Toncoin (TON) is the cryptocurrency powering The Open Network, a blockchain built directly into Telegram that 950+ million users can access. If you’ve seen TON mentioned in Telegram chats, mini-apps, or @wallet notifications, this guide explains what it is, whether it’s worth buying, and the easiest way to purchase it. Trading at $1.50-1.53 in January 2026, TON offers instant payments within Telegram plus staking rewards around 3-5% APY. You can buy TON using any cryptocurrency you already own through RocketX Exchange—no complicated registration or moving funds between multiple platforms required.

What Is Toncoin?

Toncoin is the cryptocurrency powering The Open Network, a blockchain that works inside Telegram. Think of it like this: just as you need dollars to buy things, you need TON to use blockchain features in Telegram—instant payments to friends, mini-app games with real rewards, digital collectibles, or earning 3-5% interest by staking.

The backstory: Telegram founders Pavel and Nikolai Durov created this in 2018 to bring crypto to messaging users. After SEC issues forced Telegram to abandon it in 2020, the community took over. Today, the nonprofit TON Foundation manages it independently but maintains tight Telegram integration.

Why it’s different: Most blockchains require separate apps, complex wallets, and recovery phrases. TON works directly inside Telegram using your existing account—just tap @wallet in any chat. This “one-tap” approach targets Telegram’s 950+ million users who’d never use traditional crypto exchanges.

Technical basics: TON uses “dynamic sharding” enabling 100,000+ transactions per second with sub-$0.01 fees. Current stats: 100+ million wallets, $160M+ in DeFi, 650+ mini-apps where TON actually gets used for payments and rewards.

Should You Buy Toncoin?

The bottom line first: TON makes sense if you believe Telegram will successfully convert its messaging users into crypto users over the next 2-5 years. It’s a bet on social media integration being crypto’s breakthrough, not another DeFi protocol competing with Ethereum.

Current situation (January 2026):

- Price: $1.50-1.53 (down 81% from $8.25 peak in June 2024)

- What this means: You’re buying after a major correction, not chasing a pump

- The opportunity: If TON returns to previous highs, that’s 440% upside

- The risk: It could drop another 50% in a bear market to $0.75

Recent developments that matter:

AlphaTON invested $46M in January 2026 to deploy AI computing infrastructure on TON, paying providers in Toncoin. This creates actual utility beyond speculation—people earn TON for providing computing power, not just hoping the price goes up.

Telegram’s July 2025 US wallet launch gave American users compliant access, though adoption remains gradual. Most Telegram users still don’t actively use crypto features—they’re messaging, not investing. Converting them takes years, not months.

Who should consider buying TON:

- You use Telegram daily and see mini-apps gaining traction

- You’re comfortable holding 2-5 years for mass adoption thesis to play out

- You want exposure to “social crypto” beyond just DeFi

- You’re okay with high volatility (81% drawdowns happen)

- You’re diversifying, not putting everything into one alt-coin

Who should avoid TON:

- You’re looking for quick 2-3 month gains (consolidation suggests patience required)

- You don’t believe social media integration will drive crypto adoption

- You want established DeFi ecosystems (Ethereum/Solana have more developers)

- You can’t afford to lose 50-80% of your investment

- You’re scared by “infinite supply” tokenomics (new tokens constantly added)

What analysts predict: Conservative estimates target $1.90-2.15 by Q2 2026 (25-40% gain). Long-term, $10 by 2028-2030 requires Telegram successfully onboarding hundreds of millions to blockchain—possible but not guaranteed. Current price suggests the market is skeptical, waiting for proof of adoption.

Toncoin’s Role in Telegram’s Ecosystem

Transaction fees: All TON network transactions require TON for gas (~$0.01 per transaction). As mini-apps, payments, and dApps scale, this drives sustained demand.

Staking rewards: Stake TON to earn 3-5% APY through validator rewards. Users can stake any amount through platforms like STON.fi or run their own validator node (requires 300,000 TON minimum).

Telegram payments: Send instant TON via @wallet in chats, purchase in-app items in mini-apps, tip creators, buy username NFTs, and use Telegram Premium features.

