Introduction

Millions of people have used Dash crypto in places where banks stop working and local currency loses trust. It did not become popular because of hype or speculation. It gained users because it functioned as a real payment system at a time when people needed a reliable alternative. This brings us to a simple question: why has Dash coin survived and remained relevant while thousands of cryptocurrencies have disappeared within a few years?

Dash coin was built to function as digital cash that anyone can send quickly at a very low cost without depending on a bank or central authority. Unlike many crypto projects that are still in the experimental stage, it has already gone through real adoption, regulatory pressure, and multiple market crashes. Even after all of this, the network continues to run, upgrade, and improve through its community-based governance system.

In this article, you will learn what Dash crypto is, how it works, how it has developed over time, whether it can still be considered a good investment and how you can buy Dash coin using RocketX in a simple and direct way.

What is Dash Crypto? (With a Short History Recap)

Dash is a cryptocurrency designed to work as real digital cash with fast confirmations, low fees and practical usability in everyday payments. It was launched in 2014 by Evan Duffield as a fork of Bitcoin under the name XCoin. It was then renamed Darkcoin during a phase when its focus leaned toward privacy features, and later rebranded again as Dash, short for Digital Cash, to emphasize a more mainstream and legally acceptable payments use case.

From the very beginning, It was built to address the limitations of Bitcoin such as slow transaction speed, high fees and weak suitability for retail payments. To improve on these areas, Dash introduced masternodes, which are special nodes that hold one thousand coins as collateral and enable services like instant transactions and optional privacy. It also created a DAO treasury system that funds development and marketing directly from block rewards through community voting rather than relying on investors or corporate sponsors.

Over time, Dash coin found real adoption in countries facing economic instability, such as Venezuela, where citizens used it for remittances and everyday expenses. Even though it faced criticism in the early stages and later came under regulatory pressure due to its privacy tools, Dash has continued to upgrade and maintain active governance. Because of this ongoing development and survival through multiple market cycles, it remains one of the oldest and still-functioning cryptocurrencies focused on payments and financial inclusion.

How Dash Works

It works through a two-layer design that improves speed, security and usability. The first layer consists of miners that secure the network through Proof of Work similar to Bitcoin, but Dash uses the X11 hashing algorithm which combines multiple cryptographic functions for stronger security and earlier resistance to specialized mining hardware.

The second layer is made up of masternodes. These are full nodes that require one thousand DASH coins locked as collateral. Masternodes provide advanced services to the network in return for block rewards. They enable fast transaction locking, optional transaction privacy, stronger protection against network attacks through ChainLocks and also handle governance by voting on proposals and treasury spending.

Dash distributes block rewards in a way that keeps the ecosystem balanced. A portion of the reward goes to miners, a portion to masternodes and a fixed share is allocated to the treasury for development, marketing and approved proposals. This structure allows the network to fund itself without depending on external investors or companies.

Because of this architecture Dash functions not only as a secure store of value but also as a practical payment system with fast confirmations, low fees and on-chain governance managed by the participants themselves.

Recent Developments (Latest Cycle Highlights)

In its recent development phase, Dash has continued to improve its technology and maintain its relevance in the payments and privacy space even under regulatory and market pressure. The network introduced updates such as Asset Unlock Transactions to support advanced applications on the Platform, regular improvements in Dash Core for better performance, and refinements in the treasury funding process to make project payouts more accountable. These changes show that Dash is still being actively developed as a functional payment network rather than fading into inactivity.

There has also been a renewed wave of interest as global debates around surveillance, censorship, and financial privacy gained momentum. In this environment, coins like Dash, Monero, and Zcash received more attention from traders and users. This was reflected in increased on-chain activity, higher participation in derivatives markets, and a technical breakout after a long period of decline.

Despite being delisted from some centralized exchanges because of compliance concerns around privacy features, This coin has managed to retain liquidity through other channels. It continues to be supported on regional and mid-sized exchanges, and many users rely on decentralized exchanges and cross-chain aggregators to access the asset. In some parts of Latin America and Africa, real-world usage persists independent of these exchange decisions.

Dash still plays an active role in regions affected by inflation, currency controls, and banking restrictions. In such places, it remains useful for remittances and daily retail payments where low fees and quick confirmation are important.

Is Dash Coin a Good Investment?

Dash mainly attracts people who believe that a cryptocurrency built for real payments, and not only for storing value, will continue to matter in the future. It has already gone through several market cycles, regulatory pressure and heavy competition. This long survival gives Dash the image of a proven and established project among older cryptocurrencies.

Why do some investors consider Dash coin

Dash has seen real usage in payments and remittances, especially in places with currency instability where fast and low-cost transfers matter. Its development is funded directly through its on-chain treasury instead of relying on external investors. The network’s architecture, supported by masternodes and features like InstantSend and ChainLocks, is built to handle day-to-day transactions efficiently. Despite setbacks such as delistings and market downturns, the network continues to function and evolve under community governance.

Risks to consider

Regulators still associate Dash with privacy coins because it once offered an optional privacy feature, and this connection can influence liquidity and exchange availability. At the same time, newer blockchains and stablecoins have captured a large portion of the payments market, increasing competition for Dash. Like most alternative cryptocurrencies, Dash has experienced steep price declines in the past and continues to show unpredictable price movement, which adds to the investment risk.

Final view

Dash is not a meme or an experiment. It is a long running payments network with real usage and community governance. Whether it is a good investment or not depends on your belief in the future demand for open and borderless digital cash in a world of increasing financial control.

