Introduction

Dusk (DUSK) is a privacy-focused Layer 1 blockchain designed for regulated financial markets and real-world asset (RWA) tokenization. Trading at $0.18-0.23 in January 2026, DUSK recently surged 120% following a Chainlink partnership announcement and breaking an 8-month downtrend. Since its mainnet launch in January 2025, Dusk has gained institutional traction with its €200M+ NPEX tokenization partnership and MiCA-compliant infrastructure. You can buy Dusk on RocketX Exchange across 200+ blockchains with guaranteed best prices.

What Is Dusk Coin?

Dusk is a Layer 1 blockchain engineered for compliant financial applications and real-world asset tokenization. Unlike traditional privacy coins facing regulatory scrutiny, Dusk implements “privacy by default, auditability when required”—appealing to institutions and users seeking confidential transactions with regulatory compliance.

The mainnet launched on January 7, 2025, marking the culmination of six years of development. A year into operation, Dusk has delivered DuskEVM (Ethereum-compatible environment), Hyperstaking with programmable staking logic, and infrastructure for tokenizing securities and bonds on-chain. The network uses zero-knowledge proofs through its Phoenix transaction model for confidentiality while maintaining compliance via the Segregated Byzantine Agreement consensus mechanism.

Dusk complies with EU regulations including MiCA, MiFID II, and the DLT Pilot Regime. The NPEX partnership (Dutch MTF-regulated exchange) has advanced to €200-300M in tokenized securities trading on Dusk infrastructure, demonstrating real institutional adoption beyond pilot programs.

What Is Dusk Used For?

The DUSK token serves multiple essential functions within the ecosystem:

Network security through staking: DUSK holders stake tokens to participate in consensus, earning ~12% APY. Hyperstaking allows custom logic for liquid staking derivatives, privacy-preserving delegation, and affiliate rewards.

Transaction fees: All Dusk Network transactions require DUSK for gas. As adoption increases through DuskPay payments, Zedger tokenization, and third-party dApps, transaction volume drives sustained demand. Target costs remain sub-$0.01 per transaction.

Smart contracts and DeFi: Developers pay DUSK to deploy contracts. DuskEVM enables Ethereum compatibility while Lightspeed L2 expands throughput. DUSK serves as collateral for lending protocols and liquidity provision in decentralized exchanges.

Governance: Future roadmap includes on-chain governance where DUSK holders vote on protocol upgrades, parameter adjustments, and treasury allocation.

Privacy-preserving payments: DuskPay leverages DUSK alongside MiCA-compliant stablecoins for confidential payment processing—crucial for enterprise adoption and institutional treasury management.

Dusk vs Ethereum: Which Is Better for RWA Tokenization?

| Feature | Dusk | Ethereum |

| Privacy | Native zero-knowledge proofs, confidential by default | Public by default, privacy requires L2s |

| Compliance | MiCA, MiFID II, DLT Pilot Regime compliant | Evolving compliance via projects |

| Transaction Costs | Sub-$0.01 per transaction | $1-50+ depending on congestion |

| Finality | Immediate (seconds) | 12-15 minutes probabilistic |

| Smart Contracts | DuskEVM (Ethereum-compatible) + confidential | Mature, industry-standard |

| Institutional Focus | Purpose-built for financial markets | General-purpose adapted for finance |

| Developer Ecosystem | Growing, early stage | Largest in crypto |

| Network Effect | Limited, emerging | Dominant, established |

When Dusk excels: Regulated European financial institutions tokenizing securities benefit from Dusk’s native compliance infrastructure, eliminating legal uncertainty while providing institutional privacy guarantees.

When Ethereum excels: Projects prioritizing maximum decentralization, extensive tooling, deep liquidity, and global reach favor Ethereum’s mature ecosystem and battle-tested security.

Hybrid potential: Lightspeed L2 bridges both—developers build on Ethereum-compatible infrastructure while settling on Dusk for privacy and compliance benefits.