DeFi and dApps: Provide liquidity on DEXs (STON.fi, DeDust), use as collateral in lending protocols, participate in 650+ mini-apps including games with player-owned assets and NFT marketplaces.

Toncoin vs Solana: Which Should You Buy?

Both are fast Layer 1 blockchains, but they target completely different users. Here’s how to choose:

| Decision Factor | Buy TON If… | Buy SOL If… |

| You are… | A Telegram user who wants easy onboarding | A crypto trader seeking DeFi opportunities |

| You value… | Social integration and simplicity | Maximum speed and DeFi composability |

| You believe… | Mainstream adoption comes through apps people already use | Crypto users want dedicated blockchain platforms |

| Your risk tolerance | High (TON down 81% from ATH, depends on Telegram) | High (SOL had network outages, volatile but proven) |

| Your timeline | 2-5 years for Telegram adoption to materialize | 1-3 years for next DeFi bull cycle |

| Current opportunity | Buying after a major correction ($1.50 vs $8.25 peak) | Established ecosystem at mid-range prices |

Technical comparison (for the curious):

- Speed: TON tested 104k+ TPS; Solana claims 65k but sustains ~3-5k in practice

- Fees: Both under $0.01 typically (TON slightly more consistent)

- Uptime: TON has no major outages; Solana had several in 2022-2023 (though improving)

- DeFi ecosystem: Solana has $8B+ TVL vs TON’s $160M (50x difference)

- Developer activity: Solana’s Rust ecosystem is mature; TON’s FunC is growing but smaller

Toncoin’s 2026 Roadmap: Layer 2, Bitcoin Bridge, and AI Integration

Q1 2026 developments: Major mainnet “Accelerator” performance update, Payment Network Layer 2 for micropayment scaling at near-zero fees, TON Storage decentralized file protocol launch competing with Filecoin/IPFS.

Mid-2026 milestone: TON BTC Teleport—trustless Bitcoin-to-TON bridge enabling BTC holders to access TON DeFi without custodians. Recent 104k+ TPS tests demonstrate technical readiness.

Ongoing AI integration: AlphaTON’s $46M Cocoon AI deployment (January 2026) positions TON for decentralized compute. GPU providers earn Toncoin for contributing computing power to privacy-focused AI workloads.

US adoption continuing: Following July 2025 wallet launch, Telegram gradually onboards American users to compliant self-custodial wallets—targeting conversion of messaging users into blockchain participants over a 2-3 year timeline.

How to Buy Toncoin & Bridge to TON Blockchain: Complete Guide

Whether you want to buy TON tokens for investment or bridge assets to the TON blockchain for DeFi/staking, the process is identical on RocketX. One platform handles everything—from any cryptocurrency, from any blockchain.

Understanding What You Need

Buying TON tokens: Getting Toncoin (TON) to hold, trade, or use in Telegram

- You end up with: TON tokens in your wallet

- Use for: Investment, Telegram payments, staking rewards, holding

Bridging to TON blockchain: Moving other assets (USDT, ETH, etc.) TO TON ecosystem

- You end up with: Your existing crypto now on the TON blockchain

- Use for: TON DeFi (STON.fi), staking pools with stablecoins, mini-apps, and lending

Good news: RocketX handles both with the same process.

Why RocketX Beats Traditional Exchanges

The problem with buying/bridging elsewhere:

- Centralized exchanges (Binance, Coinbase) require KYC, registration, and withdrawal fees

- You probably hold BTC, ETH, or USDT—but most exchanges force you to sell for fiat first (double fees)

- Manual bridges require checking 5+ different websites individually

- No guarantee you’re getting the best price

- Complicated multi-step processes

How RocketX solves everything:

- Aggregates 250+ exchanges & bridges → Compares all options automatically, finds the cheapest route

- Direct cross-chain swaps → Hold ETH? Swap directly to TON. No intermediate steps.

- No registration → Just connect wallet (MetaMask, Phantom, Trust Wallet, etc.)