How to Buy Dash Crypto on RocketX (Step-by-Step)

After understanding why people choose Dash and what risks exist, the next practical step for anyone who decides to own Dash coin is knowing the safest and most convenient way to buy it. Since this coin is not listed on every exchange due to regulatory changes, using a reliable cross-chain platform becomes important.

RocketX is one of the simplest ways to convert existing crypto like ETH, USDT or USDC into Dash coin in a single transaction without using multiple exchanges or bridges.

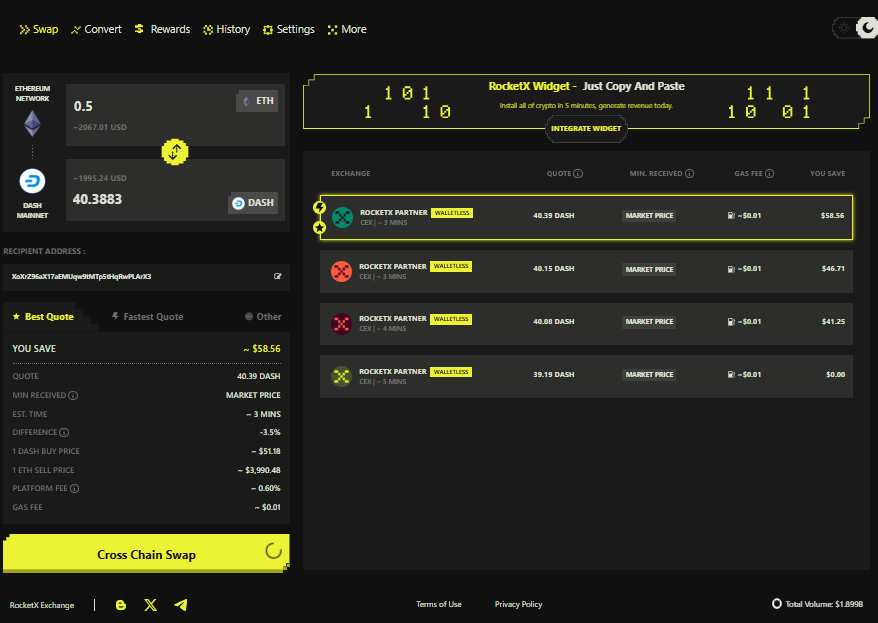

Follow this step-by-step process to buy Dash coin:

Step 1 — Open RocketX and Connect Your Wallet

Open app.rocketx.exchange in your browser and connect a wallet that holds the funds you want to swap. You can use wallets like MetaMask, Rabby, Trust Wallet or OKX Wallet if your assets are on EVM networks, and wallets like Phantom or Backpack if your funds are on the Solana network.

Step 2 — Select Source Network and Token

Choose the blockchain where your funds are (for example Ethereum, BNB Chain, Polygon, Arbitrum, Solana etc.). Then select the token you want to swap (for example ETH, USDT or USDC).

Step 3 — Select Destination Network and Asset

Choose the Dash network as the destination and select Dash coin as the asset you want to receive.

Step 4 — Enter Amount and Recipient Address

Enter how much you want to exchange and paste your wallet address (from a compatible wallet).

Step 5 — Confirm and Approve

Click “Cross-Chain Swap,” approve the transaction in your wallet, and wait for it to complete. Most swaps finish within seconds to a few minutes.

Step 6 — Check Your Wallet

Open your wallet and confirm that your coins have arrived.

With RocketX, you do not need to bridge or move funds through multiple platforms manually — the aggregator finds the best route for you automatically.

Best Wallets to Store Dash Coin Safely

Choosing the right wallet is important when holding Dash, especially if you plan to store it for a long time or use it regularly for payments. Dash supports both official and third-party wallets, giving users the flexibility to pick according to security, convenience, and features.

1) Official Dash Core Wallet (Desktop)

This is the primary wallet maintained by the Dash team. It gives full control of funds, supports InstantSend and PrivateSend, and is also required for running masternodes. It is best suited for advanced users and long-term holders who want maximum control.

2) Dash Mobile Wallet (Android / iOS)

These lightweight official apps are ideal for everyday spending, especially in countries where Dash coin is used for retail payments and remittances. They are simple and beginner-friendly.

3) Electrum-Dash (Lightweight Desktop Wallet)

A faster alternative to the full core wallet, designed for users who want security without downloading the full blockchain.

4) Hardware Wallets — Ledger & Trezor

For high-value storage, hardware wallets provide the strongest protection by keeping private keys offline. Dash.org also recommends hardware wallets for large holdings.

5) Trusted Multi-Coin Wallets (Trust Wallet, Exodus, Coinomi, Edge)

These wallets are convenient for users holding multiple cryptocurrencies. They support Dash coin sending, receiving, and, in some cases, InstantSend.

Security Tip:

Always back up your recovery phrase offline. Never store it in email or cloud apps, and avoid keeping large funds in mobile wallets for long periods.

Conclusion

This is one of the few cryptocurrencies that has lasted from the early phase of the crypto market to today without relying on hype or venture funding. Its goal has always been to function as fast, low-cost, and reliable digital money that can be used in the real world. Even after facing controversy, regulatory pressure, and new competitors, the network continues to upgrade and stay active in regions where traditional finance does not work well.

For those who believe that borderless and censorship-resistant payment networks will remain important, this coin stands as a mature and community-governed option. And if someone wants to buy it, platforms like RocketX make the process simple by allowing swaps from major tokens in a single step.

In summary, it is not a trend based asset. It is a payment infrastructure that has already been tested by time and real usage. Whether you use it, invest in it, or simply follow it, the project still holds relevance in the digital economy.