Introduction

In the ever-expanding world of decentralized finance (DeFi), Curve Finance stands out as one of the most vital protocols for stablecoin trading and low-slippage swaps. Launched in 2020, Curve Finance offers a highly efficient and scalable platform that serves as a foundation for liquidity provision and yield farming, especially for assets with similar values like stablecoins or tokenized Bitcoin.

Whether you’re a liquidity provider looking for steady returns or a trader trying to avoid high slippage, Curve offers a solution that’s both technically sound and community-owned. In this comprehensive guide, we’ll explore what Curve Finance is, how it works, its DAO governance model, CRV token utility and tokenomics, the project’s future outlook, and how to buy Curve DAO Token (CRV) using RocketX Exchange.

What is Curve Finance?

Curve Finance is a decentralized exchange protocol designed to facilitate efficient trading of stablecoins and other pegged assets. Instead of using a traditional order book model, Curve relies on an automated market maker (AMM) that’s specifically optimized for low-volatility tokens. This makes it ideal for swapping stablecoins like USDT, USDC, DAI, and tokenized versions of BTC or ETH.

The project was founded by Michael Egorov, a Russian physicist and cryptographer with an impressive background in decentralized technology. Prior to Curve, Egorov co-founded NuCypher, a protocol focused on privacy-preserving infrastructure, and also worked on LoanCoin, a decentralized lending network. His deep understanding of cryptography and financial mathematics is what allowed him to engineer the unique bonding curves that power Curve’s stability-focused AMM design.

Since its inception, Curve has launched several key products, including its decentralized exchange (Curve DEX), the crvUSD stablecoin issuance system, and Curve Lend, which provides isolated lending and borrowing markets. Each of these innovations is geared toward giving users more efficient, secure, and profitable ways to interact with digital assets.

How Curve Finance Works

Curve Finance doesn’t function like the typical crypto exchange. Instead of relying on buyers and sellers to manually match trades, it uses AMM smart contracts to automatically facilitate swaps between assets held in liquidity pools. What sets Curve apart is its specialized approach to stablecoins and assets with similar prices. The protocol uses what’s called the StableSwap algorithm, which concentrates liquidity around a 1:1 ratio, significantly reducing slippage during trades. This feature is especially beneficial for large-volume stablecoin swaps that would otherwise incur major losses on platforms like Uniswap.

Liquidity providers (LPs) deposit tokens into Curve’s pools and, in return, earn a portion of the trading fees as a reward. These fees are notably low—often just 0.04% per transaction—making Curve one of the most cost-effective platforms for DeFi users. Additionally, liquidity providers can stake their LP tokens to earn CRV tokens, adding another layer of passive income.

Over time, Curve has expanded beyond stablecoins. With the release of Curve v2, the platform now supports volatile assets through dynamic pricing models and internal oracles. Pools like TriCrypto (which includes ETH, WBTC, and USDT) allow users to trade between assets with different risk profiles while still benefiting from Curve’s efficient pricing and low fees. The protocol also operates on multiple blockchains, including Ethereum, Arbitrum, Optimism, Polygon, etc., giving users broader access and lower transaction costs.

Security is also a core part of Curve’s design. Its smart contracts are written in Vyper, a secure language that prioritizes auditability. This, along with Curve’s long-standing reputation, has helped the platform manage billions of dollars in total value locked (TVL) with relatively few security issues compared to other DeFi protocols

Curve DAO Token (CRV): Utility and Tokenomics

The Curve DAO Token (CRV) is the lifeblood of Curve’s governance and incentive structure. Launched in August 2020, CRV serves multiple purposes within the ecosystem. It is used for voting on governance proposals, distributing protocol fees, and rewarding users who provide liquidity to the platform.

CRV Token Utility:

- Governance: CRV holders can lock their tokens to receive veCRV (vote-escrowed CRV) and participate in governance decisions, ranging from adding new pools to protocol upgrades.

- Incentives for Liquidity Providers: LPs earn CRV as rewards. These emissions are calculated based on the volume, type of pool, and duration of liquidity provided.

- Boosting Rewards: By locking CRV for up to 4 years, users can boost their CRV rewards by up to 2.5x, increasing yield and platform participation.

- Fee Sharing: veCRV holders also receive a share of Curve’s trading fees, giving them a passive income stream in addition to governance rights.

CRV Tokenomics:

The total supply of CRV is capped at 3.03 billion tokens, with about 62% reserved for community liquidity providers. Another 30% goes to team members and early investors, with vesting schedules ranging from two to four years. The remaining 8% is split between early employees and a community reserve. There was no premine, and CRV was designed to be gradually distributed over time.

What makes CRV especially compelling is how its utility is deeply tied to Curve’s core operations. Users who want to earn maximum rewards or have a say in governance must commit to locking their tokens. This vote-locking model—unique at the time of its launch—has since been adopted by numerous other protocols, highlighting Curve’s influence in the broader DeFi landscape.

Future Potential of the CRV Token

The future of the CRV token looks promising, thanks to Curve’s continuous innovation and growing relevance in the DeFi world. One of the most exciting developments is the launch of crvUSD, Curve’s own overcollateralized stablecoin. Unlike traditional stablecoins, crvUSD features a “soft liquidation” system that helps protect borrowers from sudden liquidations during market volatility. This mechanism brings more lending and borrowing activity to the protocol, adding new use cases for CRV holders.