Why Is Dusk Surging in January 2026?

DUSK’s 120% January 2026 surge stems from technical breakout and fundamental catalysts:

Technical breakout after 8-month consolidation: DUSK broke above a descending trendline from mid-2025, confirmed by volume surge and RSI strength (62.5). The breakout attracted momentum traders anticipating moves toward $0.25-0.30 resistance levels after prolonged accumulation.

Chainlink Partnership Announcement (January 19, 2026): Dusk has integrated Chainlink’s CCIP (Cross-Chain Interoperability Protocol), enabling the cross-chain settlement of tokenized securities. This partnership directly addresses liquidity fragmentation in RWA markets, enabling Dusk-based assets to interact with Ethereum, Avalanche, and other EVM chains, thereby significantly expanding the addressable market.

NPEX platform momentum: The €200-300M tokenized securities trading platform on Dusk moved from pilot to active production, demonstrating real institutional usage. This validates Dusk’s product-market fit beyond speculative promises—institutions are actually using the infrastructure for regulated securities trading.

Privacy narrative strengthening: While traditional privacy coins face delistings and regulatory pressure, Dusk’s “auditable privacy” model gains traction. European institutions seeking MiCA-compliant confidential transactions have limited alternatives, positioning Dusk uniquely as regulators tighten surveillance requirements.

Broader RWA sector attention: BlackRock, Franklin Templeton, and traditional finance continue expanding blockchain-based funds, raising awareness of compliant tokenization infrastructure. Dusk benefits from this institutional attention as European entities’ primary MiCA-compliant option.

Is Dusk a Good Investment?

Dusk presents compelling investment potential based on one year of mainnet operation, institutional traction, and positioning in the rapidly growing RWA tokenization sector.

DUSK trades at $0.18-0.23 in January 2026, experiencing a 120% surge mid-month following Chainlink partnership announcements and breaking an 8-month downtrend. The token remains 80-85% below its $1.17 all-time high from December 2021 but has recovered substantially from its $0.01 bear market low.

Key investment catalysts for 2026:

One year post-mainnet, Dusk demonstrates real institutional usage through NPEX’s €200-300M tokenized securities platform actively trading on Dusk infrastructure. The January 2026 Chainlink partnership enables cross-chain settlement of regulated securities using CCIP, expanding interoperability with EVM chains. Hyperstaking continues offering ~12% APY with custom staking logic.

Q1 2026 roadmap includes completing DuskEVM upgrades (enhanced EVM compatibility), launching Dusk Pay (MiCA-compliant payment network), and finalizing Superbridge for cross-chain asset transfers. Unlike 2025’s theoretical promises, these 2026 deliverables build on proven mainnet infrastructure.

RWA tokenization continues expanding as a sector, with projections estimating tokenized assets could reach $16 trillion by 2030. Dusk’s compliance-first positioning specifically targets European financial markets where regulatory clarity (MiCA) creates immediate adoption opportunities versus global competitors facing regulatory uncertainty.

Investment considerations: Dusk suits investors seeking exposure to privacy-preserving infrastructure meeting institutional compliance requirements. One year of mainnet operation reduces execution risk versus pre-launch speculation. However, DUSK remains a mid-cap cryptocurrency ($87-117M market cap) with typical crypto volatility, competition from Ethereum-based tokenization solutions, and dependency on continued institutional adoption.