- Non-custodial → Funds never leave your wallet, go directly from the source → destination

- Transparent pricing → See total cost upfront (gas + bridge fee + platform fee)

- Best route auto-selected → Yellow “WALLET LESS” tag highlights cheapest option

- One interface for everything → Buy TON tokens, bridge to TON blockchain, swap within TON—all same place

Universal Process (Works for All Scenarios)

Whether you’re:

- Swapping ETH → TON tokens

- Bridging USDT from Ethereum → TON blockchain

- Swapping SOL → TON tokens

- Bridging stablecoins from Base → TON for DeFi

- Converting any crypto → TON from any chain

The 7-step process is identical:

Step 1: Visit RocketX

Go to app.rocketx.exchange

Step 2: Connect your wallet

- Ethereum/EVM chains: MetaMask, Coinbase Wallet, WalletConnect, Trust Wallet

- Solana: Phantom, Solflare

- Other chains: 50+ wallet options supported

Step 3: Select source network & asset

- “From” field: Choose your blockchain (Ethereum, Solana, Base, BNB Chain, Polygon, Arbitrum, etc.)

- Asset: Select what you’re swapping (ETH, SOL, USDT, USDC, BTC, or any token)

- Amount: Enter how much you want to swap

Step 4: Select destination

- For bridging to TON blockchain: Select “TON Network” then choose asset (TON, USDT, USDC, etc.)

- Destination address: Enter your TON wallet address (Tonkeeper, TON Space)

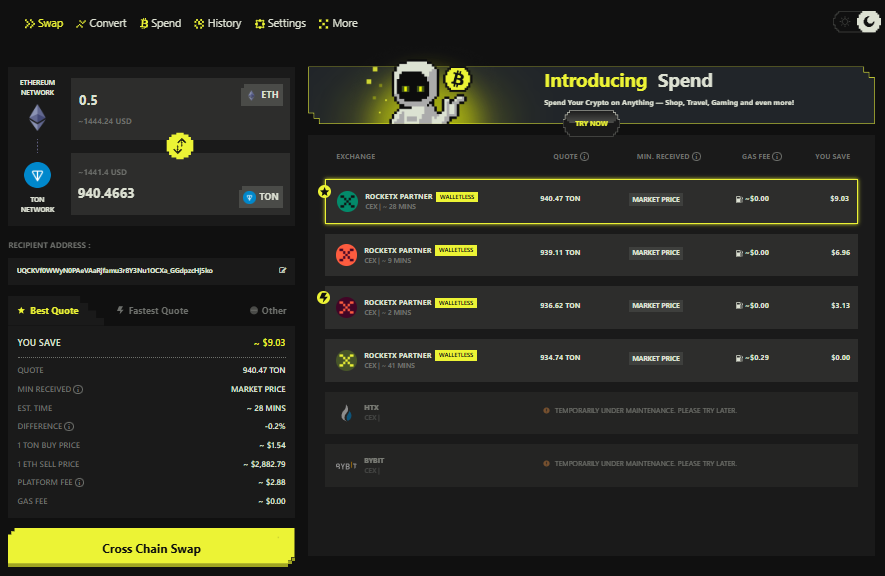

Step 5: Review route options.

RocketX displays multiple routes with:

- Quote: How much TON/asset you’ll receive

- Min. Received: Guaranteed minimum (accounting for slippage)

- Gas Fee: Network transaction cost

- You Save: How much cheaper than other routes

- Completion time: Usually 30 seconds to 20 minutes

Best Quote automatically highlighted with “WALLET LESS” yellow tag

Step 6: Execute swap

- Click the “Cross Chain Swap” button

- Approve the transaction in your wallet

- Your wallet shows exact amounts and gas fees before signing

- Confirm transaction

Step 7: Receive tokens

- Completion: 30 seconds to 20 minutes (depending on source chain)

- Tokens arrive automatically in your wallet

- No manual claiming needed

After receiving, you can:

- Transfer TON to the Telegram wallet for in-app use

- Stake TON for 3-5% APY on STON.fi

- Use bridged stablecoins in TON DeFi

- Hold as an investment

Cost & Time Comparison by Source Chain

For buying $500 worth of TON tokens or bridging $500 USDT:

| Source Chain | Gas Fee | Platform Fee | Total Cost | Time | Best For |

| BNB Chain | ~$0.30 | 0.2-0.5% (~$1-2.50) | $1.30-2.80 | 3-8 min | Cheapest option, small amounts (<$500) |

| Polygon | ~$0.50-2 | 0.2-0.5% (~$1-2.50) | $1.50-4.50 | 5-10 min | Budget-conscious, fast |

| Base | ~$0.50-1 | 0.2-0.5% (~$1-2.50) | $1.50-3.50 | 5-10 min | Coinbase users, low fees |

| Solana | ~$0.01 | 0.3-0.6% (~$1.50-3) | $1.51-3.01 | 10-20 min | SOL holders, cheap |

| Arbitrum | ~$1-3 | 0.2-0.5% (~$1-2.50) | $2-5 | 5-15 min | L2 users |

| Optimism | ~$1-3 | 0.2-0.5% (~$1-2.50) | $2-5 | 5-15 min | L2 users |

| Ethereum | ~$5-15 | 0.2-0.5% (~$1-2.50) | $6-17.50 | 10-20 min | Large amounts (>$5K), most liquid |

Key insights:

- BNB Chain = Cheapest ($1.30-2.80 total)

- Ethereum = Most expensive but best for large amounts

- L2s (Base, Arbitrum, Optimism) = Good middle ground

- Solana = Very cheap gas but slightly longer routing

Why RocketX Finds Better Prices (Technical Explanation)

Hidden route optimization: Sometimes the cheapest path isn’t direct. RocketX might route:

- ETH → Polygon → TON (cheaper than ETH → TON direct)

- SOL → BNB Chain → TON (cheaper than SOL → TON with limited bridges)

You never see this complexity — RocketX handles it automatically. You just see “Best Quote” highlighted.

Price aggregation:

- Compares Binance DEX, MEXC, 1inch, Uniswap, PancakeSwap, and 250+ more

- Checks TON Bridge, Orbit Bridge, LayerZero for cross-chain

- Updates prices in real-time

- Accounts for slippage, gas, and fees

Real savings example:

- Buying 150 TON on Binance: Sell ETH for USDT (0.1% fee) + Buy TON with USDT (0.1% fee) + Withdrawal (0.5 TON) = $0.75 + opportunity cost

- Buying 150 TON on RocketX: Direct ETH→TON (0.3% fee) = $0.45 + guaranteed best price = You get 2-3 more TON tokens

Multiply this across larger purchases: On a $5,000 swap, 2% difference = $100 saved.

After Getting TON: What to Do Next

If you bought TON tokens:

- Transfer to Telegram: Send TON to your Telegram wallet for in-app payments

- Stake for rewards: Earn 3-5% APY on STON.fi or through validator pools

- Hold as investment: Keep in secure wallet (Tonkeeper, Ledger)

- Use in mini-apps: Play Telegram games, participate in the TON ecosystem

If you bridged assets to the TON blockchain:

- DeFi participation: Provide liquidity on STON.fi, use DeDust for swaps

- Lending/borrowing: Use bridged USDT/USDC as collateral

- Staking pools: Stake stablecoins for yields

- Mini-app participation: Use assets in TON dApps

Pro tip – Bridge + Buy strategy:

- First, buy 10-20 TON tokens (for gas fees on the TON network)

- Then bridge your larger stablecoin amounts to TON blockchain

- Now you have TON for gas + assets for DeFi/staking

Common Questions about Bridging

What’s the difference between buying TON and bridging to TON?

-

Buying TON: Getting Toncoin tokens (the cryptocurrency)

-

Bridging to TON: Moving other assets (USDT, ETH, etc.) to TON blockchain to use in TON DeFi

Think of it like: Buying TON = getting the currency. Bridging = moving your existing money to the TON banking system.

Do I need TON tokens for gas on the TON blockchain?

Yes. Every transaction on TON costs ~$0.01-0.05 in TON. If you’re bridging stablecoins to use in TON DeFi, bridge $10-20 worth of TON first for gas fees.

Can I bridge any token to TON?

Most bridges support: USDT, USDC, ETH, wBTC, BNB, SOL, and major tokens. Obscure tokens need to be swapped to supported assets first (RocketX does this automatically).

