Introduction

If you’ve used Ethereum for even a short while, you already know the struggle: a simple swap can cost more than your coffee, and transactions feel like they take forever when the network is busy. Ethereum is powerful, but it wasn’t built for millions of people trading, farming, and minting NFTs at once.

This is where Arbitrum comes in. It’s Ethereum’s most popular Layer-2 scaling solution, fast, cheap, and secure. By bridging your assets to this network, you can unlock an ecosystem filled with liquidity, innovative apps, and opportunities that simply aren’t affordable on the Ethereum mainnet.

So let’s walk through what Arbitrum is, how it works, the ARB token, how you can bridge to the Arbitrum network using RocketX, and why this blockchain has such a promising future.

What is Arbitrum Network and How Does it Work?

Arbitrum is a Layer 2 scaling solution for Ethereum, built on the optimistic rollup model, developed by Offchain Labs. Its mission is simple but powerful: make Ethereum faster, cheaper, and more scalable without sacrificing the security that makes Ethereum so reliable.

Here’s how it works:

Instead of executing every transaction directly on the Ethereum mainnet, Arbitrum processes transactions off-chain in batches. These bundles are then posted back to Ethereum as compressed data. This design allows the network to handle significantly more activity at a fraction of the cost, while fraud proofs ensure that invalid transactions can be challenged and corrected. The end result? Lower fees, faster confirmations, and Ethereum-level trust.

The Arbitrum ecosystem is designed to cater to various needs within the blockchain world, striking a balance between flexibility and specialization.

Arbitrum One is the flagship chain, where most of the ecosystem’s DeFi protocols, NFT marketplaces, and general-purpose applications thrive. From trading on Uniswap to lending on Aave or exploring NFT platforms, It has become the go-to hub for activity that mirrors Ethereum but at a fraction of the cost.

Arbitrum Nova takes a different path. Tailored for gaming and social applications, Nova offers ultra-low transaction fees and massive throughput capacity. This makes it ideal for apps that require frequent, low-value transactions, such as in-game purchases, rewards systems, or social micro-transactions.

Finally, Arbitrum Orbit empowers developers to launch their own custom Layer-3 blockchains on top of Arbitrum’s secure infrastructure. Projects like ApeChain and Galxe’s Gravity showcase how Orbit is enabling entire ecosystems to flourish within Arbitrum’s broader framework.

As of 27 September 2025, this network secures over $3.24B in DeFi TVL, hosts a stablecoin market cap of $4.02B, and processes around 1.5M transactions daily while collecting $684K in fees — a fraction of what Ethereum users would have paid for the same activity.

That’s why users are choosing to bridge ETH here.

Everything You Need to Know About the ARB Token

The ARB token is the governance backbone of the ecosystem. Launched in March 2023 through one of the most talked-about airdrops in the crypto space, it marked the transition of Arbitrum from a developer-led project to a community-governed Layer 2 network. Over 12.75% of the total supply was distributed to early users and DAOs based on their activity, such as bridging or maintaining active on-chain participation.

Use cases of Token

Unlike gas tokens on some blockchains, ARB is not used for transaction fees; those are still paid in ETH. Instead, ARB’s primary utility lies in governance, where holders can vote on Improvement Proposals (AIPs), delegate votes to trusted representatives, and decide how the DAO treasury is spent. This treasury, one of the largest in the L2 space, funds incentive programs, ecosystem grants, and development initiatives that shape Arbitrum’s growth.

Tokenomics

From a tokenomics perspective, ARB has a fixed supply of 10 billion tokens. The distribution is designed to balance ecosystem growth and long-term sustainability: 35% for the DAO treasury, 27% for the team and advisors, 17% for investors, and the rest for community incentives and the foundation. While vesting schedules mean new tokens unlock gradually through 2027, there is no inflation beyond the capped supply, supporting scarcity over time.

In short, ARB is not just another token to trade — it’s a vote in Arbitrum’s future, a mechanism to reward its community, and a lever that ensures the network evolves in a decentralized way.

How to Bridge Assets to the Arbitrum Blockchain and Buy Arbitrum Tokens

If you’re holding ETH on Ethereum mainnet or even other supported tokens, the best way to unlock Arbitrum’s speed and low costs is to bridge your assets into this network. Once bridged, your assets become part of the ecosystem, where you can use them to trade, lend, farm yields, or even swap into the ARB token.

Why Bridge to Arbitrum?

- Lower fees: Transactions on Arbitrum often cost just a few cents.

- High activity: With over $452M in daily DEX trading volume and $685M in perpetuals volume, your ETH finds deep liquidity and active markets.

- Incentives: Programs like ARB airdrops and DeFi rewards regularly reward on-chain participation.

- Apps to explore: Trade on RocketX Exchange and Camelot, lend on Aave, or use perps on GMX, all at lower cost than Ethereum.

Here’s a step-by-step guide to get started:

Step 1: Visit RocketX

Go to app.rocketx.exchange. No downloads or registrations are required—just open the app in your browser.

