Introduction

Decentralized finance (DeFi) keeps proving a simple idea: money gets smarter when it moves without gatekeepers. Among the earliest and most enduring pillars of this movement is Aave—a permissionless money market where anyone can supply assets to earn yield or borrow against collateral. Thanks to years of steady shipping, thoughtful governance, and safety-first design, it has evolved from a single-chain pool into a multi-network powerhouse that keeps expanding into new ecosystems.

In 2025, the protocol hasn’t slowed down. It’s pushing beyond EVM, extending its native stablecoin (GHO) across chains, refining the core engine (v3.5), and seeding new market types for institutional-grade use cases. Below, you’ll find a future-focused guide that covers what the protocol is, how it works across chains, what’s new in 2025, where it’s heading next—and exactly how to buy AAVE using RocketX Exchange’s hybrid liquidity aggregator.

What is Aave and How Did It Begin?

Aave, derived from the Finnish word for “ghost,” is a decentralized, non-custodial liquidity protocol revolutionizing crypto lending and borrowing. It allows users to deposit digital assets into liquidity pools to earn interest or access loans using those assets as collateral. Known for its transparency and accessibility, the platform stands out with features like flash loans—instant, collateral-free borrowing that must be repaid within the same transaction.

Launched in 2017 as ETHLend by founder Stani Kulechov, the protocol underwent a rebranding in 2020 to reflect its evolving services and broadened vision as Aave. Addressing the inefficiencies of traditional lending systems, Aave employs blockchain technology to deliver faster, decentralized alternatives. Today, it has gained substantial popularity, offering its services across 12 major blockchain networks, including Ethereum, Polygon, and Avalanche.

How Does it Work?

It operates as a decentralized liquidity protocol, enabling seamless lending and borrowing of crypto assets. Its functionality is driven by liquidity pools and a decentralized market model, offering flexibility and innovation to its users.

- Lending: Users can deposit their digital assets into Aave’s liquidity pools to earn interest. These funds then become available for others to borrow, creating a balanced ecosystem of lenders and borrowers.

- Borrowing: Borrowers can access loans by providing collateral. Aave supports both over-collateralized loans—where users borrow less than the value of their collateral—and uncollateralized flash loans for specialized use cases.

- Dynamic Interest Rates: Interest rates are determined dynamically, based on the real-time supply and demand of assets within the liquidity pool. This ensures fairness and flexibility for both lenders and borrowers.

- Flash Loans: One of the most unique features, flash loans allow users to borrow without providing collateral, as long as the loan is repaid within the same transaction. This feature is ideal for arbitrage opportunities, refinancing, and executing complex financial strategies.

By combining decentralized technology with user-focused features, Aave simplifies DeFi lending and borrowing, making it accessible to both beginners and advanced users.

Major Partnerships, Integrations & Ecosystem Expansion (with Timeline)

Aave’s journey in 2025 has been marked by strong collaborations and continuous ecosystem growth. Here are the standout milestones with their respective dates:

-

Aptos Deployment (August 21, 2025)

Aave V3 officially launched on Aptos, becoming the protocol’s first non-EVM integration. The team rewrote the code in Move, integrated Chainlink oracles, and backed it with multiple audits and a $500k bug bounty. Supported assets include APT, sUSDe, USDT, and USDC. -

Expansion to Sonic (March 3–4, 2025)

The protocol extended to Sonic, a new Layer-1 ecosystem evolved from Fantom. This marked the first L1 expansion of the year and introduced incentive programs to bootstrap liquidity. -

GHO Stablecoin Goes Multi-Chain (2025)

Aave’s native stablecoin, GHO, is rapidly expanding. Using Chainlink CCIP, the DAO has extended GHO to Avalanche (June 27, 2025) and Gnosis Chain (August 7, 2025), while also enabling usage on Base. Alongside this, the community introduced the sGHO savings model to strengthen adoption. -

Protocol Upgrades: v3.5 and Horizon (August 2025)

The v3.5 upgrade improved precision and safety, while Horizon, a new RWA-backed lending market on Ethereum, opened doors for institutional and qualified participants. -

Looking Ahead: Aave v4 (Proposal, May 1, 2024 → Development 2025)

Aave v4 remains under development, promising a unified liquidity layer, deeper GHO integration, and modular upgrades. It’s projected to shape the next chapter of Aave throughout 2025.

Everything You Need to Know About AAVE Token

The AAVE token is the backbone of the protocol, enabling governance, staking, and utility within its decentralized ecosystem. Launched as part of the rebranding from ETHLend in 2020, it is an ERC-20 token designed to empower users and enhance the protocol’s functionality.

Use Cases of Token

- Governance: Token holders can participate in protocol decisions by voting on improvement proposals, shaping the future of the platform.

- Staking: Token holders can stake their tokens in the protocol’s safety module to earn rewards while securing the network against potential shortfalls.

- Fee Discounts: Borrowers who use AAVE as collateral enjoy reduced fees on the platform.

- Deflationary Mechanism: A portion of fees collected is used to buy back and burn AAVE, reducing its supply over time.

With its multi-functional role and integration across various blockchain networks, this token is a cornerstone of the ecosystem, driving its growth and innovation.

AAVE Tokenomics

-

Total Supply: 16 million (fixed, no inflation).

-

Circulating Supply: 15.21M as of today.