Another key factor is Curve’s expansion across Layer 2 networks. By deploying on chains like Arbitrum, Base, Optimism, etc. Curve makes it easier and cheaper for users to interact with its pools, potentially increasing volume and demand for CRV. The platform’s deep integration with other DeFi leaders—such as Convex Finance, Lido, and Yearn—also strengthens its position as a core infrastructure layer.

While CRV’s price has seen highs and lows like most crypto assets, its long-term value is increasingly tied to governance influence and protocol revenue. Analysts have projected a moderate rise in CRV’s price over the coming years, especially if Curve continues to grow its stablecoin ecosystem and Layer 2 footprint.

How to Buy Curve DAO Token (CRV) Using RocketX Exchange

Looking to buy the CRV token? RocketX Exchange makes it seamless, secure, and cost-efficient—whether you’re swapping from Ethereum, Arbitrum, BNB Chain, or even Solana. With RocketX’s hybrid liquidity aggregator, you can access the best rates across multiple blockchains and DeFi protocols in just a few clicks.

Even better, RocketX supports trading of Curve DAO Token (CRV) across all major chains where it’s active, including Ethereum, Polygon, Optimism, Arbitrum, and Base. So no matter which chain you’re on, RocketX has you covered.

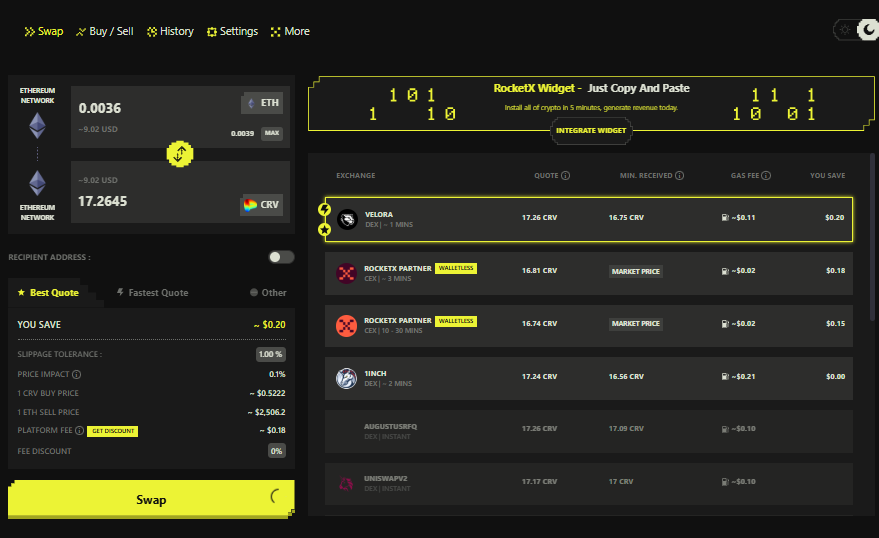

Follow these simple steps to get started:

Step 1: Visit the RocketX App

Head over to the app.rocketx.exchange on your browser.

Step 2: Connect Your Wallet

Click on the “Connect Wallet” button at the top right and choose your preferred wallet based on the network and asset you’re starting with.

Step 3: Select the Source Network & Token

Choose the network and token you currently hold (e.g., ETH on Ethereum or USDT on BNB Chain) as your “From” asset.

Step 4: Select Destination Chain and Choose CRV as Your Token

Now it’s time to decide where you want your CRV tokens to land. In the “To” field on RocketX, start by searching for “CRV.” You’ll see the Curve DAO Token available across multiple supported chains—including Ethereum, Polygon, Optimism, Arbitrum, and Base.

Select CRV on your preferred destination network depending on where you plan to use or hold your tokens. Whether it’s for low fees on Arbitrum or ecosystem access on Base, RocketX gives you full flexibility.

Step 5: Enter Amount and Review

Input the amount of the token you want to swap for CRV. RocketX will automatically fetch the best available route across DEXs and bridges for the lowest fees and best conversion rates. Review the estimated output and slippage.

Step 6: Confirm and Approve the Swap

Click “Swap” and approve the transaction in your wallet. RocketX will handle all the routing and bridging logic automatically, so you don’t need to worry about manual steps.

Step 7: Receive CRV in Your Wallet

Once the transaction is confirmed, your CRV tokens will be delivered to your wallet on the selected network. You can now use them for staking, governance, or trading within the Curve ecosystem.

With RocketX Exchange, you’re not just buying CRV—you’re doing it the smart way. Thanks to multi-chain support and deep liquidity aggregation, you can buy CRV on your terms, across your preferred networks, with minimal friction.

Conclusion: Why Curve Finance Is Built to Last

Curve Finance has gone beyond being just another DeFi protocol—it has become a foundational layer for stablecoin liquidity and decentralized trading. With innovations like StableSwap, veCRV governance, and crvUSD, Curve has demonstrated staying power, adaptability, and technical excellence.

The CRV token is more than a speculative asset—it’s your gateway to protocol governance, boosted rewards, and long-term DeFi participation. And thanks to RocketX Exchange, accessing CRV is now more seamless, secure, and multi-chain than ever.

If you’re serious about DeFi, Curve Finance is a protocol you simply can’t ignore. Whether you’re trading, providing liquidity, or staking for governance, Curve offers a reliable, efficient, and community-driven platform for the future of finance.