Step 2: Connect Your Wallet

Click Connect Wallet and choose a supported wallet such as MetaMask, Rabby, or Ledger, depending on the blockchain you’re bridging from.

Step 3: Choose Source Network and Token

In the “From” field, choose Ethereum or whichever blockchain currently holds your assets as the source network. Select ETH (or any other supported token) and enter the amount you’d like to bridge.

Step 4: Select Arbitrum as Destination Network and Token

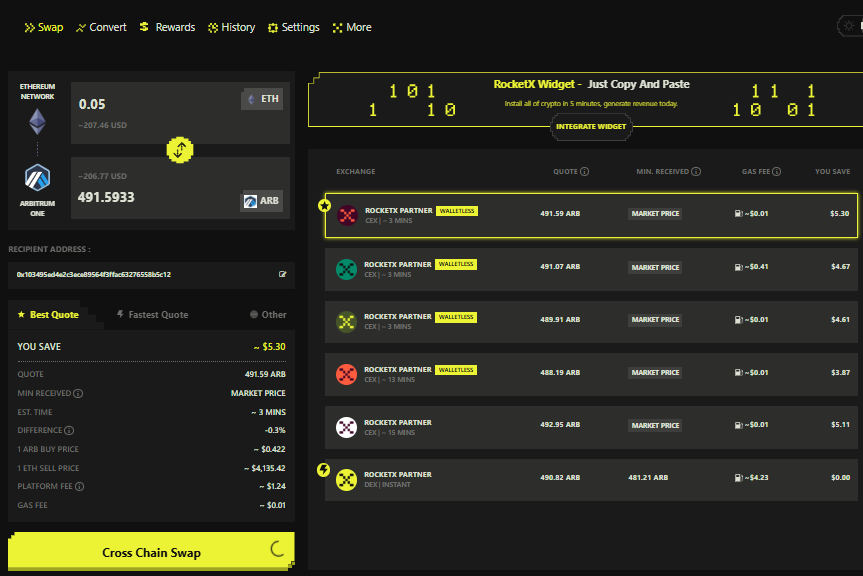

In the “To” field, set Arbitrum as your destination network. You can bridge ETH directly or swap into ARB tokens during the same process. RocketX automatically finds the best route for you.

Step 5: Review the Quote

RocketX shows a live quote with the amount you’ll receive on Arbitrum, estimated fees, and the route it will use. Double-check the details before confirming.

Step 6: Confirm the Swap/Bridge

Click on the Cross-Chain Swap button and confirm the transaction in your wallet. RocketX will automatically route it through the best available partner, as shown in the quote list, and your funds (e.g., ARB on Arbitrum) will arrive in your wallet within minutes.

Step 7: Done!

Switch your wallet network to Arbitrum and check your balance. Your ETH (or ARB tokens) will now be available on Arbitrum, ready to trade, stake, or use in DeFi apps like GMX, Uniswap, or Aave.

Future Potential of Arbitrum Blockchain

Arbitrum is no longer seen as just an Ethereum helper—it’s steadily evolving into the scaling backbone of the Ethereum ecosystem. The network’s progress shows that it isn’t only solving Ethereum’s fee and speed issues but also laying the foundation for the next generation of decentralized applications.

One of the biggest milestones is BoLD (Bounded Liquidity Delay), which has introduced permissionless validation. This shift is crucial for decentralization, reducing reliance on whitelisted validators and strengthening trust in the network’s long-term security. Alongside this, the introduction of Stylus is bridging the gap between web2 and web3 by allowing developers to code smart contracts in familiar languages like Rust, C, and C++. This opens the doors for more diverse applications, from gaming engines to data-heavy financial tools, to be built on Arbitrum.

Arbitrum’s Orbit expansion is another growth driver. Projects like ApeChain and Gravity prove that entire ecosystems can launch their own custom blockchains on top of Arbitrum while still benefiting from Ethereum’s security. This model creates a network of interconnected chains that funnel activity back to Arbitrum’s infrastructure.

From a liquidity standpoint, this network has already processed billions in daily volume, ensuring it remains one of the most attractive platforms for traders, investors, and DeFi builders. And thanks to ArbOS upgrades, it continues to stay aligned with Ethereum’s roadmap, ensuring long-term compatibility as Ethereum evolves.

Every upgrade, incentive program, and Orbit chain compound Arbitrum’s advantage. For users, bridging to this network isn’t just about saving fees; it’s about gaining early access to the future of Ethereum scalability.

Conclusion

Arbitrum has quickly grown into Ethereum’s leading Layer-2, combining low fees, high speed, and strong security with a thriving ecosystem of DeFi, NFTs, gaming, and custom Orbit chains. By bridging to this network, you’re not just saving on gas costs you’re unlocking access to billions in liquidity, innovative dApps, and a governance system that puts the community in charge. With RocketX, the process is seamless, secure, and beginner-friendly, making it the easiest way to start exploring Arbitrum today.

Stay connected with us on social media platforms like Twitter, Telegram, and YouTube for more insightful articles like this. Join our community and stay updated.