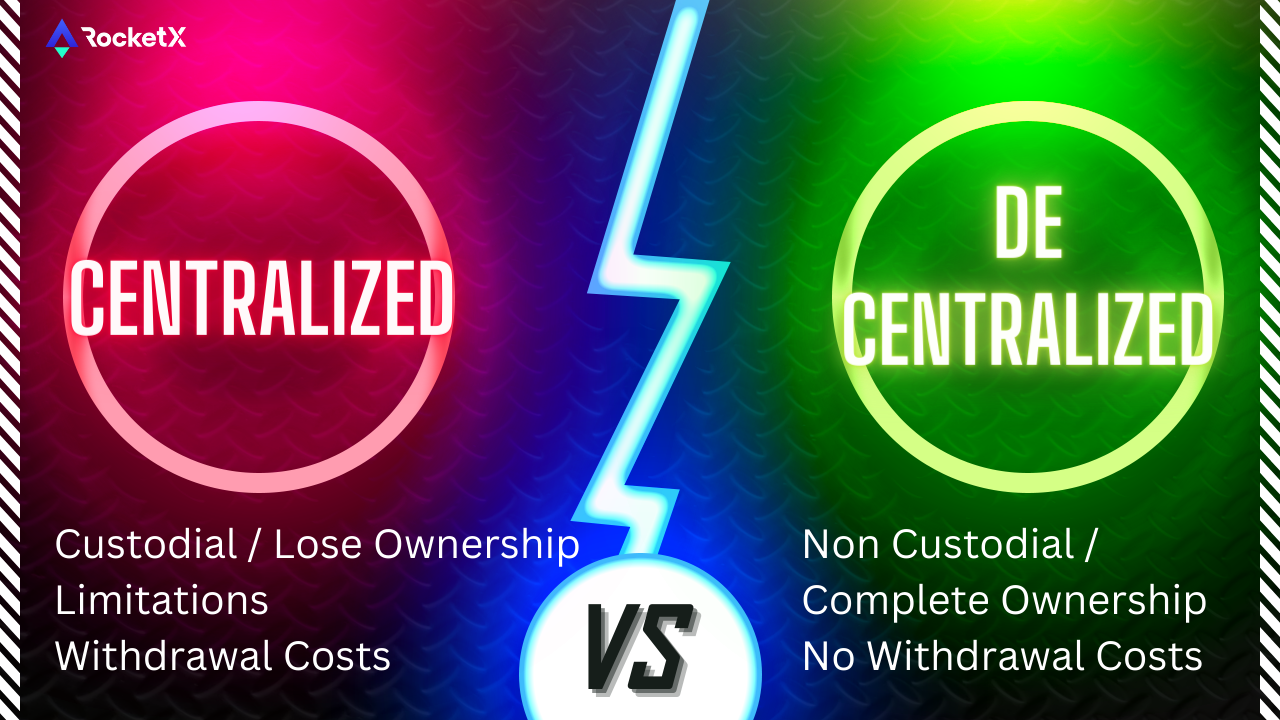

Blockchain bridges can be classified into two broad categories: Custodial bridges and Non-Custodial bridges.

Custodial crypto bridges sometimes referred to as trust-based bridge, are centralized bridges that needs to be managed by a central organization of mediators. Users must rely on the central entity to verify and validate transactions when transferring crypto from one chain to another. They might seem to be a cost-effective choice when transferring a large quantity of cryptocurrency.

However, it’s crucial to realize that when you send your cryptos to an exchange and trade there, you lose ownership of it. Instead, you’re turning over control of your crypto assets to the exchange, which might be prone to hacks. Your cryptocurrency stays under their control if you don’t withdraw it from their site. This suggests that they could place limitations on your account and thereby, on your cryptocurrency. Additionally, there are expenses associated with the withdrawal of cryptocurrency out of the CEX as well.

Non-custodial crypto bridges that relies on smart contracts and smart order-routing engines to function are known as a trust-less or decentralized bridge. Unlike custodial bridges, users do not need to deposit their crypto on the DEX for transferring crypto via these non-custodial bridges. So, there is no need for withdrawal fees as well. Most importantly, the users have complete ownership of their crypto when using a decentralized bridge.

They can provide users with greater security, ease and more flexibility compared to centralized bridges. The users can just connect their #DeFi wallets and start using decentralized bridges since there is no requirement to create an account. Hence, there is no need to divulge your personal information. Traders are switching over to decentralized crypto bridges because of these significant advantages.

Join Us on Telegram

VULNERABILITIES OF CRYPTO BRIDGE

While we discussed two broad categories of crypto bridges in previous section, they have their set of vulnerabilities.

SINGLE POINT OF FAILURE:

Centralized bridges rely on a single administrator or trusted parties called guardians for their functioning. Users face hazards as a result of centralization, which forces them to rely on a firm. However, trust is meaningless when dealing with enormous sums of money. A hacker or unscrupulous insider can easily infiltrate a central node or permissioned network and take over the blockchain bridge, stealing user funds or minting new tokens without deposits.

Technical CHALLENGE:

Decentralized bridges handle asset transfers/bridging using smart contracts to lessen dependency on trusted middlemen. The minting of wrapped tokens on the other blockchain is automated via a smart contract to which the user deposits his funds. Smart contracts though are not without flaws; for instance, their level of security depends on the developers. Many decentralized bridges rely on the robustness of the smart contract code and not the security of the blockchain. Because of this, malicious exploits can be used to attack bridges using poorly written smart contracts, increasing the risk to users.

HOW TO BRIDGE/TRANSFER CRYPTO COST-EFFECTIVELY?

Let’s delve into a much more effective and economic option of bridging crypto via a Hybrid Exchange like RocketX. They source their liquidity from 250+ exchanges, both centralized and decentralized. They leverage their novel proprietary smart-order-routing engine, to transfer crypto from one chain to another.

The liquidity is obtained through their CEX Pool, which has higher liquidity since the involved CEXs have incentives to retain asset pools on numerous platforms. RocketX multi-chain bridges are therefore highly cost-effective and have minimal slippage. The platform fee can be slashed down by 100% by holding the exchange’s token RVF. With just 1-click you can transfer your crypto across chains in a jiffy.

With a totally non-custodial solution that supports a variety of popular digital wallets like MetaMask, Coinbase, TrustWallet, Phantom etc, this hybrid crypto exchange gives users total control over their digital assets. RocketX has cleared security audit from Zokyo and NII Consulting, one of the leading cyber security firms in APAC. RocketX also has a very user-friendly interface similar to the Web2 dApps we are accustomed to. This makes using the RocketX crypto bridge and transferring tokens even more straightforward, greatly improving users’ DeFi experiences.

BENEFITS OF CRYPTO BRIDGES

Over time, several innovations have been made to link networks, allowing for the smooth flow/exchange of data from one blockchain to another while also increasing adoption rates. One such innovation is the crypto bridge powered by cross-chain technology which allows:

- Interoperability between disparate blockchains.

- Smooth exchange of crypto between blockchains.

- Increasing accessibility of blockchains.

- Lowering the entry barrier and driving mass adoption.

Most Popular Crypto Bridges

Video Tutorials on Crypto Bridge

Here’s a select few popular video-tutorials on how to economically and easily do cross-chain crypto transfers via Hybrid and decentralized platform – RocketX Exchange.