Despite the slowing crypto market, the Non-Fungible Token(NFT) market has been consistently making waves, with OpenSea processing over $446 million worth of Ethereum transactions in January 2023 alone. The new NFT marketplace, Blur, overtook OpenSea on Feb 15 in daily Ethereum trading volume, which is a testament to the continued growth of NFTs – unique and indivisible digital assets that can represent anything from artwork and collectibles to virtual real estate and in-game items.

However, buying NFTs) in a multi blockchain world can still be challenging, as it requires navigating the different blockchain networks and marketplaces where these tokens are sold. Each blockchain has its own unique set of rules and requirements for purchasing and trading NFTs, which can be confusing and time-consuming for new buyers.

In this blog post, we will explore these challenges and how crypto aggregators can simplify the buying process. But, first let’s talk about NFTs, in brief.

What Are NFTs

We know it’s late. Hundreds of articles and videos already exist. But, if you are reading this, chances are: you want to try just one last time to “really” understand “NFTs.”

We won’t disappoint, hopefully!

Well, why don’t we start learning a bit about traditional artwork?

Image courtesy: Mall Galleries

This is a famous Monalisa painting. While no proof exists that shows its whereabouts, it is only by tracking history that we can find that the original painting is at the Louvre Museum in Paris.

In the traditional art world, if one has to verify if a particular painting is real, there is either a clear history, a signed certificate of authenticity, a sales receipt, or some sort of document available today in reference to the original work. Therefore, in most cases, a way exists to authenticate the real from the fake when it comes to physical artwork.

But, how would you differentiate between two similar digital paintings, like the ones below?

Image courtesy and artist: Proko

We copied them for the sake of an example, but can you identify the real one?

It is difficult to verify digital artwork. Anyone could replicate them – perfectly, endlessly, and in most cases, without any additional cost, as we did. Besides, copying digital art is much easier compared to traditional artwork. Spammers no longer need to sit for days to create replicas. They can simply copy the work and sell it as theirs. The original creators could try to track forgeries, but how many complaints can you really register?

Despite the growing industry, no technology exists that can prove that the above digital art is, indeed, by Proko; but, that’s up until now.

Enter NFTs!

NFTs are short for “non-fungible token(s).” That’s two words: non-fungible and token.

- If you are not aware of the word “token”, think of a voucher that is redeemable for items of value.

- Non-fungible is something that can’t be replaced by another identical item, and only one such item exists.

Combine non-fungible (NF) with tokens (Ts), and we have digital vouchers (read tokens) that can’t be mutually interchanged because they are unique and no two NFTs are ever the same.

But, how is this possible? What’s the proof that no other similar NFT exists elsewhere?

This is due to the underlying technology of NFTs – blockchain.

“You don’t need to understand blockchains to make sense of NFTs, however; keep in mind that a blockchain, like Ethereum, is an open ledger that records data, which no one can change/modify, and which is always available for the general public. There is a whole lexicon of terms and processes that proves blockchain’s immutability and openness, but we don’t need to learn that. The important part is: no one can change the data once it’s added to a blockchain network, and anyone can verify that data, as well as, the authenticity of the record.”

When someone creates (aka mint) an NFT, what they are essentially doing is registering the copyright ownership by issuing a token for their digital artwork on a blockchain. When the transaction happens, details like the description of the work, the artist’s name, or any additional information are added onto the blockchain network with a timestamp, for once and ever. Along with this data, the NFT token can record transaction history.

If we are to summarize NFTs, they are:

- Digital tokens

- Represents an underlying digital work,

- Unique, thus rare

- Verifiable

Now, connect what we learn with Proko’s artwork.

Proko can create an NFT of his painting by issuing a token on a blockchain. Collectors can buy that token, and since blockchains are immutable and open, buyers can verify whether the bought item is actually from Proko or not by simply scanning the history of the token on the issuing blockchain network. This proof of provenance makes NFTs valuable because buyers now have certainty that they are, indeed, getting the original work.

It boils down to the fact: what a certificate of authenticity is to traditional art, the NFTs are to digital art.

The whole concept is intriguing; revolutionary in the sense that no such technology ever existed up until a few years ago, through which digital artworks could be authenticated.

What Can be NFTs?

We have learned (from our examples) that NFTs are key to authenticating digital artwork. But, what else can they verify? (This should also answer what else can NFTs be?)

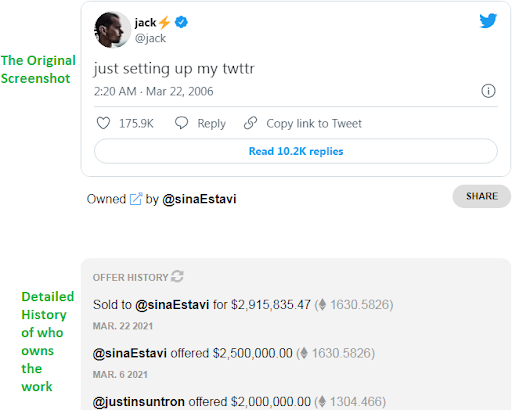

In addition to digital artworks, anything that is scarce and valuable (either for you or in the eyes of the beholders) can be turned into an NFT. For example, the founder of Twitter, Jack Dorsey sold his first tweet for $2.9 million as an NFT.