What if I enter the wrong TON address?

Crypto transfers are irreversible. Always double-check your TON wallet address. Send a small test amount ($10-20) first if unsure.

Which is better: RocketX or official TON Bridge?

-

RocketX: Better for <$5,000, finds the cheapest routes, one interface for everything

-

Official TON Bridge (bridge.ton.org): Better for >$5,000, more trustless, direct Ethereum↔TON

For most users, RocketX’s convenience and cost savings outweigh marginal security differences.

How long does it take?

-

BNB Chain/Base: 3-10 minutes

-

Polygon/L2s: 5-15 minutes

-

Ethereum: 10-20 minutes

-

Solana: 10-20 minutes (routing through intermediaries)

What if the transaction gets stuck?

RocketX shows live transaction status. If stuck >30 minutes, contact support with the transaction hash. Blockchain transactions don’t disappear—funds are always recoverable.

Can I convert fiat (dollars) directly to TON?

Not on RocketX (crypto-to-crypto only). To go fiat → TON:

-

Buy ETH, USDT, or BTC on Coinbase/Kraken with a bank account

-

Send to your wallet

-

Use RocketX to swap for TON

Alternative: Binance allows direct credit card → TON but charges 3-5% fees vs RocketX’s 0.2-0.4%.

Frequently Asked Questions (From Real Toncoin Searchers)

How do I actually use Toncoin in Telegram?

Open any Telegram chat and type @wallet to access the TON wallet bot. You can send TON to friends by typing “@wallet send [amount]” or clicking the paperclip icon → Payment. You can also buy Telegram Premium with TON, purchase username NFTs, play mini-app games with TON rewards, and tip creators in channels. It works like Venmo but inside Telegram—no separate app needed.

Where can I store Toncoin safely? What’s the best wallet?

For Telegram users: TON Space (built into Telegram, self-custodial since July 2025 US update) is easiest. For serious investors: Tonkeeper (official wallet recommended by TON Foundation) offers full features including staking and NFTs. For maximum security: Ledger hardware wallets support TON. Trust Wallet and MetaMask also work but require bridging. If you’re just starting, begin with TON Space for convenience, then graduate to Tonkeeper as you get comfortable.

Can I convert my dollars/euros directly to Toncoin?

Not on RocketX (it’s crypto-to-crypto only). To go from fiat to TON: (1) Buy ETH, USDT, or BTC on Coinbase/Kraken with your bank account, (2) Send to your MetaMask wallet, (3) Use RocketX to swap that crypto for TON. This sounds complicated but takes 15 minutes total once you’re set up. Alternative: Some centralized exchanges like Binance let you buy TON directly with credit card, but charge 3-5% fees vs RocketX’s 0.3%.

What’s the difference between TON on different blockchains (Ethereum vs native)?

Native TON lives on The Open Network blockchain—this is the “real” TON you use in Telegram. Wrapped TON on Ethereum (wTON) or BNB Chain exists for trading on those networks’ DEXs. Think of wrapped versions like IOUs that can be exchanged 1:1 for native TON. When buying, RocketX handles this automatically—you receive native TON in your wallet regardless of which chain you swapped from.

Is Toncoin price going up or down? What do experts predict?

Current price is $1.50-1.53, down 81% from $8.25 peak in June 2024. Conservative analysts predict $1.90-2.15 by mid-2026 (25-40% gain) if roadmap delivers. Long-term forecasts vary wildly: $4-8 by 2027, potentially $10 by 2028-2030 if Telegram adoption succeeds. Reality check: These are guesses based on “if everything goes right.” Crypto is volatile—TON could also drop to $0.75 in a bear market. Only invest what you can afford to lose.

Should you Buy River Token After 85% Crash: Chain-Abstraction Stablecoin Guide

Introduction In the volatile world of cryptocurrency, few tokens have captured the imagination like River token (RIVER) in 2026. Surging over 500%...

Should You Buy Axie Infinity (AXS)? Risks, Rewards, and Reality

What Is Axie Infinity? Axie Infinity is a blockchain game where you collect, breed, and battle digital creatures called Axies—think Pokémon meets...