-

Distribution:

-

Original supply transitioned from LEND to AAVE in a 100:1 token migration in 2020.

-

A significant portion is community-governed, with reserves allocated for ecosystem growth and safety.

-

-

Key Tokenomics Features:

-

Deflationary by Design: When Safety Module slashing occurs, part of the staked AAVE can be liquidated, reducing circulating supply.

-

Staking Rewards: Incentives encourage long-term commitment and backstop security.

-

Governance-driven Utility: The community can adjust token utility, rates, or integrate new features, making tokenomics adaptive.

-

Discounted Borrowing via GHO: AAVE stakers enjoy borrowing GHO at reduced rates, driving further demand for staking.

-

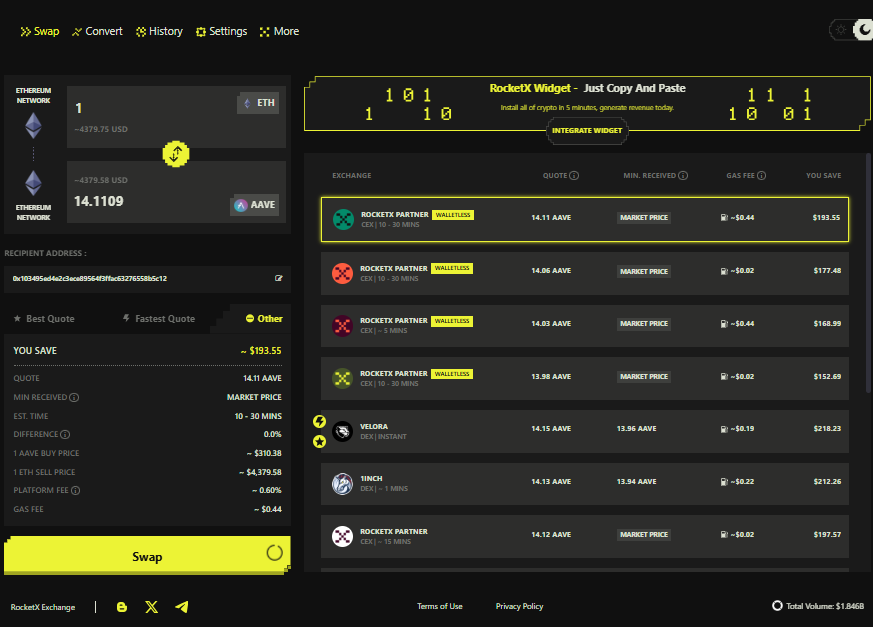

How to Buy AAVE on RocketX Exchange

Buying this token on RocketX Exchange is a seamless and flexible process, allowing users to purchase it on Ethereum, Solana, and Fantom networks using any token from any blockchain. Follow these steps to acquire this token efficiently:

- Visit RocketX Exchange

Open the RocketX platform in your browser to begin. - Connect Your Wallet

Link a compatible wallet like MetaMask, Trust Wallet, or Phantom Wallet, depending on the blockchain network you’re using. Ensure your wallet is connected to the correct network. - Select Source Network and Token

Choose the blockchain network and token you wish to swap from—this could be ETH, SOL, USDT, or any other supported asset across 150+ networks. - Select Destination Network and Token

Set the destination network to Ethereum, Solana, or Fantom, and choose AAVE as the token you want to receive. - Enter the Amount and Address

Specify the amount of the token you want to swap. Enter your wallet address on the chosen destination network to receive the tokens.

6. Review and Confirm

Double-check the transaction details, including amounts, networks, and addresses. Click on the swap to initiate the process.

7. Receive Tokens

After processing the transaction, your tokens will be credited to your wallet on the selected network.

Price Prediction and the Future

As one of the leading DeFi protocols, It has carved a significant place in the crypto ecosystem. Its innovative features position it as a pioneer in decentralized finance. Here’s a look at the potential future of Aave and its price trajectory:

Market Performance and Adoption

Aave has consistently maintained a strong presence in the DeFi sector, with billions of dollars locked in its liquidity pools. Its ability to adapt to market demands through features like community governance and staking has bolstered its reputation. With growing adoption by institutions and retail users, Aave is expected to remain a cornerstone of DeFi lending and borrowing.

Future Innovations

The protocol’s ongoing upgrades, such as Aave V3, enhance scalability, cross-chain interoperability, and efficiency. These advancements could further solidify it’s dominance and attract more users, leading to increased demand for its native token.

Price Prediction

While cryptocurrency prices are inherently volatile and influenced by broader market trends, analysts predict that AAVE’s value could rise in the coming years, especially if DeFi adoption accelerates. With its strong fundamentals and innovative roadmap, AAVE could see significant price appreciation as the crypto market matures.

Disclaimer: Price predictions are speculative and subject to market conditions. Always conduct thorough research before investing.

Conclusion

This decentralized protocol is more than a DeFi platform—it’s a comprehensive financial ecosystem transforming how people interact with money. With its innovative features, it provides users with unparalleled flexibility and opportunities. Whether you aim to lend, borrow, or stake, the protocol delivers a versatile solution tailored to diverse financial needs.

Through RocketX Exchange, acquiring AAVE tokens becomes seamless, enabling you to become part of a global community driving the future of decentralized finance. Begin your journey today and unlock the limitless potential of DeFi innovation.