What Jack did is take a screenshot of his first-ever tweet, minted it on a blockchain (Polygon), and listed it for auction on Valuables. It was bought by the CEO of Bridge Oracle, Sina Estavi. Anyone can confirm the purchase by checking the history of the NFT representing the original screenshot.

Even quotes can be turned into an NFT. Here is one by Mark Cuban:

The NFT list could go on: the original 9,555 lines of the World Wide Web’s source code by Sir Tim Berners-Lee, an AI-based talking GIF, Bad Luck Brian’s meme, a short clip of LeBron James dunk, Tom Brady’s Signature, a digital Gucci bag, or the iconic photo of Shiba Inu dog named Kabosu (AKA Doge).

With each NFT, the owners are selling the copyright ownership of what they believe is valuable and rare. But, creativity doesn’t end here.

Here is an NFT by a Croatian Tennis player, Oleksandra Oliynykova, who sold lifetime tattoo & body art rights of her right arm & shoulder:

The buyer has exclusive rights to place an art object on the space on her right arm and shoulder.

Crazy, eh?

Wait, until you hear about GourmetNFT – a platform that claims to be “we are to Chefs what iTunes is to Rock Stars.” It is a marketplace that allows chefs to sell their recipes as NFTs.

Then, there is the American rock band, Kings of Leon, which offered their latest album, “When You See Yourself,” in the form of an NFT.

Furthermore, we have come across domain names, private sessions, Instagram posts, concert tickets, virtual real estate, and a lot more – all being sold (or auctioned) as NFTs. If these different forms of NFTs tell us anything, in particular, it is that opportunities with NFTs are only limited to our imagination.

If one thing is common here: each NFT is offering some form of value to the collector. What to pay for them or not is up to the collectors, but the use case is what defines their worth.

To learn more about how RocketX amplifies user experience in the multi-blockchain world, follow our social media .

Barriers to Buying NFTs in A Multi-Blockchain World

Now that we understand NFTs, let us talk about the barriers to buying these unique assets in the multi-blockchain world.

- One of the main challenges is that NFT projects are hosted on different blockchain networks. This means that each NFT project has its own unique characteristics, such as the network it uses, the native tokens it accepts, and the wallet it is compatible with. For instance, Jack Dorsey’s tweet NFT was created on the Polygon network, while Sir Tim-Berners’ NFT was minted on the Ethereum blockchain.

- While most NFT projects are hosted on the Ethereum blockchain, others use Solana, Polygon, Arbitrum, Optimism, and more. This fragmentation makes it challenging for users to buy NFTs because they need to navigate between different platforms and understand the different native tokens. This requires shuffling between different platforms and can be time-consuming, not to mention the high fees for the exchange.

For example, if a user wants to buy an NFT on the Optimism blockchain and only has ETH, they would need to swap their ETH for Optimism tokens. This can be challenging for new users who are not familiar with the process, as they would need to figure out how to swap their tokens, how much they need to pay in fees, and how to ensure that the transaction is secure.

- Moreover, the use of different blockchain networks creates confusion for users as they need to keep track of the conversion rates. For instance, if a user buys an NFT using Ethereum, they need to understand the conversion rate for the native token of the blockchain network the NFT is hosted on. This can be confusing for users who are not familiar with the different blockchain networks and their respective tokens.

Streamlining NFT Market with Crypto Aggregators

Crypto aggregators like RocketX can help make the process of buying and selling NFTs simpler and more efficient for users. These platforms allow users to make the cross-chain swap of any cryptocurrency for the cryptocurrency that is accepted by the NFT project. There are three main ways in which crypto aggregators can assist users:

NFT marketplaces such as OpenSea and Blur can integrate a crypto aggregator widget into their platforms, enabling users to swap their cryptocurrency for the accepted cryptocurrency without having to leave the platform.

- Individual NFT projects can also use crypto aggregator widgets to allow users to make cross-chain swap of their crypto assets with the cryptocurrency accepted by the project. This helps overcome the challenge of users needing to navigate between different platforms and understand different native tokens.

- By using a crypto aggregator, users can easily make the swap and then return to the NFT platform to complete the purchase with their desired cryptocurrency. This simplifies the buying process and also allows users to sell their NFTs for any cryptocurrency of their choosing.

- There are a number of crypto aggregators that users can use to make the cross-chain swap, including RocketX. After making the cross-chain swap, users can return to the NFT platform to complete the purchase.

Using a crypto aggregator can benefit not only NFT buyers and sellers, but also NFT marketplaces themselves. By integrating a crypto aggregator widget, NFT marketplaces can provide a more seamless and user-friendly experience for their customers, potentially attracting more users and increasing their overall transactions. This can ultimately help to grow the NFT market as a whole.

End Note

NFTs are quickly gaining popularity and becoming a significant part of the art and collectibles world. However, as the market grows and more tokens become available, it is essential to ensure that the buying process remains easy and simple. This is where crypto aggregators can play an important role in unifying the NFT landscape. By providing a one-stop-shop for buyers, they can navigate through multiple marketplaces and blockchain networks, significantly reducing confusion and time consumption.

As or when more NFT marketplaces and buyers start to use crypto aggregator widgets or even just crypto aggregator platforms, the NFT world will become more accessible, bringing more investors and artists to this growing market, leading to a better future for the NFT industry.