How to Buy Dusk on RocketX Exchange

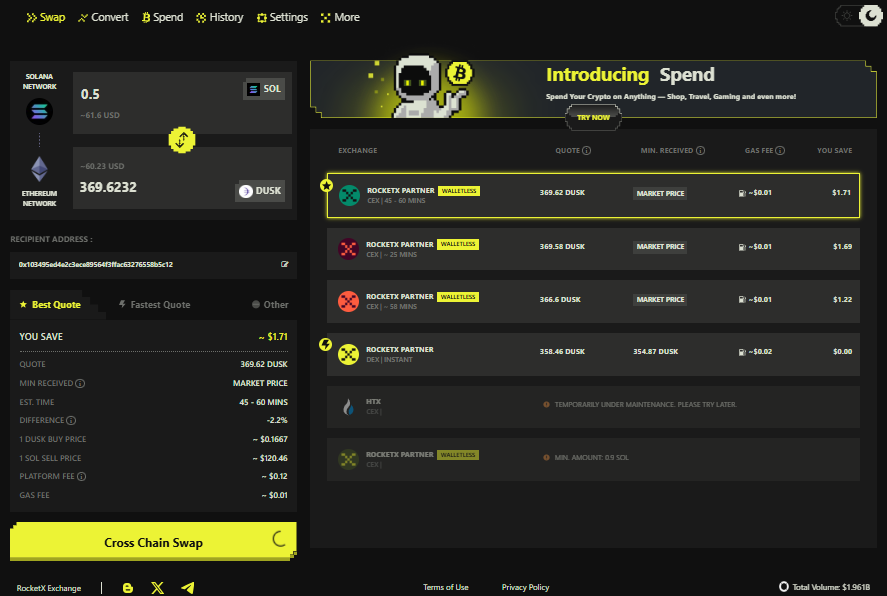

RocketX provides optimal DUSK pricing through its hybrid CEX-DEX aggregator, querying 250+ exchanges including Binance, MEXC, and Gate.io while supporting cross-chain swaps across 200+ blockchains.

Step 1: Connect wallet. Visit app.rocketx.exchange and connect MetaMask, WalletConnect, Coinbase Wallet, or 50+ other wallets.

Step 2: Select source crypto. Choose the token you want to swap for DUSK—Bitcoin, Ethereum, SOL, USDT, USDC, or any asset on 200+ blockchains.

Step 3: Choose DUSK. Search “Dusk” or “DUSK” in the destination field. Select DUSK on Ethereum (primary trading network).

Step 4: Review routing. RocketX displays multiple routes with price breakdowns, completion times (30 seconds to 5 minutes), and total costs including gas.

Step 5: Execute the Swap: Click “cross-chain swap” and approve the transaction in your wallet. RocketX handles all bridging automatically.

Step 6: Track progress: RocketX provides real-time status updates. Single-chain swaps complete within 30-90 seconds. Cross-chain swaps take 3-8 minutes, depending on network congestion.

Step 7: Receive DUSK: Once completed, DUSK Coin appears in your wallet. You can immediately stake it or hold it as an investment.

What Are the Risks of Investing in Dusk?

Despite strong fundamentals, DUSK carries several risk factors:

Regulatory uncertainty beyond Europe: While Dusk excels in EU compliance, expansion into US, Asian, or other markets faces uncertain regulatory frameworks. Privacy features might trigger scrutiny in jurisdictions restricting privacy coins.

Execution and competition risk: Delivering Lightspeed L2, DuskPay, and institutional partnerships on schedule presents challenges. Ethereum, Avalanche, and Polygon actively pursue RWA tokenization with significant resource advantages, including established developer ecosystems and deeper liquidity.

Limited network effects: As a newer mainnet, Dusk has minimal liquidity versus established chains, creating higher slippage for large trades and limiting DeFi composability. Building sufficient traction requires years of sustained growth.

Token supply inflation: Total supply of 1 billion DUSK includes 500 million gradually releasing over 18-36 years through staking rewards, creating ongoing selling pressure as new tokens enter circulation.

Institutional adoption dependency: Dusk’s value relies heavily on institutions tokenizing assets. If traditional finance adoption proceeds slowly or institutions choose competing platforms, the growth thesis weakens substantially.

Market volatility: DUSK correlates with broader crypto sentiment. Bitcoin and Ethereum movements heavily influence DUSK regardless of project developments. Bear markets could drive 50-80% drawdowns even with strong fundamentals.